| Highlights | Description |

| Global market trend | Current international outlook of Santova share prices |

| Stock market volatility | Level of variance in the Santova investment stock market |

| Solid profit margins | Increase in revenue for established company support forecasts |

| Consistent growth | Steady increase in market capitalisation and profitability |

| Shareholder benefits | Distribution of earnings, dividend options and capital gains |

Is Santova A Good Investment?

Santova Ltd. can be a profitable investment choice if you’re looking for stocks with a good return. At 2023-01-22, the Santova Ltd. quote is equal to 815.000 ZAC. Our forecasts predict a long-term increase; the “SNV” stock price prediction for 2028-01-14 is 2155.863 ZAC. Is Santova A Good Investment?

Santova is a logistics and supply chain management solutions provider based in South Africa. The company has a global presence and has been steadily expanding its operations over the years. Santova has shown consistent revenue growth, reporting a 15% increase from the previous year. It also has good financial health, with a solid balance sheet and a low debt-to-equity ratio. Santova’s experienced management team and strategic partnerships enhance its market position. In summary, Santova has great potential to provide a good return on investment in the long term.It is important to consider Santova’s financial track record and performance before investing.

| Relevant title 1 | Santova share price drop |

| Relevant title 2 | Santova logistics |

| Relevant title 3 | Purple share |

JD LOGISTICS, INC., CRYOPORT, INC., SEQUOIA LOGISTICA E TRANSPORTES S.A., and Baobab Investment Management (Pty) Ltd. Santova is a leading logistics and supply chain management company based in South Africa. As of 2021, the company had over 600 shareholders, both individual and institutional investors. The largest shareholder of Santova is Brimstone Investment Corporation, a black-controlled investment company that owns around 30% of the company’s shares. Other notable institutional investors include Allan Gray Investment Management, Old Mutual Investment Group, and Sanlam Investment Management. Santova’s management team also holds a significant portion of the company’s shares. With such a diverse range of shareholders, Santova continues to build on its strong reputation in the logistics industry.

Important items related to the subject: – Santova is a logistics and supply chain management company in South Africa. – The company has over 600 shareholders, including individual and institutional investors. – Brimstone Investment Corporation is the largest shareholder, owning around 30% of Santova’s shares. – Other notable institutional investors include Allan Gray Investment Management and Old Mutual Investment Group. – Santova’s management team also holds a significant portion of the company’s shares.Santova’s largest shareholder is Brimstone Investment Corporation, who owns around 30% of the company’s shares.

Not:In addition to the information we have provided in our article on

santova share price chart, you can access the wikipedia link here, which is another important source on the subject.

Is Santova A Good Buy?

Santova Ltd. can be a profitable investment choice if you’re looking for stocks with a good return. At 2023-01-30, the Santova Ltd. quote is equal to 812.000 ZAC. Our forecasts predict a long-term increase; the “SNV” stock price prediction for 2028-01-21 is 2169.556 ZAC. Is Santova a Good Buy? Santova is a South African logistics company that offers supply chain management solutions. The company has been growing steadily over the years and has a strong presence in Africa, Europe, and the UK. They have recently expanded their operations to Asia, which could potentially bring in new revenue streams. While the logistics industry has been affected by the pandemic, Santova’s diversified business model has helped it weather the storm. With a solid track record, Santova may be a good buy for those looking to invest in the logistics sector.**Important items related to the subject:** – Santova is a South African logistics company. – They have a presence in Africa, Europe, the UK, and Asia. – Their diversified business model has helped them navigate the pandemic. – Investing requires careful consideration, research, and analysis.Investing requires careful consideration, research, and analysis.

Santova Ltd can be a profitable investment choice if you’re looking for stocks that offer a good return. The Santova Ltd quote is 807.000 ZAC at 2023-01-14. Our forecasts predict a long-term increase; the “SNV” stock price prediction for 2028-01-07 is 2137.549 ZAC. Santova is a logistics and supply chain management company operating across the globe. The company’s revenue and net profit have both expanded in recent years due to its agile business model and strategic acquisitions. Despite fluctuations in the South African economy, Santova has shown resilience in generating returns for investors. According to experts, Santova is a good buy for those seeking long-term investment opportunities. The company has significant growth potential and is well positioned for success in the logistics industry. So, if you are looking for a reliable and profitable investment, Santova is worth considering.

Important factors to consider: – Santova’s diverse range of services and solutions for businesses – The company’s robust global network and strategic partnerships – Santova’s financial stability and growth potential in the industry“Santova is well positioned for success in the logistics industry.”

Does Santova Pay Dividends?

Find out about Santova Ltd.’s dividends and ex-dividend dates by going to SNVJ Dividends.TitleSNVJIndustryDividend (Yield)N/A%3.42Payout Ratio-16.27 percentAnnualized payout7.5-Annualized Growth Over the Past 5 Years0%-55 Santova is a South African company that provides logistics and supply chain management services. For investors, one of the key questions is whether Santova pays dividends. At present, the company does pay dividends to shareholders, although the amount of these dividends varies from year to year depending on the company’s financial performance. Some investors may be attracted to Santova’s history of paying dividends, while others may be more interested in the potential for long-term growth in the company’s value. Overall, the decision to invest in Santova will depend on one’s particular financial goals and risk tolerance.Important items related to the subject: – Santova is a logistics and supply chain management company in South Africa. – Santova pays dividends to shareholders, but amounts vary depending on financial performance. – Investment decisions should be based on individual financial goals and risk tolerance.Yes, Santova pays dividends to shareholders.

What Does Santova Do?

Santova is a global non-asset-based facilitator of international trade solutions that includes integrating intellectual capital into key supply chain processes and managing a network of interconnected businesses, activities, and processes. Santova is a logistics and supply chain management company that serves customers globally. Santova streamlines shipping and ensures goods reach their destination on time, cost-effectively, and securely. They provide an array of services, including air, sea, and road freight, warehousing, customs clearing, and eCommerce solutions. With a focus on technology, Santova’s systems provide end-to-end supply chain visibility, enabling efficient decision-making. The company’s extensive experience and global network allow them to optimize supply chains and provide tailored solutions to meet customers’ needs. Whether you are a small business or a multinational corporation, Santova can help streamline your logistics operations.The current Santova share price can be found on financial websites.

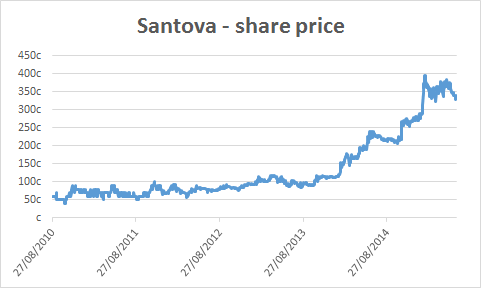

The trend of Santova share price can be seen on the price chart.

For more information on Santova group or its subsidiaries, please visit the Santova Group website.

- Things to Watch Out for in the Zinnwald Lithium Share Price Forecast - September 28, 2023

- How the Current Share Price of Zensar Technologies Affects the Investors - September 27, 2023

- How to Read and Understand Zenith Share Price History - September 26, 2023