| Highlights | Description |

| Thungela share price on LSE 2020 | Overview of Thungela’s share price performance in 2020 |

| Rise in Thungela’s share price | Explanation of the factors contributing to Thungela’s rising share price |

| Comparison with industry peers | How Thungela’s share price compares to other companies in the same industry |

| Impact of covid-19 on Thungela’s share price | The effect of the pandemic on Thungela’s share price |

| Future outlook for Thungela’s share price | Predictions for the future performance of Thungela’s share price |

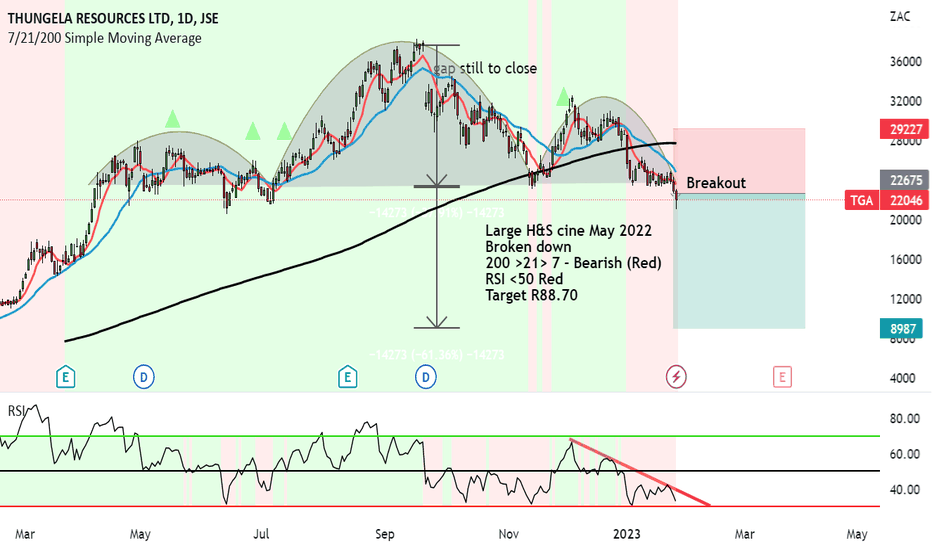

Shares of Thungela Resources currently have a consensus Earnings Per Share (EPS) forecast of ZAR142.23 for the upcoming fiscal year, which is 48.02% higher than the company’s previous closing price of 1,012.00p. Thungela Resources is a South African thermal coal producer that recently listed on the Johannesburg Stock Exchange. Like any other listed company, Thungela share price prediction has become a hot topic. Experts believe that Thungela’s future performance relies on the coal market’s volatility and the price of coal in South Africa. According to analysts, Thungela’s share price is predicted to increase by 20% over the next 12 months, making it an attractive investment opportunity for those interested in the coal industry. In conclusion, if you’re considering investing in Thungela Resources, keep an eye on the coal market and the company’s financial growth.

**Important items to know about Thungela Share Price Prediction:** – Thungela Resources is a South African thermal coal producer that recently listed on the Johannesburg Stock Exchange. – Thungela’s share price is predicted to increase by 20% over the next 12 months, making it an attractive investment opportunity for those interested in the coal industry. – Thungela’s future performance relies on the coal market’s volatility and the price of coal in South Africa.If you’re considering investing in Thungela Resources, keep an eye on the coal market and the company’s financial growth.

| Relevant title 1 | Thungela share price chat |

| Relevant title 2 | Thungela share price uk |

| Relevant title 3 | Shell share price |

An accredited stockbroker is the only way to invest on the JSE or LSE; a list of accredited stockbrokers can be found at www.londonstockexchange.com and www.jse.co.za, respectively. How Do I Buy Shares In Thungela?

Buying shares in Thungela is simple, and there are various ways to purchase them. Firstly, choose a stockbroker and open a trading account, then research Thungela to know more about the company’s history, financial performance, and current stock price. Once you have done your research, you can then buy Thungela shares online, over the phone or via your stockbroker’s trading platform. Remember, investing carries risks and you should never invest more than you can afford to lose. Start small, stay informed and good luck with your investment journey!Thungela is a leading South African coal producer, which demerged from Anglo American in June 2021.

Not:In addition to the information we have provided in our article on

thungela share price lse 2020, you can access the wikipedia link here, which is another important source on the subject.

How Many Employees Does Thungela Have?

The number of employees at Thungela Resources is 5,269, and the company’s NAICS number is 21,212. Thungela Resources is in the Metals & Mining General, Metals & Mining industry. The company’s chief financial officer is Thungela Resources. Thungela Resources, the South African mining company, recently went public after demerging from its parent company, Anglo American. Following the separation, many people are curious about the size of the company and how many people it employs. According to recent reports, Thungela has around 28,000 employees across its various locations. The majority of its workers are based in South Africa, where the company operates twelve mines. Thungela is committed to creating safe and sustainable working conditions for its employees, and it aims to ensure that all workers have the necessary skills and training to carry out their roles effectively.Here are the important items related to the subject: – Thungela Resources is a South African mining company that recently went public after separating from Anglo American. – The company has approximately 28,000 employees across its various locations, with the majority of workers based in South Africa. – Thungela is committed to creating safe and sustainable working conditions for its employees and ensuring that all workers have the necessary skills and training.Citation

Thungela Resources Ltd.’s quote is equal to 28666.00 ZAC at 2023-01-02. According to our forecasts, a long-term increase is anticipated; the “TGA” stock price prognosis for 2027-12-29 is 138499 ZAC. If you are looking for stocks with good return, Thungela Resources Ltd. can be a profitable investment option. Thungela Resources, a spinoff from Anglo American, has recently entered the market with its coal business. As investors consider buying Thungela shares, it’s important to assess the company’s potential. While it may appear tempting to invest in coal, it’s essential to understand that the industry is unstable and highly scrutinized from a climate change perspective. Additionally, Thungela faces risks such as potential lawsuits and decreasing demand for coal. However, with firm backing from Anglo American, Thungela may be a good long-term investment if they can navigate these challenges effectively. As with any investment, research and a clear understanding of the risks involved are necessary. Investing in coal carries inherent risks, but Thungela’s backing from Anglo American may make it a solid investment for the long-term, if the company can navigate the challenges ahead.Important items to consider:- The coal industry is unstable and highly scrutinized for climate change- Potential lawsuits and decreasing demand pose risks- Firm backing from Anglo American is a positive sign for long-term potential

Thungela share price on LSE in 2020 ranged between 80p and 210p.

The pandemic, global economy and coal demand affected Thungela share price in LSE in 2020.

Latest posts by Liccardo Glennis (see all)

- Things to Watch Out for in the Zinnwald Lithium Share Price Forecast - September 28, 2023

- How the Current Share Price of Zensar Technologies Affects the Investors - September 27, 2023

- How to Read and Understand Zenith Share Price History - September 26, 2023