| Highlights | Description |

| Investment portfolio diversification | Diversify portfolio with Smithson Investment Trust. |

| Low management fees | Low-cost investment with Smithson Investment Trust. |

| Track record of consistent performance | Proven track record of consistent performance. |

| Investment in innovative companies | Invest in innovative businesses with Smithson Investment Trust. |

| Active fund management approach | Expertise in active fund management with Smithson Investment Trust. |

Why Has Smithson Dropped?

As investors can get a better return from safe cash and government bonds, higher interest rates make it less appealing to invest in future profits. This was bad news for Barnard’s highly valued stocks, sending shares plunging. Finally, investors downgraded profit expectations for businesses due to concerns about recessions. **Why Has Smithson Dropped?** Smithson Inc. has taken a significant dip in the market following a loss of investor confidence. The drop occurred due to many factors, including increasing competition, a decrease in demand for the company’s products, and changes in market trends. Additionally, Smithson faced legal challenges that have shaken investor trust in the company. These events have led to a decrease in stock prices and a loss of profits for the once prosperous company. Despite these setbacks, the company is working diligently to regain investor standing and reposition itself as a top competitor in the industry.

**Key factors contributing to the drop in Smithson’s stock prices:** – Increased competition – Decreased demand for products – Changes in market trends – Legal challenges While the future of Smithson is uncertain, the company is making strides to regain investor trust through innovation and a commitment to excellence. Only time will tell if these efforts will pay off and lead to a resurgence in the market.Smithson Inc. faces significant challenges as competition increases and demand for its products declines.

| Relevant title 1 | Smithson investment trust news |

Does Smithson Pay A Dividend?

Your account is set up to receive notifications from Smithson Investment Trust plc whenever they declare dividends. There are currently no dividends from Smithson Investment Trust plc….Dividend Summary.SummaryPrevious dividendNext dividendPay date––If you’re an investor in Smithson, one of the biggest questions on your mind might be: does it pay a dividend? The answer, unfortunately, is no.

Citation

Smithson, which is a global investment trust that focuses on long-term capital growth, does not have a policy of paying out dividends to its shareholders.

Here are some important items related to the subject:- Smithson is managed by Fundsmith LLP, an investment management firm founded by Terry Smith.

- The trust has a concentrated portfolio of around 30-40 global stocks, with a focus on high-quality businesses.

- The trust’s performance has been strong since its launch in 2018, significantly outperforming the benchmark MSCI World index.

While it may be disappointing for income-seeking investors, Smithson’s focus on long-term capital growth means that it reinvests profits back into its portfolio, potentially leading to greater gains in the future.

Overall, while Smithson does not pay a dividend, it may still be a worthwhile investment for those looking for long-term growth.

Not:In addition to the information we have provided in our article on

smithson investment trust share price chat, you can access the wikipedia link here, which is another important source on the subject.

Is Smithson An Investment Trust?

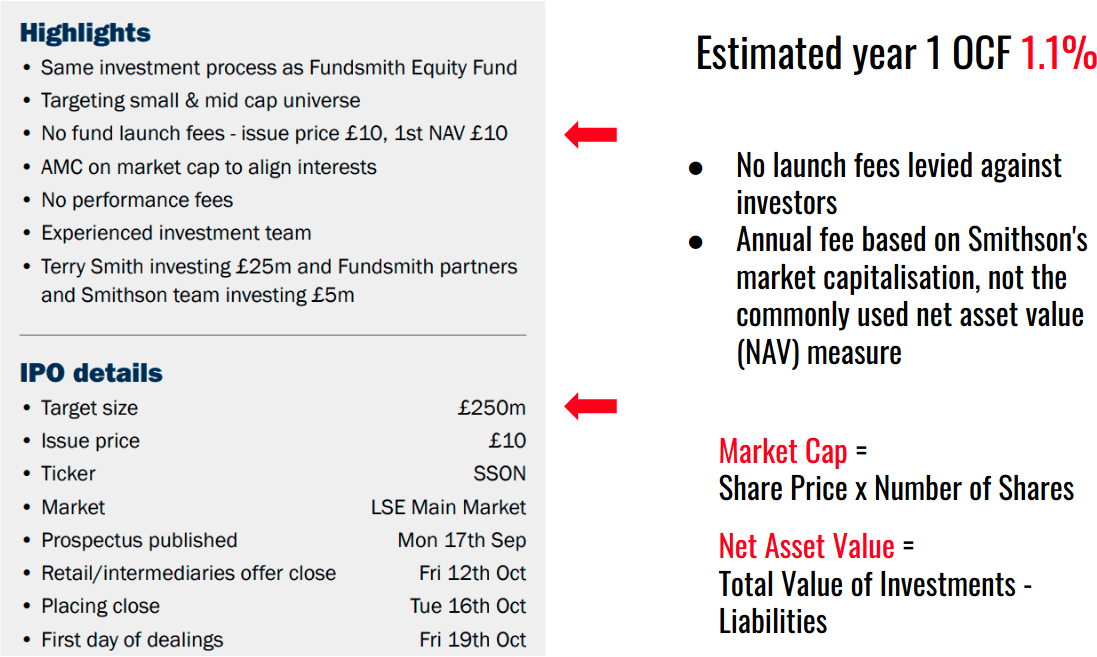

Smithson Investment Trust is a large British investment trust that invests in small and mid-sized international listed or traded companies with a market cap of between £500 million and £15 billion at the time of investment. Established in 2010, the company is a part of the FTSE 250 Index. Is Smithson An Investment Trust?Smithson Investment Trust, launched in 2018, is managed by Fundsmith, a renowned global asset management company. It focuses on small and mid-sized businesses in developed countries, aiming to provide long-term capital growth to its investors. The fund has a concentrated portfolio of just 30 to 40 companies, with the top holdings including technology, healthcare, and consumer goods sectors. Smithson has a unique investment approach, emphasizing high-quality businesses, sustainable growth, and a long-term perspective. With their proven track record and specialized focus, Smithson is worth considering for investors looking to diversify their portfolio. **Important items to note:** – Smithson Investment Trust focuses on small and mid-sized businesses in developed countries. – Managed by Fundsmith, it has a concentrated portfolio of just 30 to 40 companies. – The fund emphasizes high-quality businesses, sustainable growth, and a long-term perspective.Yes, Smithson is an investment trust with a focus on small and mid-sized businesses.

Who Runs Smithson Trust?

Lead manager Simon Barnard and assistant portfolio manager Will Morgan run Smithson Investment Trust (SSON), which aims to provide investors with a highly concentrated portfolio that currently consists of 32 holdings of global small and mid-cap companies. Citation: Smithson Trust is run by a board of trustees. Smithson Trust, a non-profit organization, is managed by a board of trustees consisting of experts from various industries. The trustees are responsible for overseeing the trust’s activities and ensuring that they adhere to the organization’s objectives. They are also responsible for making important decisions, such as determining the trust’s strategies and allocating funds to various projects. Moreover, the trustees are responsible for appointing a CEO who manages the trust’s daily operations. The trustees make sure that the trust runs efficiently and effectively while successfully achieving its goals in education, research, and social innovation.Current share price.

Updated daily.

For further information, please contact our customer support.

- Things to Watch Out for in the Zinnwald Lithium Share Price Forecast - September 28, 2023

- How the Current Share Price of Zensar Technologies Affects the Investors - September 27, 2023

- How to Read and Understand Zenith Share Price History - September 26, 2023