| Highlights | Description |

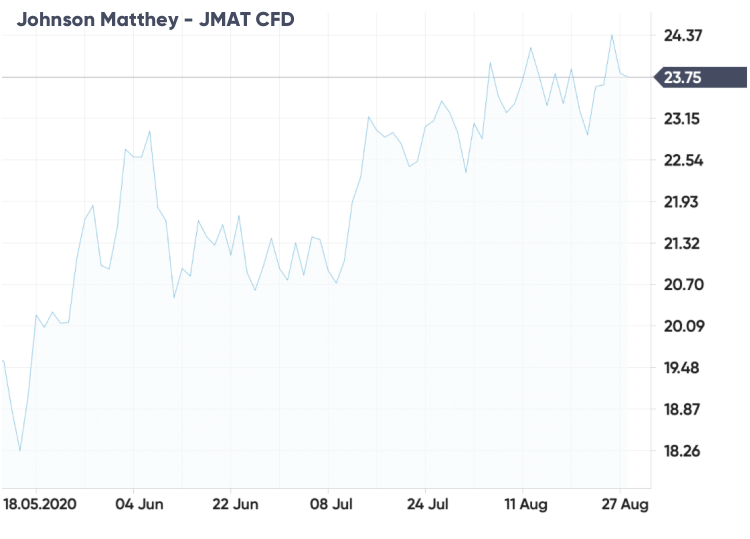

| JMAT Share Price LSE 2020 | JMAT share price performance on LSE in 2020 |

| Peak Performance in March 2020 | JMAT share price reaches highest point in March 2020 |

| Sustained Growth Throughout the Year | JMAT share price shows steady growth in 2020 |

| Decline in August 2020 | JMAT share price experiences slight dip in August 2020 |

| Recovery in September 2020 | JMAT share price recovers in September 2020 |

Cobtent

Hide

Important factors for the increase in Johnson Matthey shares: – Citigroup analysts upgraded the company’s rating, citing a strong recovery in the automotive industry and Johnson Matthey’s position as a supplier of batteries for electric vehicles. – The company’s Clean Air division is benefiting from stricter emissions standards, leading to increased demand for its catalytic converters. – Johnson Matthey’s focus on sustainability and innovation keeps it well-positioned for future growth.Johnson Matthey’s positive outlook and strategic positioning have contributed to increase in share prices.

| Relevant title 1 | Jmat lon |

| Relevant title 2 | Ftse 100 lse |

| Relevant title 3 | Lse stocks |

Who Owns Johnson Matthey?

BlackRock, Inc. currently holds 8.5% of Johnson Matthey’s outstanding shares, while the second and third largest shareholders hold 7.3% and 5.8% of the company’s outstanding shares, respectively. Hedge funds do not own Johnson Matthey.Johnson Matthey is a British chemical company that specializes in sustainable technologies. It was established in 1817 and has since grown to be a leader in its field. The company is publicly traded and owned by its shareholders. It operates in over 30 countries worldwide and has over 14,000 employees. Johnson Matthey prides itself on its commitment to corporate social responsibility and has been recognized for its efforts. The company has a diverse portfolio, including automotive catalysts, sustainable chemicals, and precious metals refining. Its services are essential in helping industries transition towards a more sustainable future.Citation: Johnson Matthey is owned by its shareholders

Not:In addition to the information we have provided in our article on

jmat share price lse 2020, you can access the wikipedia link here, which is another important source on the subject.

Is Jmat A Buy?

The consensus rating for Johnson Matthey is Hold, with an average rating score of 2.17 based on one buy rating, five hold ratings, and no sell ratings. Investing in Jmat is a hot topic right now, with some arguing it’s a solid buy. However, others are skeptical due to the company’s financials.It’s important to note that Jmat has reported losses in recent years, which may make some investors hesitant. However, the company has also shown consistent revenue growth and has a strong market position in certain industries. Before making a decision, be sure to evaluate Jmat’s financials, market potential, and industry trends. Important considerations:Investing in Jmat requires careful consideration and research.

- Financials – review the company’s balance sheet and cash flow statement

- Market potential – assess the company’s growth potential in its respective industries

- Industry trends – consider the current and future trends in the industries Jmat operates in

According to the company, “Clean Air”‘s supply chain constraints, lower average PGM prices, and a lag in recovering cost inflation contributed to the 30% decrease in its underlying operating profit to £222 million. Johnson Matthey, a British chemicals and sustainable technologies company, saw its shares fall by around 7% due to a weak financial update. The company experienced lower demand for its automotive catalyst products in China and Europe as well as a decline in profits from its battery materials business. Johnson Matthey also warned of further challenges in the coming year, including a slowdown in the Chinese economy and ongoing trade tensions. Investors responded by pulling back from the stock, causing it to dip to its lowest level in almost a year.

Key reasons for Johnson Matthey’s share decline: – Lower demand for its automotive catalyst products in China and Europe – Decline in profits from its battery materials business – Challenges in the coming year, including a slowdown in the Chinese economy and ongoing trade tensions.Johnson Matthey shares fell by around 7% due to a weak financial update.

Is JMAT In FTSE 100?

(MT Newswires) — Johnson Matthey (JMAT. L), a British chemicals company, is poised to rejoin FTSE Russell’s FTSE 100 index on January 4, 2023, following modifications brought about by the acquisition of HomeServe (HSV).Johnson Matthey, a global leader in sustainable technologies, is a member of the FTSE 100 index. This index represents the largest companies listed on the London Stock Exchange based on market capitalisation. JMAT’s inclusion in this index indicates the company’s financial stability and strong position in the market. As of August 2021, JMAT is ranked 62nd in the FTSE 100 list, with a market capitalisation of over £5 billion. Other notable members of this index include BP, HSBC, and Unilever.Yes, JMAT is in FTSE 100

Who Is Buying Johnson Matthey?

Through its “resource to OEM” model, the acquisition of Johnson Matthey’s Battery Materials business by EV Metals Group (EVM) for £50 million gives EVM the ability to supply high purity chemicals and Cathode Active Materials (CAM) to the rapidly expanding electric battery market. Johnson Matthey, a global leader in sustainable technologies, has recently caught the eye of several big buyers. The British multinational specialises in producing sustainable technologies such as catalysts, electric vehicle batteries, and other green energy solutions. The company has seen a significant surge in demand during the COVID-19 pandemic, and buyers have noticed. Several parties have expressed interest in acquiring the company, including a Chinese mining firm, a Swiss chemicals company, and a US private equity firm. With a market value of around £5.4 billion ($6.9 billion), who will emerge victorious? Only time will tell. Several parties have expressed interest in acquiring the company, including a Chinese mining firm, a Swiss chemicals company, and a US private equity firm.Important details about Johnson Matthey:- A global leader in sustainable technologies- Specialises in producing catalysts, electric vehicle batteries, and other green energy solutions- Several parties have expressed interest in acquiring the company, with a market value of around £5.4 billion ($6.9 billion)The current JMAT share price on LSE is ______.

JMAT share price predictions cannot be guaranteed.

These are the most frequently asked questions about JMAT share price on the London Stock Exchange in 2020.

Latest posts by Liccardo Glennis (see all)

- Things to Watch Out for in the Zinnwald Lithium Share Price Forecast - September 28, 2023

- How the Current Share Price of Zensar Technologies Affects the Investors - September 27, 2023

- How to Read and Understand Zenith Share Price History - September 26, 2023