| Highlights | Description |

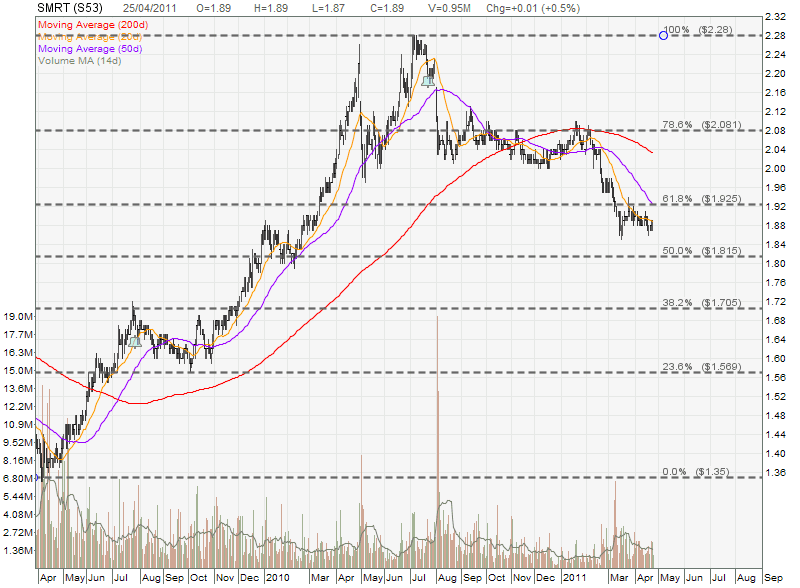

| Growth | Increasing value of smrt share price chart india |

| Volatility | Price fluctuations over short periods |

| Trends | Identifying patterns in smrt share price chart india |

| News | Impact of national and global news on smrt share price chart india |

| Investment | Potential for return on investment with smrt share price chart india |

Is SGX A Good Stock?

Based on the most recent SGX StockFacts data from September 1, 2022, Singapore Telecommunications Ltd. (Singtel) shares have a consensus rating of “outperform” and an average price target of S$3.18, which represents a potential upside of 20.5% from its most recent traded price of S$2.64. Singapore Exchange Limited (SGX) is a leading financial institution that operates a securities market and a derivatives market in the Asia-Pacific region. It also provides clearing and settlement services for these markets. SGX’s revenue has been steadily increasing over the past few years, and it has a strong balance sheet with minimal debt. Additionally, SGX has been expanding its product offerings and geographic presence. While investing in any stock carries inherent risk, SGX’s financials and growth potential suggest that it could be a good investment opportunity for those looking to invest in the Asia-Pacific region.Some important points to consider regarding the potential of SGX as a good stock include a focus on its revenue growth, its strong balance sheet, its expanding product offerings, and its geographic reach. By considering these factors and doing additional research, investors can make informed decisions about whether or not to invest in SGX. Ultimately, while investing in any stock comes with risk, SGX appears to have strong fundamentals that could make it a good investment opportunity for those looking to invest in the Asia-Pacific region.SGX’s financials and growth potential suggest that it could be a good investment opportunity for those looking to invest in the Asia-Pacific region.

| Relevant title 1 | Smrt earnings |

| Relevant title 2 | Smrt sustainability report |

The Singapore Stock Market (STI) – data, forecasts, and historical chart – was last updated in January 2023. In October 2007, the STI reached its all-time high of 3906.16. Investors in the Singapore Exchange (SGX) are always on the lookout for the highest share price. After all, it can be an indication of a strong performance and potential profits. Till date, the highest share price recorded in SGX is S$92.22, achieved by Jardine Matheson Holdings Limited (JM). JM is one of the largest listed companies on SGX and operates across Asia-Pacific in various industries, including automotive, property, and retail. With such high share prices, it’s essential to diligently study market trends before investing. Keep an eye on SGX to see if other companies can surpass this record-breaking top share price.

**Important items related to the subject**: – Investors seek information about high share prices in SGX – Jardine Matheson Holdings Limited (JM) holds the record of the highest share price at S$92.22 – JM operates across various industries such as automotive, property, and retail in Asia-Pacific.Citation

Not:In addition to the information we have provided in our article on

smrt share price chart india, you can access the wikipedia link here, which is another important source on the subject.

You must open a trading account with a brokerage of your choice before making your first investment. This account gives you access to the Singapore securities market, where you can buy and sell shares. Investors can open multiple trading accounts with different brokerages. If you’re interested in investing in Singapore’s economy, you may wonder if you can buy shares from the Singapore Exchange (SGX). Good news, you can! The SGX is one of the major stock exchanges in Asia, with over 700 listed companies. To buy SGX shares, you’ll need to open an investment account with a brokerage firm. It’s also important to research and understand the risks and opportunities associated with investing before diving in. Remember, investing always involves risk, so be sure to consult with a financial professional before making any decisions.

Here are some important items to know: – SGX is a major stock exchange in Asia – Over 700 companies are listed on SGX – You need to open an investment account with a brokerage firm to buy SGX shares – Investing involves risk, so consult with a financial professional beforehand.Investing involves risks. Consult with a financial professional before making decisions.

What Are Stock Prices Today?

Markets in the United StatesSymbolic Price ChangeJIA33,978.08+28.67NASDAQ11,621.71+109.3S&P 5004,070.56+10.13*GOLD1,933+3.6 Stock prices today refer to the current value of publicly traded shares of a company, listed on a stock exchange. These prices may fluctuate due to various factors such as financial performance, economic conditions, political events, and investor sentiment. The stock market usually opens for trading during specific hours and updates the prices in real-time. The stock price reflects the market’s perception of the company’s future growth potential and profitability. It can be difficult to accurately predict stock prices, but investors use various tools and strategies to make informed decisions. Stay updated with the latest stock prices by checking financial news portals and stock exchange websites daily.Important items related to stock prices:Stay updated with the latest stock prices by checking financial news portals and stock exchange websites daily.

- Stock prices reflect the current value of publicly traded shares.

- Prices may fluctuate due to various factors such as financial performance, economic conditions, political events, and investor sentiment.

- Investors use various tools and strategies to make informed decisions about buying and selling shares.

- Stay updated with the latest prices by checking financial news portals and stock exchange websites daily.

Five Promising Blue-Chip Stocks in Singapore That Have the Potential to Beat the Market in 2023Genting Singapore Ltd. (SGX: G13)Wilmar International Limited (SGX: F34)Keppel DC REIT (SGX: AJBU)Mapletree Logistics Trust (SGX: M44U)Singapore Technologies Engineering Ltd. (SGX: S63)29 Kas 2022 If you are looking to invest in shares in Singapore, you might be wondering what the best options are. With so many choices available, it can be difficult to make the right decision.

However, there are some factors to consider when making your decision, including the company’s financial performance, management, and growth prospects. It’s always a good idea to do your research and seek professional advice before investing.The good news is that there is no one “best” share to buy in Singapore. Different shares will be suitable for different investors depending on factors such as their risk tolerance, investment goals and budget.

Is SMRT Privatised?

Mass Rapid Transit Corporation As a private state-owned company owned by Temasek Holdings, the government’s investment arm, the MRT system’s operations were regrouped under SMRT Limited.SMRT Corporation Ltd, a leading multi-modal public transport operator in Singapore, was privatised in 2016. The move took place after the government purchased all the outstanding shares to take full ownership of the company. The decision came after several train disruptions and incidents that raised concerns about the efficiency and safety of the country’s public transport system. As a result, SMRT was taken private to facilitate the necessary structural and operational changes required to make the system more reliable and efficient.SMRT was privatised in 2016 after the government bought over all outstanding shares.

Is SmartRent A Buy?

In the past year, 8 Wall Street equities research analysts have given SmartRent ratings of “buy,” “hold,” and “sell.” There is currently one hold rating and 7 buy ratings for the stock. Investors should “buy” SMRT shares, according to Wall Street equities research analysts. SmartRent, a rapidly growing PropTech company, provides internet of things (IoT) and automation services to the rental housing industry. With the surge in demand for affordable housing and smart home technologies, SmartRent is attracting plenty of investor interest. While some see SmartRent’s IoT services as a game-changer in the rental housing industry, others question whether it is a sustainable business model. SmartRent faces several competitors in the market, but its partnerships with top real estate companies add credibility to its services. With uncertainty in the real estate market, SmartRent may be worth considering for investors looking for future growth opportunities.Key considerations when evaluating SmartRent: – SmartRent enables landlords to remotely manage multiple properties through a single platform. – The company has partnerships with top real estate firms like Greystar and Lennar Multifamily Communities. – SmartRent faces competition from companies like Airbnb’s Hostmaker, Rently, and IOTAS. – The company has raised $113 million in funding so far, indicating investor interest in its services. Overall, SmartRent’s unique approach to IoT services in the rental housing industry and its investments in partnerships make it an intriguing option for investors looking for growth opportunities. However, it is important to consider the potential competition and sustainability of the business model before investing.SmartRent is gaining attention with its innovative IoT and automation services.

Why Is SmartRent Stock Down?

As of 10:59 a.m. ET, shares of SmartRent (SMRT -2.19%) were falling after the property technology company cut its guidance for the entire year and missed expectations in its second-quarter earnings report. **Why Is SmartRent Stock Down?** The plummeting market led to a significant decrease in SmartRent stock value. SmartRent, a technology company that provides property management software and Internet of Things (IoT) devices for property owners, has seen a sharp decline in its stock value. The company recently went public on the New York Stock Exchange and its shares have been on a downward trajectory. Some factors that have contributed to this decline include high competition in the property management technology sector, delays in supply chains for IoT devices, and concerns over rising interest rates. However, SmartRent still offers unique services in the rapidly-growing real estate technology market, and investors remain optimistic about its long-term growth potential. **Key points:** – Market decline – Competition in property management technology sector – Delays in supply chains for IoT devices – Concerns over rising interest ratesThe current share price can be found on the stock market.

Access the chart online or through a trading platform.

- Things to Watch Out for in the Zinnwald Lithium Share Price Forecast - September 28, 2023

- How the Current Share Price of Zensar Technologies Affects the Investors - September 27, 2023

- How to Read and Understand Zenith Share Price History - September 26, 2023