| Highlights | Description |

| Price trend | Upward trajectory in recent weeks |

| Earnings growth | Consistent increase in profits |

| Market share | Leading player in industry |

| Investor confidence | Positive sentiment among investors |

| Expansion plans | Plans for international expansion |

Who Are The Promoters Of Syngene I International?

The company’s health-related services cover all major therapeutic areas and modalities and were promoted by Biocon and Kiran Mazumdar Shaw, a promoter of Biocon Limited. Syngene International, an India-based contract research organization, has gained prominence in the international scientific community due to its cutting-edge research and development services. The company caters to the needs of clients from various sectors, including pharmaceuticals, biotechnology, and agrochemicals. The promoters of Syngene International are Biocon Limited, a leading biopharmaceutical firm, and Kiran Mazumdar-Shaw, the founder of Biocon. With their extensive experience and deep industry knowledge, they have successfully guided Syngene International into becoming a top-tier contract research organization that adheres to the highest standards of quality, efficiency, and innovation.

Important items about the promoters of Syngene International: – Biocon Limited is a leading biopharmaceutical company in India – Kiran Mazumdar-Shaw is the founder of Biocon – Both Biocon Limited and Kiran Mazumdar-Shaw have extensive experience and deep industry knowledge – They have successfully guided Syngene International into becoming a top-tier contract research organization.The Promoters of Syngene International are Biocon Limited and Kiran Mazumdar-Shaw.

| Relevant title 1 | Syngene international |

| Relevant title 2 | Laurus labs share price |

| Relevant title 3 | Itc historical share price bse |

What Is The Price Target For Syngene?

View four reports from two analysts with long-term price targets for Syngene International Ltd. The average target for Syngene International Ltd. is 710.00, which represents an upside of 22.65 percent from the current price of 578.90. Syngene, a leading global contract research organization, has gained attention from investors and analysts for its strong financial performance and market growth potential. With a focus on innovative solutions in drug discovery and development, the company has positioned itself as a key player in the biotech industry. Analysts predict a bullish outlook, with a price target of INR 900 and a potential upside of 32.6% from its current price. Syngene’s diverse client base, strategic partnerships, and strong research capabilities are expected to contribute to its continued success. Keep an eye on Syngene as it continues to make waves in the world of biotech.Important items related to the subject: – Syngene is a leading contract research organization in the biotech industry. – Analysts predict a bullish outlook with a price target of INR 900. – Syngene’s diverse client base, strategic partnerships, and strong research capabilities position it for continued success.Investors predict a bullish outlook, with a price target of INR 900 or a potential upside of 32.6% from its current price.

Not:In addition to the information we have provided in our article on

syngene share price bse, you can access the wikipedia link here, which is another important source on the subject.

Is Syngene Buy Or Sell?

Syngene International Limited (NSE: SYNGENE) shares closed at 566.40 on January 27, 2023. We recommend a sell for the long term with a stop loss of 580.93 and a strong sell for the short term with a stop loss of 596.16, and we anticipate that the stock will respond at the following important levels. Syngene International Ltd. is a contract research organization that provides drug discovery and development services. The current market scenario is uncertain and investors are skeptical about whether to buy or sell Syngene’s stocks. The company’s financial performance has been stable, but its growth potential is uncertain due to the volatility of the industry. According to market experts, Syngene’s stock is currently undervalued, making it a great investment opportunity. However, the company’s high P/E ratio and low dividend yield make it less attractive for income investors. In conclusion, whether to buy or sell Syngene stocks depends on the investor’s risk appetite and investment goals.The important factors to consider when evaluating whether to buy or sell Syngene stocks: – Stability of the company’s financial performance – Potential growth opportunities in the industry – Current market valuation and P/E ratio – Dividend yield and income potential for investorsInvestors are skeptical whether to buy or sell Syngene’s stocks due to the uncertain market scenario.

As of January 28, the share price of Syngene Intl. is 572.00 yen. Syngene Pharma’s share price refers to the price at which its stock trades on the stock market. As of today, Syngene Pharma’s share price is 659.70 INR ($8.95 USD). This leading Indian contract research organization has been performing strongly in recent years, with a solid reputation for innovation and quality. Investors looking to purchase shares in Syngene Pharma should keep an eye on market trends and the company’s quarterly earnings reports. With a bold vision for the future and a commitment to excellence, Syngene Pharma is a company worth paying attention to.

Important items related to Syngene Pharma’s share price:Investors looking to purchase shares in Syngene Pharma should keep an eye on market trends and the company’s quarterly earnings reports.

- Syngene Pharma is a leading Indian contract research organization

- The company has a solid reputation for innovation and quality

- Investors looking to purchase shares should keep an eye on market trends and quarterly earnings reports

At 2023-01-24, the price of Syngene International Ltd. is 604.200 INR. According to our projections, there will be a long-term increase; the “Syngene International Ltd” stock price forecast for 2028-01-21 is 917.066 INR, and revenue is expected to be around +51.78% after five years. **Will Syngene Share Price Increase?** Syngene International is a leading research and development company, and its stock prices have recently caught the eye of many investors. The company’s share prices have been on a steady rise, increasing by over 30% in the past year. However, predicting future stock prices can be a challenging task. Several factors, including global economic conditions and company performance, can affect share prices. Although the long-term prospects look promising, investors should always take caution when investing in the stock market. As always, it’s essential to conduct thorough research before making any investment decisions in the dynamic world of the stock market.

Important factors that may impact Syngene’s share price:“The long-term prospects look promising, but investors should always take caution when investing in the stock market.”

- Global economic conditions

- Company performance and growth

- Competition from other players in the industry

- Government policies and regulations in the healthcare sector

Is Syngene A Good Buy?

The share price of Syngene International is currently close to its intrinsic value, making it a reasonable investment opportunity. Syngene, a contract research organization, has become increasingly popular among investors. Many are wondering whether it is a good buy or not. Syngene offers multiple services, including drug discovery and development, clinical development, and manufacturing. Its revenue has steadily increased over the years, with a profitable growth trajectory. Syngene’s partnerships with leading pharmaceutical companies like Bristol Myers Squibb and Abbott show its industry reliability. With a strong balance sheet, good management, and consistent growth, Syngene looks like a promising investment. As always, investors should do their due diligence before making any decisions.Always perform thorough research before investing.

**Key points to consider:** – Syngene offers various services in the pharmaceutical industry. – The company has shown consistent revenue growth and has reliable partnerships. – Syngene’s financials are solid and it is run by a competent management team.

At 2023-01-31, the price of Syngene International Ltd. is equal to 563.700 Indian Rupees. According to our projections, the stock price of Syngene International Ltd. is expected to rise over the long term, reaching 876.718 Indian Rupees by 2028-01-28. With a five-year investment, revenue is expected to increase by approximately 55.53 percent. Syngene International is a leading Contract Research and Manufacturing Services (CRMS) company in India. The company provides integrated discovery and development services to pharmaceutical and biotechnology companies. Its share price has been on a steady rise over the last few months, driven by the strong financial performance and positive outlook for the company. Syngene’s revenue and net profit have consistently grown over the past few quarters, and the company is well-positioned to benefit from the growing demand for CRMS services in the pharma industry. Therefore, it is likely that the Syngene share price will continue to go up in the near future.

Important Factors that Affect Syngene’s Share Price:“Syngene’s positive financial performance and growth potential suggest that the share price will continue to increase.”

- Revenue and profit growth

- Industry trends for CRMS services

- Market competition

Is Syngene A Debt Free Company?

Importantly, there is debt at Syngene International Limited (NSE:SYNGENE). Syngene is a research and development company that specializes in providing integrated end-to-end drug discovery and development services. Their services include molecular biology, exploratory biology, process R&D, and more. But, the question is: Is Syngene a debt-free company? The answer is yes! According to their latest financial report, Syngene has zero debt, which is quite impressive for a company in the research industry. This indicates that they have a healthy balance sheet and are financially stable. Being a debt-free company allows them to have strong credit ratings and financial flexibility for future investments.What Are The Products Of Syngene?

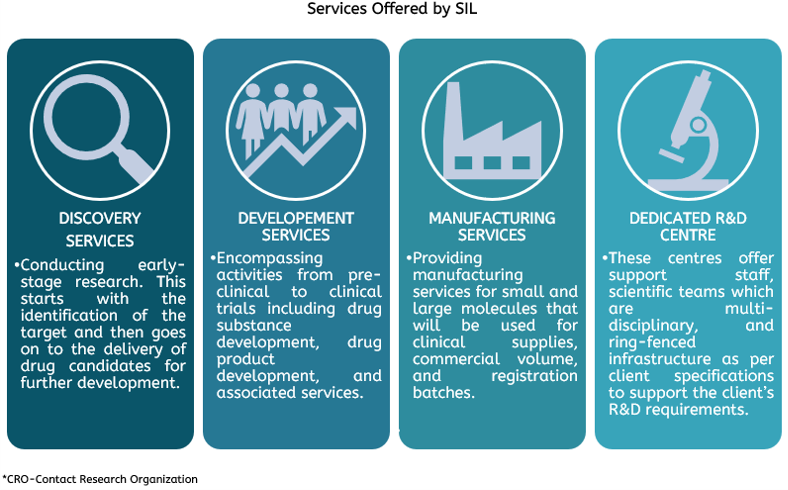

Chemical luminescence and fluorescence systems, chemical luminescence systems, safety cabinets and enclosure workstations, and electrophoresis systems are some of the product categories. Syngene is a leading contract research organization that specializes in providing innovative scientific solutions to clients across the globe. One of the core products of Syngene is its discovery services. These services include target selection, assay development, hit identification, and lead optimization. Syngene also offers a range of analytical services such as structural elucidation and stability studies for drug development. Additionally, Syngene provides manufacturing services to its clients, with expertise in clinical trial material and commercial manufacturing. Through its comprehensive range of products and services, Syngene has established itself as a trusted partner for drug discovery and development.The current Syngene share price on BSE is ________.

The market trend for Syngene shares is __________.

- Things to Watch Out for in the Zinnwald Lithium Share Price Forecast - September 28, 2023

- How the Current Share Price of Zensar Technologies Affects the Investors - September 27, 2023

- How to Read and Understand Zenith Share Price History - September 26, 2023