What Is Cholamandalam Investment?

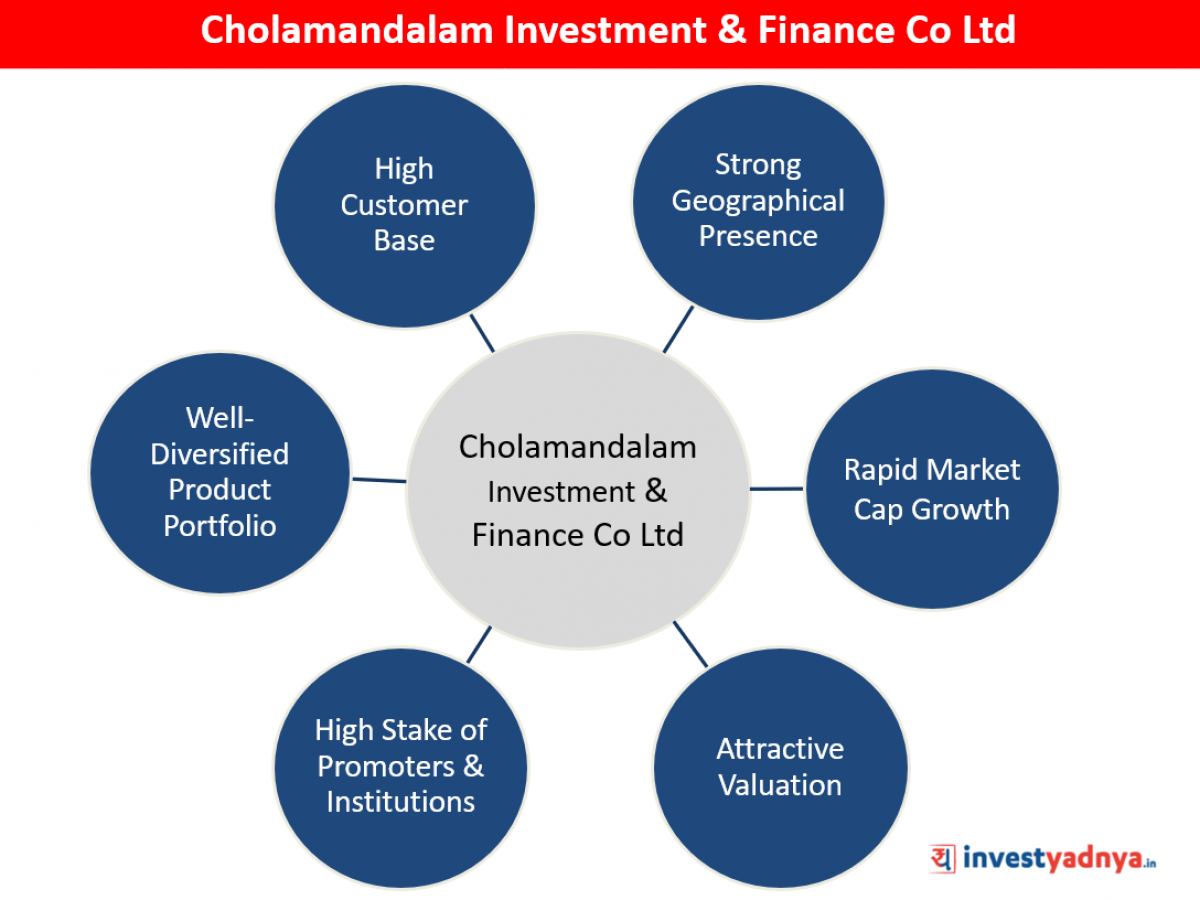

Chola began as an equipment financing company but has since grown into a full-service financial services provider that provides customers with vehicle finance, home loans, home equity loans, loans for small and medium-sized businesses, investment advisory services, stock broking, and a wide range of other financial services.

What Is Cholamandalam In History?

Cholamandalam Investment and Finance Company is a public industry that provides financial services. It was founded in 1978 and has its headquarters in Chennai, Tamil Nadu, India. Key personnel include Arun Alagappan, who serves as the company’s managing director.

How To Invest In Cholamandalam?

Find and invest in bonds issued by top corporations, PSU banks, NBFCs, and many more… Find your first bond. Find safe and high-yielding bonds for your buck. Find the right bonds meeting your investment amount and investment horizon. Invest in high-rated bonds from as little as Rs. 10,000.

Who Is The Founder Of Cholamandalam?

On August 17, 1978, M Arunachalam, M V Murugappa, and M V Subbiah formed the public limited company Cholamandalam Investment and Finance Company (CIFCL), which belonged to the Murugappa Group. On November 22, 1978, the company began operations.

Is Lam Research A Good Buy?

By January 26, 2024, Wall Street analysts anticipate that Lam Research’s share price will reach $486.79, an increase of 0.81 percent from the $482.88 that the LRCX share price currently carries.

What Is The Stock Price Forecast For Lam Research?

Stock Price Forecast The 18 analysts who have provided 12-month price forecasts for Lam Research Corp have a median target of 517.50, with a high estimate of 565.00 and a low estimate of 370.00. This represents an increase of 7.20 percent from the stock’s previous price of 482.73 dollars.

Is Lam Research A Growth Or Value?

Overall, Lam Research Corporation stock has a Value Grade of C, a Growth Grade of A, and a Momentum Grade of D. Your individual objectives, risk tolerance, and allocation will ultimately determine whether or not you should purchase Lam Research Corporation stock.

Is Lam A Buy Or Sell?

Based on 12 buy ratings, 6 hold ratings, and no sell ratings, Lam Research has received a consensus rating of Buy, with an average rating score of 2.67.

Is Lam Research A Big Company?

Dr. David K. Lam founded Lam Research in 1980. Its headquarters are in Fremont, California, in the Silicon Valley. As of 2018, it was the second largest manufacturer in the Bay Area, behind Tesla. Lam Research. Type Public company. Total equity US$6.28 billion (2022) Number of employees c. 17,700 (2022) Website Lamresearch.com

Who Is Lam Research Biggest Customer?

Lam is a manufacturer of wafer fab equipment (WFE), which are the machines used to make semiconductors. Its main customers include Taiwan Semiconductor (TSM -0.43%), Intel (INTC 1.11%), and SK Hynix, to name a few.

- How Will Ethereum 2.0 Improve Upon Existing Blockchain Platforms? - February 9, 2023

- Dogecoin Explained: What is Dogecoin and How Can You Use It? - February 9, 2023

- Smart Investing Strategies for Wise in 2018: A Share Price Forecast - February 5, 2023