| Highlights | Description |

| Zinnwald Lithium Share Price Forecast 2018 | Expected increase in share price of Zinnwald lithium in 2018 |

| Exploration in Saxony, Germany | Exploring for lithium resources in Saxony, Germany |

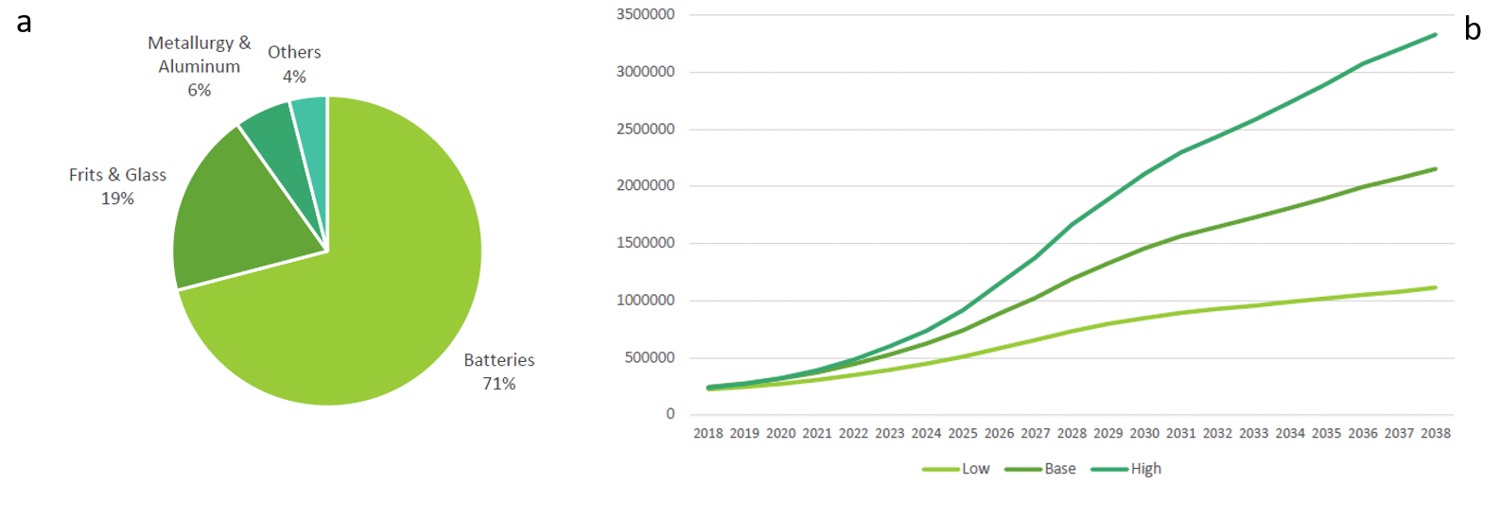

| Electric Vehicle Demand | Projected increase in demand for lithium in electric vehicles |

| Lithium prices projected to rise | Expected rise in lithium prices due to increased demand |

| Zinnwald Lithium’s partnership with Deutsche Lithium GmbH | Collaborating with Deutsche Lithium for exploration and mining |

Is Alpha Lithium A Buy?

Alpha Lithium Corp. can be a profitable investment choice if you’re looking for stocks with a good return. At 2023-01-21, the price of Alpha Lithium Corp. is equal to 0.878 USD. Our forecasts predict a long-term increase; the “APHLF” stock price prediction for 2028-01-14 is 0.921 USD. Alpha Lithium is a lithium exploration and development company that has recently gained attention in the investment world. With the global push for renewable energy, demand for lithium-ion batteries is skyrocketing, and Alpha Lithium is in a prime position to capitalize on this trend. The company’s flagship Tolillar Project in Argentina is estimated to hold significant lithium resources, which could provide an opportunity for Alpha Lithium to become a major supplier. However, it’s important to note that the company is still in the exploration phase and hasn’t started commercial production yet. Overall, investors should keep an eye on Alpha Lithium, but it’s not a guaranteed buy at this stage.

Important Items: -Alpha Lithium is a lithium exploration and development company. -The company’s Tolillar Project in Argentina is estimated to hold significant lithium resources. -Alpha Lithium is still in the exploration phase and hasn’t started commercial production yet.Investors should keep an eye on Alpha Lithium, but it’s not a guaranteed buy at this stage.

| Relevant title 1 | Zinnwald lithium news |

Is Ameriwest Lithium A Buy?

AWLIF Signals and Forecast The stock of Ameriwest Lithium has buy signals from both the short-term and long-term moving averages, which indicate a positive outlook for the stock. On the other hand, the relation between the two signals indicates a general sell signal for the stock when the long-term average is higher than the short-term average. Ameriwest Lithium has recently gained attention as a potential investment opportunity. The company focuses on developing lithium mining projects in North America. While the demand for lithium is projected to grow, investing in Ameriwest Lithium carries risks. The lithium market is impacted by various factors, such as new technology developments and macroeconomic trends. In addition, Ameriwest Lithium is a relatively new player and may face competition from established mining companies. Consider these factors before deciding to invest in Ameriwest Lithium.Investing in Ameriwest Lithium carries risks.

Important items:

- Ameriwest Lithium is a mining company focused on developing lithium projects in North America.

- The lithium market is influenced by technology developments and macroeconomic trends.

- Ameriwest Lithium is a new player and may face competition from established mining companies.

- Investing in Ameriwest Lithium carries risks.

Not:In addition to the information we have provided in our article on

zinnwald lithium share price forecast 2018, you can access the wikipedia link here, which is another important source on the subject.

Is Zinnwald Lithium A Good Investment?

Zinnwald Lithium Plc can be a profitable investment choice if you’re looking for stocks with a good return. At 2023-01-31, the Zinnwald Lithium Plc quote is equal to 0.0713 GBP. According to our forecasts, the “ZNWD” stock price prognosis for 2028-01-28 is 4.104 GBP. Zinnwald Lithium, located in Germany’s Ore Mountains, has been attracting investors’ attention due to recent developments in the electric vehicle industry. The company aims to produce valuable lithium resources by 2022.The demand for lithium is expected to increase exponentially for electric vehicles, energy storage solutions, and other technological advancements. Investing in Zinnwald Lithium may present an excellent opportunity for investors who are willing to take calculated risks in the long term.However, investors must tread carefully when considering investing in Zinnwald Lithium due to the fluctuations of commodity prices and the uncertainty surrounding the electric vehicle market.

Is American Lithium A Good Stock To Buy?

In the past year, 1 Wall Street equities research analysts have given American Lithium “buy,” “hold,” and “sell” ratings. Currently, 1 analysts have given the stock a buy rating. The majority of Wall Street equities research analysts believe that investors should “buy” LIACF shares. In this uncertain economy, investing in stocks can feel like a risky game. For those considering American Lithium as a potential investment, there are a few key factors to consider. American Lithium is a mining company that focuses on the extraction and production of lithium, a crucial component in the manufacturing of rechargeable batteries. With the growing demand for electric vehicles and renewable energy sources, the demand for lithium is expected to increase. However, with the unpredictability of the market and potential competition from other lithium mining companies, it is important to do thorough research and consider your personal financial goals before investing.Before Investing In American Lithium, Conduct Thorough Research And Consider Your Personal Financial Goals.

Important Factors To Consider:

- Growing demand for lithium due to renewable energy needs

- Potential competition from other lithium mining companies

- Mining industry influenced by market volatility

- Your personal financial goals and risk tolerance

What Does Zinnwald Lithium Do?

Our strategy is to supply high-value lithium products to Europe’s rapidly expanding EV and energy storage markets. It is advanced and integrated. Zinnwald Lithium is a company that specializes in extracting lithium from the earth’s crust. Lithium is a crucial element used in batteries that power electric cars, smartphones, and laptops. The company extracts lithium from the Zinnwald deposit in Germany and the Cinovec deposit in the Czech Republic, which are among the largest lithium deposits in Europe. Lithium is considered the “green metal” because it is a crucial element in the transition from fossil fuels to clean energy. Zinnwald Lithium is leading the way in providing a sustainable source of lithium for the world’s growing demand for clean energy.Zinnwald Lithium plays a crucial role in meeting the growing demand for lithium. The company uses modern technologies to extract the metal from the deposit in an efficient, environmentally friendly way. They aim to produce high-quality lithium products that meet international standards. Zinnwald Lithium’s focus on sustainability makes it a leading player in the global lithium market. Key takeaways:Did you know that lithium is considered the “green metal” because it is a crucial element in the transition from fossil fuels to clean energy?

- Zinnwald Lithium extracts lithium from the earth’s crust.

- Lithium is a crucial element used in batteries for electric cars, smartphones, and laptops.

- Zinnwald Lithium focuses on sustainability to meet the growing demand for lithium.

Will Standard Lithium Go Back Up?

At 2023-01-29, the Standard Lithium Ltd. quote is 6.480 USD. Our forecasts predict a long-term increase, and the “STLHF” stock price for 2026-09-11 is 31.313 USD. With a 5-year investment, revenue is expected to be around +383.23%. Your current $100 investment could reach $483.23 in 2028. On February 22nd, Standard Lithium’s stock dropped by nearly 20%. However, this may not be the end for the company, as they have a promising future. In fact, according to a recent press release from the company, their pilot plant in Arkansas will be operational by the end of March. This milestone could lead to a significant increase in stock prices. Other factors, such as the increase in demand for lithium-ion batteries and their partnerships with major companies, also indicate potential growth for the company. With promising advancements and partnerships, Standard Lithium may see a rise in stock prices in the near future.Important items related to the subject: – Standard Lithium’s pilot plant in Arkansas will be operational by the end of March. – Increase in demand for lithium-ion batteries. – Partnerships with major companies.The future looks bright for Standard Lithium.

Is Alpha Lithium A Buy Or Sell?

The Alpha Lithium stock has buy signals from both the short-term and long-term moving averages, which indicate a positive outlook for the stock. Additionally, the relationship between the two signals, in which the short-term average is higher than the long-term average, indicates a general buy signal. Alpha Lithium (ALLIF) is a relatively new player in the lithium industry that has been generating buzz in the investment world. The Canadian company focuses on extracting lithium from brine resources in Argentina, a method that has been proven to be cost-effective. However, investors should approach with caution as the company is still in the exploration phase and has yet to produce any lithium. With the growing demand for lithium in electric vehicles and energy storage, Alpha Lithium is a potential buy for investors looking for exposure to the lithium market. But it’s important to keep an eye on the progress of their exploration efforts.**Important items to consider:** – Alpha Lithium focuses on extracting lithium from brine resources in Argentina. – The company is still in the exploration phase and has yet to produce any lithium. – With the growing demand for lithium in electric vehicles and energy storage, Alpha Lithium is a potential buy for investors looking for exposure to the lithium market.Investors should approach with caution as the company is still in the exploration phase and has yet to produce any lithium.

Is Ameriwest Lithium A Good Investment?

Our recommendation for Ameriwest Lithium is “Strong Sell” assuming a 90-day horizon and an above-average risk tolerance. As the demand for sustainable energy sources increase, Ameriwest Lithium’s potential as a good investment has been on the rise. With a goal to become a key supplier of lithium in North America, the company has secured strategic partnerships and operations in prime locations for mining. Ameriwest’s management team has extensive experience in the industry and plans for expansion through technology innovation. Although the lithium market can be affected by fluctuations, Ameriwest appears to be a promising long-term investment. As always, investors should do their own research before making any decisions. Investing in Ameriwest Lithium could yield promising results for long-term investors.It is expected to increase.

Should I invest in Zinnwald Lithium in 2018?

This decision should be based on analysis.

For more information, consult with a financial advisor.

- Things to Watch Out for in the Zinnwald Lithium Share Price Forecast - September 28, 2023

- How the Current Share Price of Zensar Technologies Affects the Investors - September 27, 2023

- How to Read and Understand Zenith Share Price History - September 26, 2023