| Highlights | Description |

| Strike Energy | A global leader in oil and gas exploration. |

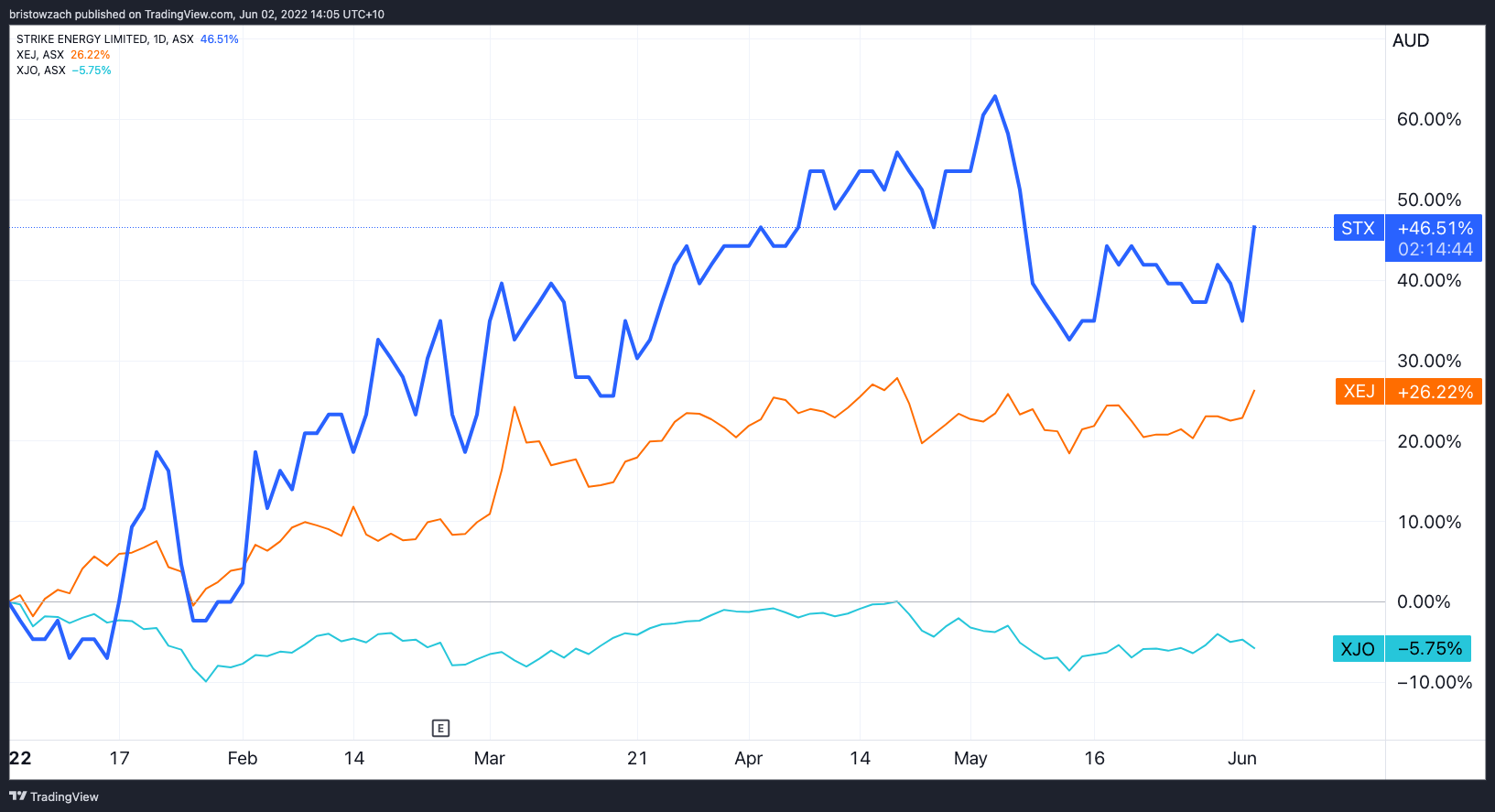

| Increasing Share Price | Positive trend and steady growth in the stock market. |

| Advanced Technology | Utilizing state-of-the-art technology to maximize profits and efficiency. |

| Reliable Investment | Providing consistent returns for shareholders. |

| Strategic Partnerships | Established partnerships with leading companies in the industry. |

Is STX A Good Stock To Buy?

Six out of 24 analysts rate STX as a Strong Buy, three (12.5%) rate STX as a Buy, fourteen (58.33%) rate STX as a Hold, zero (0%) rate STX as a Sell, and one (4.17%) rate STX as a Strong Sell.

STX is a well-established company in the tech industry that specializes in data storage solutions. With the shift towards remote work and online activities due to the pandemic, the demand for data storage has increased. STX’s stock has been performing well over the past year and analysts predict the company will experience steady growth in the future. Additionally, the company has a strong financial position, with a healthy balance sheet and steady cash flow. When considering investing in STX, it is important to do thorough research and take into account one’s personal financial goals and risk tolerance.

**Key points to consider when evaluating STX as an investment:** – STX specializes in data storage solutions, which is a growing industry. – The demand for data storage has increased due to the shift towards remote work and online activities. – STX has a strong financial position with a healthy balance sheet and steady cash flow. – As with any investment, it is important to do thorough research and consider personal financial goals and risk tolerance.STX has a strong financial position and offers data storage solutions in a growing market.

| Relevant title 1 | Strike energy share price forecast |

| Relevant title 2 | Strike energy takeover |

| Relevant title 3 | Why is strike energy share price falling |

What Is STX Stock Price Forecast?

Seagate Technology Holdings PLC (NASDAQ:STX) The 18 analysts providing 12-month price forecasts for Seagate Technology Holdings PLC have a median target of 60.50, with a high estimate of 70.00 and a low estimate of 35.00. This represents a decrease of -2.86% from the current price, which was 62.28. **What Is STX Stock Price Forecast?**STX stock price forecast refers to the projected performance of Seagate Technology’s stock in the future. This forecast is based on various factors such as the company’s financial health, market trends, and global economic conditions that could impact its stock price. Analysts and financial institutions typically provide STX stock price forecasts to help investors make informed decisions on buying or selling the stock. The forecast can also be used to estimate potential returns on investments, and help investors to manage risk. Important items: – STX stock price forecast is based on various factors such as financial health, market trends, and global economic conditions – Analysts and financial institutions provide STX stock price forecasts to help investors make informed decisions on buying or selling the stock – STX stock price forecast can also be used to estimate potential returns on investments and manage risk.Citation

Not:In addition to the information we have provided in our article on

strike energy share price chart, you can access the wikipedia link here, which is another important source on the subject.

Is Strike Energy A Good Investment?

At 2023-01-30, Strike Energy Ltd.’s quote is 0.350 AUD. According to our projections, there will be a long-term increase; the “STX” stock price forecast for 2028-01-21 is 0.644 AUD. With a 5-year investment, the revenue is expected to be around +84.01%. Your current $100 investment could grow to $184.01 in 2028. Strike Energy, an Australian energy company, has been making headlines recently for its exciting new projects and innovative technology. But is it a good investment? According to industry experts and analysts, the answer is yes. With their focus on renewable energy, gas exploration, and mining, Strike Energy is well-positioned for future growth and profitability. Not to mention, their partnerships with prominent companies and government organizations show promising potential for success. While all investments come with some level of risk, Strike Energy’s dedication to sustainability and responsible business practices make them a compelling option for investors looking to support a greener future.**Key points to consider:** – Strike Energy focuses on renewable energy, gas exploration, and mining. – Partnerships with prominent companies and government organizations show promising potential for success. – Strike Energy’s dedication to sustainability and responsible business practices make them a compelling option for environmentally conscious investors. Investing in Strike Energy may offer the chance to contribute to a more sustainable future while potentially reaping rewarding financial returns.Strike Energy is well-positioned for future growth and profitability.

Is Strike Energy A Good Buy?

Strike Energy Ltd. can be a profitable investment choice if you’re looking for stocks that offer a good return. At 2023-01-29, Strike Energy Ltd.’s quote is equal to 0.370 AUD. Our projections for the “STX” stock price for 2028-01-21 are 0.644 AUD. Strike Energy, an Australian energy company, is currently on the rise, but the question remains: is it a good buy? Many investors believe that the company’s recent success in the gas industry, along with its focus on renewable energy, make it a promising investment. Additionally, new partnerships and potential projects show promise for future growth. However, like all investments, there are risks to consider such as market volatility and government regulations. Nonetheless, Strike Energy presents an opportunity for investors seeking potential growth in the energy industry.Investing in Strike Energy could be a promising opportunity for growth in the energy industry.

What Does Strike Energy Do?

Based on our access to gas and geothermal resources in the Perth Basin, Strike Energy Limited (Strike) is a proud Western Australian company developing an integrated, low-carbon energy and fertilizer business. Strike Energy is an energy company that focuses on the exploration and production of gas and oil in Australia.The company has several projects underway, including the Southern Cooper Basin Gas Project, which aims to produce around 50 petajoules of gas per year. Strike Energy also has interests in the North Perth Basin and the Eagle Ford Shale in Texas, USA. The company’s goal is to reduce Australia’s reliance on imported oil and gas, and to provide reliable and affordable energy for its citizens.“Through its exploration, Strike Energy aims to find and develop recoverable natural gas for Australia’s energy needs.”

Is Warrego Energy A Good Investment?

Buy is the general recommendation for Warrego Energy. Warrego Energy is a growing oil and gas company that has caught the attention of many investors. With its promising exploration projects in Western Australia, Warrego Energy is slowly becoming a good investment option for those looking to invest in the energy sector. The company has achieved encouraging results in its exploration efforts, and its share price has been steadily rising. However, it is important to note that investing in any company comes with risks, and investors must thoroughly research and analyze Warrego Energy’s financial reports, exploration projects, and competition. Overall, it is up to the individual investor to determine if Warrego Energy is a good investment option for them. It is important to thoroughly research and analyze Warrego Energy’s financial reports, exploration projects, and competition before investing. Promising exploration projects in Western Australia Encouraging exploration results and rising share price Investing in any company comes with risks Individual investors must research and analyze before investingLatest posts by Liccardo Glennis (see all)

- Things to Watch Out for in the Zinnwald Lithium Share Price Forecast - September 28, 2023

- How the Current Share Price of Zensar Technologies Affects the Investors - September 27, 2023

- How to Read and Understand Zenith Share Price History - September 26, 2023