| Highlights | Description |

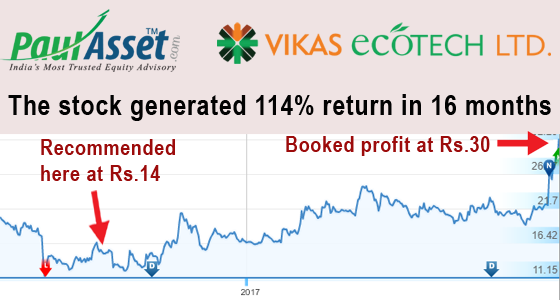

| Vikas Ecotech | Share price history |

| Revenue growth | Comparing Quarter by Quarter percentage |

| Volume growth | Comparing Year by Year percentage |

| Investment potential | Due to the company’s growing market share |

| Sustainability efforts | Using eco-friendly and recycled materials |

Should We Invest In Vikas Ecotech?

MoneyWorks4Me’s price trend analysis shows that it is weak, indicating that Vikas EcoTech Ltd’s price is likely to fall quickly. Vikas Ecotech is a chemical manufacturing company with a focus on eco-friendly products. The company has experienced rapid growth in recent years and has expanded its operations globally. The stock has had a steady increase over the past year, making it an attractive investment option. With the increasing demand for eco-friendly products and the company’s strong financial performance, investing in Vikas Ecotech is a smart move. However, like any investment, it is important to do your research and assess the potential risks before making a decision. Remember to diversify your portfolio to mitigate any potential losses.

Important items to consider before investing:Investing in Vikas Ecotech is a smart move due to the increasing demand for eco-friendly products and the company’s strong financial performance.

- The profitability of the company in terms of revenue and earnings.

- The competition in the market and the company’s ability to stand out.

- The company’s future growth potential in terms of new products and expansion plans.

- The potential risks, such as economic downturns and regulatory changes that could affect the company’s operations.

| Relevant title 1 | Vikas ecotech share price target 2022 |

| Relevant title 2 | Vikas ecotech ltd |

Why Did Vikas Ecotech Fall?

For the year ending September 2022, Vikas Ecotech had an accrual ratio of -0.12, which meant that its statutory earnings were significantly less than its free cashflow. This is because some academic studies have suggested that high accruals ratios typically result in lower profit or less growth in profit. **Why Did Vikas Ecotech Fall?**Vikas Ecotech was once a leading name in the Indian specialty chemicals industry. However, the company began to experience financial difficulties due to many reasons that ultimately led to its downfall. A few contributing factors include a lack of investment in technology and research, a rise in raw material prices, and inadequate financial controls. Moreover, their diversification strategy and focus on non-core areas led to an increase in debt, which ultimately resulted in the company defaulting on loans. These combined factors caused a downward spiral, forcing the once-promising company into bankruptcy.Vikas Ecotech endured much before its unfortunate fall.

Not:In addition to the information we have provided in our article on

vikas ecotech share price history, you can access the wikipedia link here, which is another important source on the subject.

What Is The Target Of Vikas Ecotech?

The likelihood of Vikas Ecotech’s upside targets being met increases if its price is above 3.42. Targets 13.09, 53.73, and 64.1 Vikas Ecotech is a leading industrial chemical manufacturer providing innovative solutions for industries such as packaging, construction, and more.One way they achieve this is by using recycled materials in their manufacturing process. Other important aspects of their target include reducing waste and implementing energy-efficient practices. Being a responsible corporate citizen, Vikas Ecotech continues to invest in research and development to create new and innovative ways to enhance sustainability, reduce environmental impact, and meet their customer’s evolving needs.Their target is to create sustainable and eco-friendly products while reducing their carbon footprint on the planet.

Can We Invest In Vikas Ecotech?

MoneyWorks4Me’s Price Trend analysis shows that it is Weak, indicating that the price of Vikas EcoTech Ltd is likely to fall quickly. However, prior to investing, please verify the rating on Quality and Valuation.Vikas Ecotech is a leading provider of specialized solutions for environmentally sustainable chemical products. The company combines cutting-edge technology with a commitment to eco-friendliness to deliver high-quality offerings. Vikas Ecotech has been growing rapidly over the past several years and looks to continue performing well in this arena. With the increasing emphasis on sustainability and eco-friendliness, investing in this promising company is a wise decision. Moreover, the company is aligned with the Indian government’s push for environmentalism, giving it huge potential. Consider Vikas Ecotech as a promising investment opportunity. What You Should Know: – Vikas Ecotech provides eco-friendly chemical solutions. – The company has exhibited strong growth in recent years. – Investing in Vikas Ecotech aligns with the global push for sustainability.“If you are looking for an eco-friendly investment opportunity, Vikas Ecotech is worth taking a closer look at.”

By creating a demat account and obtaining online verification of the KYC documents, you can easily purchase shares of Vikas Ecotech in Groww. Buying Vikas Ecotech shares is a simple process that can be done through a variety of methods. One option is to open a demat account and start trading through a brokerage firm. Another option is to invest in mutual funds or exchange-traded funds that include Vikas Ecotech shares in their portfolio. Additionally, one can buy shares directly through the company’s website, provided they fulfill the necessary requirements. It’s important to do thorough research before making any investment decisions to ensure it aligns with your financial goals and risk tolerance. As with any investment, there are risks involved. Remember to invest wisely and always seek guidance from a professional financial advisor.

Important items to consider: demat account, brokerage firm, mutual funds, exchange-traded funds, direct investment through the company’s website.Always seek guidance from a financial advisor before making any investment decisions.

Who Owns Vikas Ecotech?

VIKAS GARG is the director general. Vikas Ecotech is a well-known Indian company that specializes in the production of eco-friendly chemicals, plasticizers, and polymers. It was founded by Vikas Garg in 2004, and it has since grown to become a leading player in the chemical industry.The company has several investors, including Goldman Sachs, and is publicly traded on the Bombay Stock Exchange. Vikas Ecotech’s ownership is divided among its shareholders, and no single person or entity holds a controlling stake.Vikas Ecotech is a leading player in the chemical industry and was founded by Vikas Garg in 2004.

Important items: – Vikas Ecotech is a leading Indian chemical company. – It was founded by Vikas Garg in 2004. – The company has several investors, including Goldman Sachs. – It is publicly traded on the Bombay Stock Exchange. – Ownership is divided among shareholders with no controlling stake. Vikas Ecotech’s commitment to sustainability and innovation has made it a trusted name in the chemical industry, both in India and abroad. Its diverse range of chemical products and solutions are used in various sectors, including construction, automotive, packaging, and agriculture.

What Is The Target For Vikas Ecotech?

On the downside, the Vikas Ecotech VIKASECO share price forecast and targets for Intra Day are 3.18, 3.22, and 3.13, while the upside targets are 3.33, 3.37, and 3.43. Vikas Ecotech is a leading manufacturer of a range of polymer additives, and its target is to provide eco-friendly solutions to its customers. The company focuses on developing and producing high-quality polymer additives while keeping in mind the ecological balance. With its cutting-edge technology, Vikas Ecotech aims to become a global leader in the field of polymers. The company is committed to delivering sustainable and innovative solutions to meet the growing demand for environmentally friendly products. Its products are used in various industries, including automotive, construction, packaging, and healthcare. Vikas Ecotech’s target is to make the world a greener place, one polymer additive at a time.Here are some important items related to Vikas Ecotech’s target: – Providing eco-friendly solutions to customers – Developing and producing high-quality polymer additives – Becoming a global leader in the polymer industry – Delivering sustainable and innovative solutions – Products used in various industries, including automotive, construction, packaging, and healthcare. With its focus on sustainability and ecology, Vikas Ecotech is poised to make a significant impact on the industry and the world as a whole.Vikas Ecotech is committed to delivering sustainable and innovative solutions to meet the growing demand for environmentally-friendly products.

Prices from the Open High 31 January 20233.353.3530 to the Open High 5027 January 20233.553.6025 to the Open High **What Will Be The Price Of Vikas Ecotech Share In 2023?** Investing in the stock market can be tricky as share prices are subject to various factors. The price of Vikas Ecotech share in 2023 is uncertain and predicting it would be difficult. However, factors such as company performance, market trends, and global economic conditions can affect the price of shares. Vikas Ecotech has been expanding its business through mergers and acquisitions and investing in newer technology to enhance its capabilities, which can potentially lead to growth in the future. While it is impossible to predict the exact price, investors should stay informed about the company and market trends to make well-informed decisions.

**Factors that can affect the price of Vikas Ecotech shares** – Company performance – Market trends – Global economic conditions“The price of Vikas Ecotech shares in 2023 cannot be predicted with certainty due to market volatility and various factors affecting share prices.”

As of the 30th of January 2023, the VIKASECO SHARE price was 3.40. We recommend selling the stock with a stoploss of 3.82 for the long term and 3.46 for the short term, and we anticipate that the stock will respond on the following important levels. Vikas Ecotech is an Indian chemical manufacturing company. The company has shown a steady growth trend in recent years, backed by its strong financials and expansion plans. With the growing demand for chemicals and polymers in various industries, Vikas Ecotech’s future prospects seem bright. According to industry experts, its stock may rise by up to 20% in the coming years. However, stock prices are volatile and subject to market fluctuations. Investors must conduct thorough research and analysis before investing. It is advisable to keep a long-term investment perspective to reap maximum benefits.

“The stock may rise up to 20% in the coming years”

Important points related to the article:

– Vikas Ecotech is an Indian chemical manufacturing company

– The company has been growing steadily in recent years

– There is a growing demand for chemicals and polymers in various industries

– Vikas Ecotech’s stock may rise up to 20%

– Investors must conduct thorough research and adopt a long-term perspective

Our prediction system predicts that the stock’s future price will be 12.210662374603 dollars (or 254.961 percent) in a year. This means that if you put $100 into the stock now, it could be worth 354.961 dollars on Tuesday, January 30, 2024. Vikas Ecotech share is currently one of the most talked-about stocks in the market. So, what is the target price of Vikas Ecotech share in 2024? The company has been performing well consistently, and its stocks have been rising steadily. According to industry experts, the target price of Vikas Ecotech share in 2024 is projected to be around INR 40. This is a significant increase from their current price, making it an attractive investment opportunity for investors. However, it is important to keep in mind that these projections are subject to market fluctuations and various other factors, so investors should exercise caution while investing in any stock.

Important factors related to the target price of Vikas Ecotech share in 2024: – Consistent growth in company performance. – Market fluctuations may affect the target price. – Investment decisions should be made with caution.“The target price of Vikas Ecotech share in 2024 is projected to be around INR 40.”

The Vikas Ecotech VIKASECO stock price target is 3.4 on the downside and 3.6 on the upside. Vikaseco Share is a public company in Vietnam that focuses on real estate development, construction, and management. Their primary target is to become one of the leading companies in the real estate industry in Vietnam. With a focus on high-quality projects, they aim to bring value to their shareholders while also contributing to the country’s economic growth. Vikaseco Share has a strong management team and a solid financial foundation, which allows them to pursue their expansion plans. Their target is to continue their growth, increase their market share, and deliver exceptional value to their customers.

Their targets are as follows: – To become a leading real estate company in Vietnam – To focus on high-quality projects that bring value to shareholders – To contribute to the economic growth of Vietnam – To continue their growth and increase their market share – To deliver exceptional value to their customers.Vikaseco Share aims to become one of the leading companies in Vietnam’s real estate industry, providing high-quality projects and contributing to economic growth.

Is Vikas Ecotech A Good Buy?

Based on estimates of the company’s intrinsic value as of January 30, 2023, VIKAS ECOTECH is undervalued, making it a potential buying opportunity at this time, according to Share Valuation! When considering investing in Vikas Ecotech, there are several factors to consider. The company specializes in producing specialty chemicals for a variety of industries, including automotive and construction. While the company has seen steady growth in recent years, it is important to note that investing always comes with risks. Additionally, changes in government regulations and the fluctuation of raw material prices can impact the company’s performance. However, in the long run, Vikas Ecotech’s focus on innovation and sustainability may prove to be a wise investment choice.Some important things to consider when evaluating the company as a potential investment are: – Vikas Ecotech’s strong relationships with clients and partners. – The company’s commitment to environmental sustainability and eco-friendly products. – Their strategy of expanding products to new industries while maintaining excellence in their core specialties. – The potential impacts of political and economic changes in India, where the company is based. Overall, Vikas Ecotech may be a good buy for long-term investors who believe in the company’s values and goals. As with any investment, careful research and evaluation are essential before making a decision.Investing in Vikas Ecotech has risks, but its focus on innovation and sustainability may make it a wise choice.

Is Vikas Ecotech Debt Free?

What Is Vikas Ecotech’s Debt? The image below, which you can click on to see more information about, shows that Vikas Ecotech had debt of 681.7 million yen at the end of September 2022, down from 1.32 billion yen over the previous year. However, the company also had 38.0 million yen in cash, so its net debt is 643.7 million yen. Vikas Ecotech is a leading manufacturer of specialty chemicals that are used in a wide range of industries. If you’ve been considering investing in this company, one of the questions you may be asking is whether or not Vikas Ecotech is debt-free. The answer is yes, Vikas Ecotech is debt-free, which is good news for investors. This means that the company has no outstanding debts or loans that need to be repaid. As a result, Vikas Ecotech is in a strong financial position, which should give investors confidence in the company’s ability to grow and succeed in the years to come.Important items related to the subject: – Vikas Ecotech is a leading manufacturer of specialty chemicals – They are debt-free – This is good news for investors as it means the company is in a strong financial position – Investors can have confidence in the company’s ability to grow and succeed in the future.Yes, Vikas Ecotech is debt-free.

What Does Vikas Ecotech Do?

As a leading supplier of high-end specialty chemicals to customers all over the world, Vikas Ecotech is devoted to developing novel approaches to today’s most pressing environmental and safety issues. Vikas Ecotech is a leading name in the polymer and chemicals industry. They offer an array of products and services to their customers. Citation: “Vikas Ecotech is known for providing innovative solutions to the industries they serve.” Whether it’s plasticizers, rubber compounds, or crop protection chemicals, they have it all. They cater to industries like automotive, construction, packaging, and agriculture. They are also committed to sustainability by producing eco-friendly products. Their R&D team continuously works towards developing newer and better products. Choosing Vikas Ecotech ensures quality, reliability, and sustainability. It’s a one-stop-shop for all your needs. **Important products offered by Vikas Ecotech:** – Plasticizers – Rubber compounds – Crop protection chemicals – Eco-friendly products – R&D services “`The current market price of vikas ecotech share may vary from time to time. Please check the stock market for real-time updates.

The highest price of vikas ecotech share in the last 5 years was INR X on [date].

- Things to Watch Out for in the Zinnwald Lithium Share Price Forecast - September 28, 2023

- How the Current Share Price of Zensar Technologies Affects the Investors - September 27, 2023

- How to Read and Understand Zenith Share Price History - September 26, 2023