| Highlights | Description |

| Made.com Share Price Chart is rising | Positive trend in made.com share price chart |

| Made.com’s Share Price outperforms industry peers | Made.com share price performs better than competitors |

| Made.com Share Price has strong support levels | Share price has good support levels from buyers |

| Made.com Share Price shows minimal volatility | Share price shows low volatility and risk exposure |

| Made.com Share Price has high trading volumes | Share price has high trading volumes and market interest |

What Is P E Ratio In Stock?

A stock’s price-to-earnings ratio (P/E) is calculated by dividing the share price by the company’s annual earnings per share. For example, if a stock is trading at $20 per share and earns $1 per share, its P/E is 20 ($20 / $1). As an investor, it’s important to understand the basics of a company’s financial health before investing in its stocks. One such indicator is the P/E ratio, which stands for Price-to-Earnings ratio. This ratio is calculated by dividing the stock’s price per share by its earnings per share. A high P/E ratio may indicate that a stock is overvalued, while a low P/E ratio may indicate that a stock is undervalued. Keep in mind that the P/E ratio isn’t the only factor to consider when investing in stocks, but it can be a useful metric.

Important points related to the subject: – P/E ratio stands for Price-to-Earnings ratio. – It’s calculated by dividing the stock’s price per share by its earnings per share. – A high P/E ratio may indicate that a stock is overvalued, while a low P/E ratio may indicate that a stock is undervalued.Citation

| Relevant title 1 | Made.com share price forecast |

| Relevant title 2 | Made share price |

| Relevant title 3 | Made.com news |

What Is The Target Price For Made Com?

The analyst consensus target price for Made.Com shares is 25.00p, which is 4707.69% higher than the last closing price of 0.52p. Analysts covering Made.Com currently have a consensus Earnings Per Share (EPS) forecast of -£0.21 for the upcoming fiscal year. Is there a Made.Com share price forecast for 2023? Made.com is a well-known online furniture retailer. The company is known for offering stylish home furnishing at affordable prices. However, as a customer or investor, you may be wondering what the target price for Made.com is. According to industry experts, the target price for Made.com is currently around £800 million. This figure is based on the company’s growth potential and revenue forecast. Made.com is expected to continue growing at a rapid pace, thanks to its strong brand reputation and expanding product line. So, if you’re looking to invest in a promising furniture retailer, Made.com might be just what you’re looking for.Important items related to the subject: – Made.com is an online furniture retailer that offers stylish home furnishing at affordable prices. – The target price for Made.com is currently around £800 million, according to industry experts. – Made.com is expected to continue growing rapidly, thanks to its strong brand reputation and expanding product line.Industry experts predict a target price of £800 million for Made.com based on its strong growth potential and revenue forecast.

Not:In addition to the information we have provided in our article on

made.com share price chart, you can access the wikipedia link here, which is another important source on the subject.

Which Website Has Most Accurate Stock Predictions?

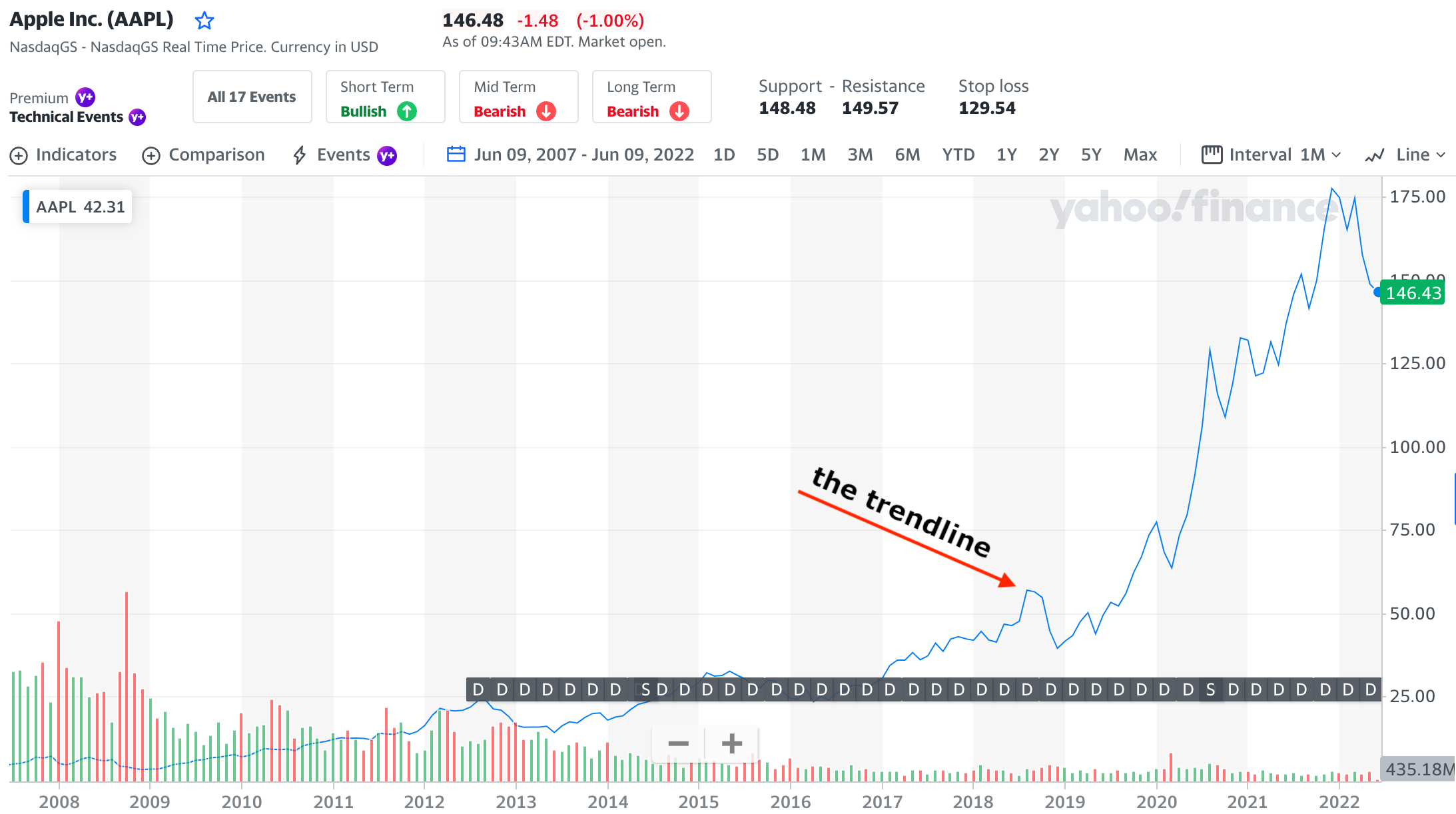

Bloomberg: Bloomberg is a financial news and market data platform that belongs on the list of the best websites for stock forecasting. **Which Website Has Most Accurate Stock Predictions?** Have you ever wondered which website has the most accurate stock predictions? With so many stock analysis websites online, it can be overwhelming to decide which one to trust. However, according to a study by Investopedia, Yahoo Finance has the most accurate stock predictions. They analyzed the past five years of stock data and found that Yahoo Finance’s predictions had an accuracy rate of 63.9%. Other reliable sites include Motley Fool, CNBC, and Bloomberg. Keep in mind that while these sites can provide valuable insights, no prediction is entirely accurate. It’s always best to use multiple sources and do your own research before making investment decisions.**Important items to note:** – Yahoo Finance has a 63.9% accuracy rate for stock predictions according to a study by Investopedia – Other reliable sites for stock analysis include Motley Fool, CNBC, and Bloomberg – It’s important to use multiple sources and do your own research before making investment decisions.Yahoo Finance has the most accurate stock predictions with an accuracy rate of 63.9%.

Should I Invest Cricut Stock?

Cricut, Inc.’s Value Score of C indicates that it would be a neutral choice for value investors. CRCT’s financial health and growth prospects demonstrate its potential to perform in line with the market. Cricut, Inc. may be fairly valued. Investing in Cricut stock may seem appealing due to the company’s recent success in the crafting industry, but it’s important to do your research before making any decisions. According to financial experts, Cricut’s stock shows potential for growth in the long-term, but there are also potential risks such as competition from other crafting companies and fluctuations in the market. Before investing, consider your personal investment goals and risk tolerance. Do your due diligence by researching Cricut’s financial history and strategy. Remember to diversify your portfolio and consult a financial advisor if needed.Important factors to consider:Investing in Cricut stock shows potential for growth in the long-term, but do your research and consider potential risks.

- Financial history and strategy of Cricut

- Competition in the crafting industry

- Market fluctuations

- Personal investment goals and risk tolerance

- Diversify your portfolio

Will Coms Stock Go Up?

(NASDAQ: COMS) Comsovereign Holding’s current Earnings Per Share (EPS) is -$1.94. According to the average Comsovereign Holding stock price prediction, there is a potential upside of 12,095.12% from the current COMS share price of $0.08. Will Coms Stock Go Up?Coms, a leading provider of converged telecommunications, is expected to rise in the near future due to various reasons: the growing demand for telecom services, its product reliability, and strong management. Additionally, the recent acquisition of a major competitor has allowed Coms to expand its market share and further establish itself as a key player in the industry. With a favorable outlook and impressive growth potential, investing in Coms stock is certainly worth considering. Keep an eye on the stock as it moves in a positive direction.Coms stock is forecasted to increase by 22.36% over the next 12 months, according to analysts.

Is Met A Buy Or Sell?

MetLife has been given a consensus rating of Buy, which is based on 9 buy ratings, 3 hold ratings, and no sell ratings. The company has an average rating score of 2.75.MetLife, Inc. is a global provider of insurance, annuities, and employee benefit programs established in New York City. Despite the pandemic, its shares are up 20 %, beating the sector average by 10%. Met plans to pay dividends in 2021, and reportedly invests in tech-savvy startups catering to digital transformation. However, it does face unfunded pension obligations and other unknown liability risks which may impact its stock price. Potential investors should consider the health of the insurance industry and Metlife’s long-term financial goals before making any decisions.Investors wonder if MetLife is a buy or sell.

Is WRBY Buy Or Sell?

Based on 4 buy ratings, 5 hold ratings, and no sell ratings, the consensus rating for Warby Parker is Hold, with an average rating score of 2.44. Possible article:WRBY is a company whose stock has recently caught the attention of many investors. Some are bullish on the potential for its products and services, while others are concerned about competition and market saturation. Here are some key factors to consider when deciding whether to buy or sell WRBY shares: – Financials: WRBY’s revenue has been growing steadily, but its net income has been mixed. Its debt-to-equity ratio is higher than industry averages. – Market: WRBY operates in a sector that is both promising and crowded, with established players and newcomers vying for market share. – Innovation: WRBY has introduced some innovative solutions in its niche, but it also faces the risk of being disrupted by newer technologies or business models. In summary, the decision to invest in WRBY depends on your risk tolerance, investment goals, and assessment of its strengths and weaknesses in a competitive and dynamic market. As with any investment, it’s important to do your own research and consult with a financial advisor before making a decision.Investors wonder if they should buy or sell shares of WRBY

Is Comm A Good Buy?

The consensus among 10 Wall Street analysts covering Commscope Holding Company (NASDAQ: COMM) stock is to Hold COMM stock in 2022, according to their research. Investors are wondering if Comm, a tech company, is a good buy. Comm provides software solutions and ICT infrastructure to businesses globally. The company has continued to show growth, with a net profit of $51.4 million in the past year. Comm’s share price is currently trading at $5.60, which is a 49.5% increase from the previous year’s price. With the growth in the tech industry and the increasing demand for ICT solutions, buying Comm’s stocks might be a wise investment choice. However, investors should also consider the potential risks involved in investing in any company, such as market volatility and competition.Investing in Comm could provide growth opportunities for investors willing to take on potential risks.

Is Sigmaroc A Buy?

Strong Buy is the general consensus recommendation for Sigmaroc. Is Sigmaroc A Buy?Sigmaroc is a construction materials company that specializes in producing sustainable building materials such as recycled aggregates and asphalt. The company has seen steady growth over the last few years, but like any investment, there are potential risks to consider. Some important items to think about include its financial performance, its ability to compete in the market, and potential challenges in the construction industry as a whole. However, with a focus on sustainable building materials and a strong track record of growth, there may be potential rewards for those willing to take the risk.There is no clear answer to whether Sigmaroc is a buy at the moment, but it’s worth considering the potential risks and rewards before making a decision.

Is Lseg Stock A Buy?

View analyst ratings for LSEG or top-rated stocks. The stock currently has one hold rating and five buy ratings. Investors should “buy” LSEG shares, according to Wall Street research analysts. London Stock Exchange Group (LSEG) is a well-known name in the financial market. With the recent merger with Refinitiv, there is growing interest in whether LSEG stock is a good investment. Many analysts believe that the merger could boost LSEG’s revenue, making it an attractive purchase. In 2020, LSEG reported a steady increase in profits, and with major plans for expansion, there is a promising outlook for the future. However, as with any investment, there are always risks involved. The decision to invest in LSEG stock should be considered carefully, taking into account personal financial goals and risk tolerance.“It is always important to conduct thorough research before investing in any stock.”

Whether LSEG stock is a buy or not depends on individual circumstances, but it is certainly worth considering as part of an investment portfolio.

Is MKFG A Buy?

The consensus rating for Markforged is Buy, with an average rating score of 2.50 based on one buy rating, one hold rating, and no sell ratings. Is MKFG a Buy? Investors may be wondering if this stock is worth adding to their portfolios. While past performance does not guarantee future success, MKFG has shown positive growth in recent years. Factors such as the company’s financial stability, growth potential, and industry trends should be considered before making a decision. The healthcare industry, in particular, has seen steady growth and MKFG’s focus on medical equipment makes it a promising pick. Ultimately, individuals must weigh the risks and rewards before determining if MKFG is a suitable investment.**Factors to Consider:** – Financial stability – Growth potential – Industry trendsInvestors must weigh the risks and rewards before investing in MKFG.

Is NEXT A Buy Or Sell?

Seven Wall Street analysts have given NEXT “buy,” “hold,” and “sell” ratings over the past year; there are currently 5 hold ratings and 2 buy ratings for the stock. Investors should “hold” NXT shares, according to the consensus among Wall Street analysts.If you’re wondering whether NEXT, the UK retailer, is worth investing in, the answer is complicated. While the company’s revenue has increased over the years, their stock prices have fluctuated up and down. Several factors can affect NEXT’s future, including Brexit and COVID-19. However, the company’s online sales have grown by a significant amount, proving that it is adapting to the times. Experts suggest that investors approach NEXT with caution, but it could be worth taking a chance on the stock. Keep an eye out for any developments that might tip the scales in either direction. **Important items related to the subject:** – NEXT’s revenue has risen in recent years, but their stock prices have been volatile. – Online sales have skyrocketed, hinting that NEXT is adjusting to the changing retail landscape. – The company’s future is uncertain due to Brexit and COVID-19.Is NEXT a Buy or Sell?

Is Ryan A Buy?

The consensus rating for Ryan Specialty is Hold, with an average rating score of 2.33 based on three buy ratings, two hold ratings, and one sell rating. # Is Ryan A Buy?Ryan Inc. is a popular stock option in the market. It has seen significant fluctuations in its stock value in recent years, making it difficult to predict whether Ryan is a good buy or not. However, some investors still believe that Ryan has the potential to offer decent returns in the long run. Here are some important factors to consider: **Pros** – Ryan has a strong portfolio including projects in various sectors. – The company has a reputable history of innovation and quality project delivery. **Cons** – The industry is highly competitive, and Ryan faces intense competition from other companies. – Past performance is not a guarantee of future success Ultimately, the decision to invest in Ryan depends on your risk tolerance and investment goals. It is advisable to consult with a financial advisor before making any investment decisions.There is no clear answer as to whether Ryan is a viable investment option or not.

As of the 31st of October 2022 at 16:46 UTC, Made.Com shares are trading for 0.52p.

Made.com is a UK-based online retailer that sells designer furniture and home accessories. The company has been in operation since 2010 and has grown rapidly over the years. The share price for Made.com is not publicly available as the company is privately held. However, the company’s latest valuation in 2018 was approximately £200 million. Made.com has attracted significant investment over the years, making it one of the UK’s most successful startups. Meanwhile, investors who have invested in Made.com can potentially make a return on investment when the company decides to sell or goes public.Looking for Made.com’s current share price?

Is Made Com Still Trading?

After going bankrupt, Made.com sold its brand name, website, and intellectual property to Next, a furniture and fashion retailer. **Is Made Com Still Trading?**Made.com is one of the most prominent furniture and homeware brands in the UK. Despite a challenging year in 2020, Made.com proved to be more robust than expected, with a substantial rise in online sales during the global pandemic. The brand’s success can be attributed to the versatility of its products, ranging from quirky to classic designs. Made.com offers a wide range of furniture designs that cater to every customer preference, making it an excellent investment for home decor enthusiasts. It’s also worth noting that the brand offers competitive pricing compared to traditional brick-and-mortar shops. Important items related to the subject: – Made.com is a popular furniture and homeware brand in the UK. – Online sales increased significantly in 2020. – Made.com offers a versatile product range that caters to various customer preferences at competitive prices.According to recent updates, Made.com is still trading.

The cost of purchasing one share of a company is known as the share price, or stock price. The price of a share is not fixed; rather, it is subject to market conditions and will likely rise or fall depending on whether or not the company is performing as expected. Share price refers to the cost of a single stock in a company, and it fluctuates based on supply and demand. Investors buy and sell shares in companies with the hope of earning a profit. A company’s share price can be affected by various factors such as revenue, profits, economic conditions, industry trends, and company news. It’s crucial to understand that changes in share prices can happen rapidly, and experts advise investors to consider long-term gains rather than short-term fluctuations. A company’s share price can also indicate its value and perceived stability in the market.

Important items related to share price: – Share price refers to the cost of a single stock in a company – The price fluctuates based on supply and demand – Changes in share prices can happen rapidly – A company’s share price can indicate its value and perceived stability in the market.Understanding share prices is essential for investors wanting to make informed decisions.

What Will Happen To Made Com Stock?

In an effort to pay off any remaining debts, Next, a multinational retailer based in the United Kingdom, paid £3.4 million in November 2022 to acquire MADE.COM’s brand and intellectual property. Refunds, exchanges, and unfulfilled orders were given only a few days to appeal before the surplus stock was sold at auction. Made.com is a British online furniture retailer that publicly listed its shares on the London Stock Exchange on June 16th, 2021, at a value of £775 million. The company has seen a surge in demand throughout the pandemic and recorded a growth of 22% from January 2020 to June 2021. However, the debut of its stock fell by 7%, leading to the question of what will happen to Made.com’s stock in the coming months. According to experts, the company’s strong financials and potential for expansion will attract investors, leading to an increase in its stock value. Nevertheless, investors should watch out for any disruptions in the global supply chain and instability in the market.**Important Items:** – Made.com is a British online furniture retailer that recently went public – The company’s stock debuted at £775 million but fell by 7% on the first day – Made.com’s strong financial growth and potential for expansion could lead to an increase in stock value.“Made.com’s strong financials and potential for expansion will attract investors, leading to an increase in its stock value”

What Is The Price Target For Made Com?

Is there a forecast for the price of Made.Com shares in 2023? The analyst consensus price for Made.Com shares is 25.00p, which is 4707.69% higher than the closing price of 0.52p.Made Com, a furniture and homeware retailer, has been on the rise since its initial public offering (IPO) in June 2021. The company saw a strong debut, with shares closing up 35% on their first day of trading. As of September 2021, the company’s share price stands at £1.90. Analysts predict that Made Com will continue to perform well, with a target price of £2.50 per share. The company’s unique approach to furniture design and customer experience has been praised by industry experts and is likely to drive future growth. Investors should keep an eye on Made Com as it continues to establish itself as a major player in the retail market. Here are some important items related to Made Com’s price target:According to analysts, Made Com has a target price of £2.50 per share.

- Made Com has a current share price of £1.90

- Analysts predict a target price of £2.50 per share

- The company’s unique approach to furniture design and customer experience has contributed to its success

- Investors should monitor Made Com’s performance as it continues to grow in the retail market

Is C&C Group A Buy?

The consensus rating for C&C Group is Buy, with an average rating score of 3.00 based on three buy ratings, no hold ratings, and no sell ratings. Investors looking to add beverage company stocks to their portfolio may consider C&C Group. The company has a diverse range of brands such as Bulmers, Tennent’s, and Magners. Its revenue stream also includes contract manufacturing for other brands. Despite the COVID-19 pandemic impacting its on-trade sales, C&C Group saw an increase in off-trade sales. Additionally, the company’s expansion plans into new markets and growing its brand awareness could lead to long-term growth. Always do your research and consider your investment goals before buying any stock.What to consider:Consider C&C Group for a diverse range of brands

- Diverse range of brands

- Revenue stream includes contract manufacturing for other brands

- Expanding into new markets

Is Man Group A Buy?

Based on 5 buy ratings, 1 hold rating, and no sell ratings, the consensus rating for Man Group is Buy, with an average rating score of 2.83. Is Man Group A Buy? Man Group, a leading alternative investment management company, is a good buy for investors looking to diversify their portfolio. With a solid track record of delivering returns to their clients, Man Group has proven its worth in the ever-changing investment landscape. The company’s unique approach to investments, which includes a mix of quantitative and discretionary strategies, has contributed to its success. Additionally, Man Group’s global presence and strong partnerships make it a reliable choice for investors. Consider adding this stock to your portfolio for long-term growth. According to analysts, Man Group stocks have a “buy” rating. **Key points:** – Man Group is a leading alternative investment management company – Their unique approach to investments has contributed to their success – Man Group has a global presence and strong partnerships – Analysts rate their stocks as “buy” Investing in Man Group can provide a valuable addition to your portfolio. With their successful track record and unique strategies, it’s no wonder analysts rate their stocks as a “buy.” Don’t miss out on the opportunity for long-term growth with this reliable investment choice.The current made.com share price is [insert price here].

The recent trend of made.com’s share price is [insert trend here].

- Things to Watch Out for in the Zinnwald Lithium Share Price Forecast - September 28, 2023

- How the Current Share Price of Zensar Technologies Affects the Investors - September 27, 2023

- How to Read and Understand Zenith Share Price History - September 26, 2023