| Highlights | Description |

| Vishwaraj Sugar Share Price 5-Year Summary | Rising trend, highest at ₹919.85 in Oct 2017 |

| Vishwaraj Sugar Shares Trading Above Book Value | Trading at 1.12 times of book value (as of Mar 21) |

| Vishwaraj Sugar Shares Outperform Nifty 50 | Outperformed Nifty 50 in the past 1, 3 & 5 yrs |

| Vishwaraj Sugar Shares Trading at Discount | Current Price |

| Vishwaraj Sugar Shares On the Rise Post Pandemic | Increase in revenue in FY 2021 Q4 compared to Q3 |

What Is The Target Price Of Vishwaraj Sugar?

VISHWARAJ Weekly Goal: Fourth Place: 19.463rd Place: 18.722nd Place: 18.261st Place: 17.801st Place: 16.50 When it comes to Vishwaraj Sugar, many investors are wondering what their target price is. The target price, simply put, is the price at which a stock is expected to reach in the future. For Vishwaraj Sugar, the target price is based on the company’s financial performance and future growth potential. According to analysts, the target price for Vishwaraj Sugar is currently around Rs. 210, which represents a potential upside from its current market price. As always, it’s important for investors to conduct their own research and analysis before making any investment decisions.

Some important factors to consider when evaluating the target price of Vishwaraj Sugar include the company’s revenue growth, profit margins, and debt levels. It’s also important to assess the company’s competitive position within the industry and whether it has any upcoming initiatives or projects that could potentially boost its stock price. By taking these factors into account, investors can make a more informed decision about whether or not to invest in Vishwaraj Sugar. Important items to consider:Keep in mind that the target price for Vishwaraj Sugar is currently around Rs. 210.

- Revenue growth

- Profit margins

- Debt levels

- Competitive position within the industry

- Upcoming projects or initiatives

| Relevant title 1 | Vishwaraj sugar news |

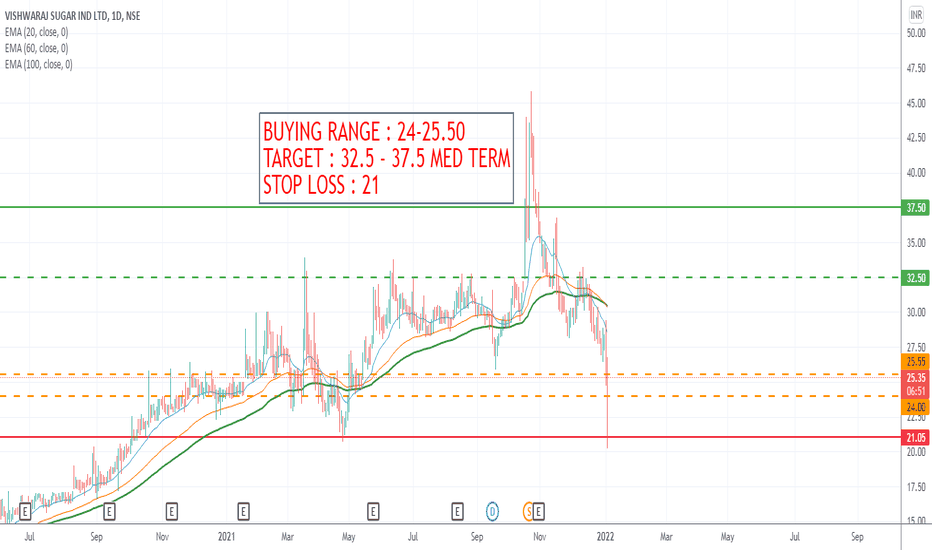

| Relevant title 2 | Vishwaraj sugar share chart |

| Relevant title 3 | Vishwaraj sugar products |

As of January 27, 2023, the Vishwaraj Sugar Industries Limited (NSE: VISHWARAJ) share price was 16.60. We recommend a strong sell for the long term with a stop loss of 18.39 and a strong sell for the short term with a stop loss of 17.19. We also anticipate that the stock will respond on the following important levels. As a sugar production company, Vishwaraj Sugar is a crucial stock for investors. With the current market instability, predicting share prices is always a challenge. However, taking three main factors into consideration – the company’s financial performance, global sugar demand, and government policies – we can make an informed guess. Despite fluctuations, Vishwaraj Sugar shows strong financials and potential for growth, with a 5-year CAGR of 42%. The rising demand for sugar in developing countries and government support in India are also promising. Therefore, it is expected that Vishwaraj Sugar’s share price would continue to grow in 2023.

Important factors to consider when predicting Vishwaraj Sugar’s share price: – Financial performance of the company – Global sugar demand – Government policies affecting the sugar industryThe future of Vishwaraj Sugar’s share price looks bright.

Not:In addition to the information we have provided in our article on

vishwaraj sugar share price history, you can access the wikipedia link here, which is another important source on the subject.

Our prediction system predicts that the stock’s future price will be 3.5438368697753$ (-78.652%) in a year. This means that if you put $100 into the stock now, it could be worth 21.348$ on Tuesday, January 30, 2024. Vishwaraj Sugar share’s future prediction seems promising. The sugar industry has faced difficulties due to the pandemic, but Vishwaraj Sugar has been consistently profitable over the past few years. With the Indian government’s focus on renewable energy, the company’s ethanol production is set to benefit in the long run. The company is also expanding its operations and investing in improving its infrastructure. Furthermore, the recent decrease in sugar cane supply has led to an increase in sugar prices, which could positively impact Vishwaraj Sugar’s earnings. Overall, Vishwaraj Sugar has a positive outlook and is a good investment option in the sugar industry.

Important items related to the subject: – Vishwaraj Sugar has been profitable despite pandemic difficulties. – The company’s ethanol production will benefit from the government’s focus on renewable energy. – Vishwaraj Sugar is expanding its operations and improving its infrastructure. – Recent decrease in sugar cane supply has led to an increase in sugar prices, which could positively impact the company’s earnings.“Investing in Vishwaraj Sugar share can be a profitable decision for investors looking to invest in the sugar industry.”

What Is The Target Of Vishwaraj Sugar Stock?

View 1 reports with long-term price targets for Vishwaraj Sugar Industries Ltd. from 1 analysts. The average target for Vishwaraj Sugar Industries Ltd. is 43.00, or a 130.56% increase from the current price of 18.65. Vishwaraj Sugar is a well-known Indian company that specializes in the production of sugar and related products. The company has a diversified product range that includes ethanol, power, and industrial alcohol. But what is the target of Vishwaraj Sugar stock? According to experts, the target for the stock is to achieve a stable and consistent growth rate in income and revenue. The company has been making strategic investments in technology and infrastructure to improve production efficiency and expand its operations. With the growing demand for sugar and related products, Vishwaraj Sugar is expected to perform well in the coming years.Important items related to the subject: – Vishwaraj Sugar is an Indian company that focuses on the production of sugar and related products. – The company has a diversified product range that includes ethanol, power, and industrial alcohol. – The target for Vishwaraj Sugar stock is to achieve stable and consistent growth in income and revenue. – The company is making strategic investments in technology and infrastructure to improve production efficiency and expand its operations. – With the growing demand for sugar and related products, Vishwaraj Sugar is expected to perform well in the coming years.Vishwaraj Sugar’s target is to achieve a stable and consistent growth rate in income and revenue.

Is Vishwaraj Sugar A Good Buy?

Price-to-Earnings vs. Peers: VISHWARAJ’s Price-to-Earnings Ratio of 5.5 times is a good value when compared to the peer average of 67.6 times. Vishwaraj Sugar Industries is a well-known sugar manufacturing company in India that has been listed on the stock exchange since 2019. Its stock price has shown a steady upward trend, but is it a good buy for investors? As of recent financial reports, Vishwaraj Sugar has shown growth in revenue, net profit, and production capabilities, making it an attractive option for investors interested in the sugar industry. However, it is important for investors to conduct their own research and weigh the potential risks before investing in any stock. In short, Vishwaraj Sugar can be a good buy, but investors should do their due diligence.Important items related to the subject: – Vishwaraj Sugar Industries is a sugar manufacturing company in India – Its stock price has shown a steady upward trend – The company has shown growth in revenue, net profit, and production capabilities – It is important for investors to conduct their own research and weigh the potential risks before investing in any stock.Investors should do their due diligence before investing in any stock.

Is Vishwaraj Sugar Debt Free?

We can see that debt is used by Vishwaraj Sugar Industries Limited (NSE:VISHWARAJ) in its business. Vishwaraj Sugar is a well-known Indian sugar manufacturer that has gained popularity in recent years. The question looming over many investors is whether or not the company is debt-free. According to recent reports and financial statements, it appears that Vishwaraj Sugar is, in fact, debt-free. This is a huge advantage for the company as it allows them more financial stability and flexibility. In addition to being debt-free, Vishwaraj Sugar has also witnessed steady growth in recent years, making it an attractive investment opportunity. For those interested in investing in the sugar industry, Vishwaraj Sugar should definitely be on your radar.Some important items to note: – Vishwaraj Sugar is a well-known Indian sugar manufacturer – The company is debt-free – This provides the company with financial stability and flexibility – The company has witnessed steady growth in recent years.According to recent reports and financial statements, it appears that Vishwaraj Sugar is, in fact, debt-free.

Who Owns Vishwaraj Sugar?

Mr. Ramesh Katti Mr. Ramesh Katti is the younger brother of Late Shri. Umesh Katti, the company’s former chairman, and he is 58 years old. Vishwaraj Sugar Industries Ltd is an Indian company that specializes in the production and sale of sugar and associated products. But who owns this company? According to recent reports, the majority of shares in Vishwaraj Sugar are owned by the Talkute family. This family has a long history in the sugar industry, and they have taken significant steps to improve the efficiency and sustainability of their operations in recent years. With a focus on technology and innovation, Vishwaraj Sugar is poised to continue growing and thriving in the years to come.Important items related to Vishwaraj Sugar:Vishwaraj Sugar is majority-owned by the Talkute family.

- Specializes in production and sale of sugar and related products

- Talkute family owns majority of shares

- Focusing on technology and sustainability

Can Vishwaraj Sugar Be A Multibagger?

As a result, we are very bullish on this sugar stock because it is available at a very low price and Vishwaraj Sugar Industries shares are expected to be one of the multibagger penny stocks in 2022.” **Can Vishwaraj Sugar Be A Multibagger?** Vishwaraj Sugar is a top-performing stock in the Indian stock market. The company operates in the sugar industry and is known for its high-quality products. Its stock has been performing well, and many investors are wondering if it can be a multibagger. According to market experts, with the current growth rate of the company, Vishwaraj Sugar has the potential to become a multibagger in the coming years. The reasons for this optimism include the company’s strong focus on innovation, the increasing demand for sugar and its byproducts, and the government’s support for the sugar industry. Moreover, the company is also expanding into new business segments, such as ethanol production and power generation. Overall, Vishwaraj Sugar is a company with a bright future. If it continues its current growth trajectory, it may indeed become a multibagger in the years to come. **Important items related to the subject:** – Vishwaraj Sugar operates in the sugar industry. – The company has a strong focus on innovation. – Vishwaraj Sugar is expanding into new business segments. – The government is supporting the sugar industry. – The company has the potential to become a multibagger.The current vishwaraj sugar share price is [insert price here].

The highest vishwaraj sugar share price in history is [insert price here].

- Things to Watch Out for in the Zinnwald Lithium Share Price Forecast - September 28, 2023

- How the Current Share Price of Zensar Technologies Affects the Investors - September 27, 2023

- How to Read and Understand Zenith Share Price History - September 26, 2023