What Is The Prediction For CWR?

CWR Financial Forecast The earnings estimate for the upcoming quarter for CWR is -0.12p, with a range of -0.12p to -0.12p. The EPS for the previous quarter was -0.12p. In the previous year, CWR beat its EPS estimate 0.00% of the time, while the industry as a whole beat its EPS estimate 45.05% of the time in the same period.

Is Ceres Power A Buy Or Sell?

In the past year, Ceres Power has received “buy,” “hold,” and “sell” ratings from two Wall Street equities research analysts, and there are currently two buy ratings for the stock.

Should I Invest In Ceres?

Ceres Power is a company in the early stages of hydrogen technology. It is not profitable, and it could be years before the company becomes profitable. At the same time, funding will continue to be a problem. However, the company does have a lot of cash resources because it raised a lot of money late last year.

Who Are Ceres Power Competitors?

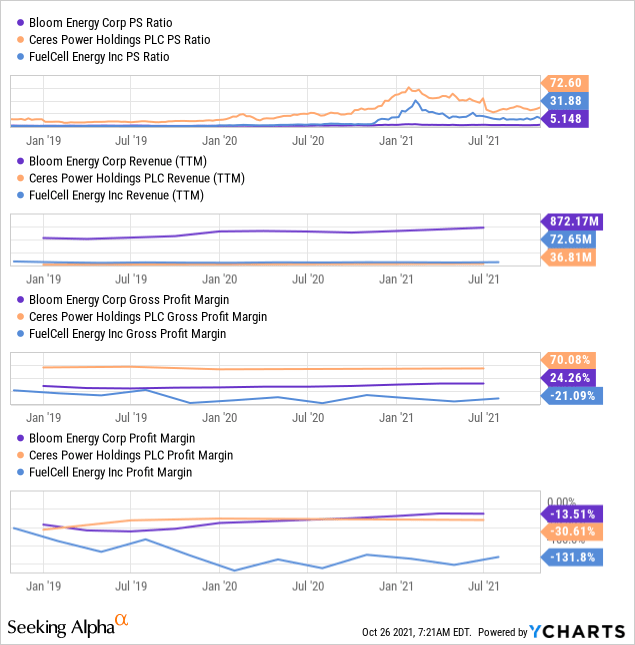

Plug Power, Bloom Energy, Nuvera Fuel Cells, and Joi Scientific are among Ceres’s rivals and similar businesses.

What Has Happened To Ceres Power?

Ceres Power (LSE: CWR) is one of the renewable energy stocks that has had a strong start to the year. The share price of Ceres Power has increased by 23% this month, but it is still 27% lower than it was a year ago and more than 70% below its February 2021 highs.

Is Ceres Power Worth Buying?

Ceres Power is a business in the early stages of hydrogen technology. It is not profitable, and it could be years before the company becomes profitable. Funding will also continue to be a problem.

What Is The Future Of Ceres Power Holdings?

Analyst Future Growth Forecasts Earnings vs. Market: CWR is expected to remain unprofitable for the next three years. High Growth Earnings: CWR is expected to remain unprofitable for the next three years. Revenue vs. Market: CWR’s revenue is expected to grow at a rate of 32.7 percent per year, which is faster than the market in the United Kingdom (4.2 percent per year).

What Is Ceres Power Price Forecast?

Based on four Wall Street analysts’ 12-month price targets for Ceres Power Holdings, the average target is 927.50p, with high and low forecasts of 1,560.00p and 400.00p, respectively.

Is CWR A Good Investment?

In the past year, three Wall Street research analysts have given Ceres Power “buy,” “hold,” and “sell” ratings, and there are currently three buy ratings for the stock. Investors should “buy” CWR shares, according to the consensus among Wall Street research analysts.

- How Will Ethereum 2.0 Improve Upon Existing Blockchain Platforms? - February 9, 2023

- Dogecoin Explained: What is Dogecoin and How Can You Use It? - February 9, 2023

- Smart Investing Strategies for Wise in 2018: A Share Price Forecast - February 5, 2023