| Highlights | Description |

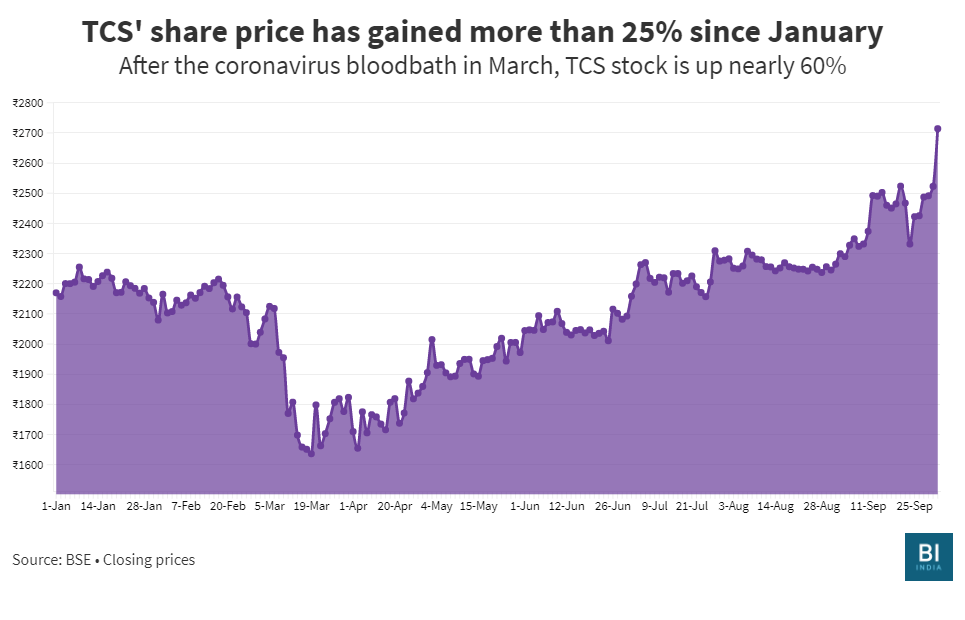

| TCS share price history chart graph | Shows TCS’s stock performance over time |

| Annual highs and lows | Records highest and lowest stock prices each year |

| Trending history | Display of trends over the years |

| Historical earnings per share | Shows how much TCS earned per share |

| Market capitalization changes | Displays changes in company value over time |

TCS set the offer price range at Rs 775-900 per share with an IPO size of Rs 4,713 crore and was listed on August 25, 2004, at a premium of 26% over the issue price of Rs 850 per share. # What Was The Share Price Of TCS In 2004?

In 2004, Tata Consultancy Services (TCS) had been public for a year, following its initial public offering in 2003. At the time, TCS was one of the largest Indian IT software services exporters, providing services such as IT consulting, application development and maintenance, and engineering services to a range of clients. In terms of share price, TCS’s IPO was offered at INR 850 per share. By the end of 2004, the price had risen to around INR 1050 per share, which represented strong growth for the company. Important items related to the subject: – TCS went public in 2003. – The company provided IT and engineering services. – In 2004, the share price was around INR 1050, up from INR 850 at IPO.Citation

| Relevant title 1 | Tcs share price in 2030 |

| Relevant title 2 | Tcs share price this week |

| Relevant title 3 | Tata motors share price history |

What Will Be TCS Price After 5 Years?

The future stock price of Tata Consultancy Services (ticker: “532540”) is expected to be 5833.961 Indian Rupees in 2028. Tata Consultancy Services (TCS) is one of the largest IT services provider in the world. It’s difficult to predict the exact stock price of TCS after five years. However, we can look at current market trends and make an informed guess. According to market analysts, TCS is expected to grow significantly due to its strong financials, diverse clientele, and continuous innovation in technology. By diversifying into newer areas like automation, AI, and cloud computing, TCS is expected to maintain its strong growth trajectory. As a result, it’s likely that TCS stock price could increase by 50-60% over the next five years.Important items related to the subject: – TCS is one of the largest IT services providers in the world. – TCS has a diverse clientele and strong financials. – TCS is continuously innovating in technology by diversifying into newer areas like automation, AI, and cloud computing. – According to market analysts, TCS stock price could increase by 50-60% over the next five years.It’s likely that TCS stock price could increase by 50-60% over the next five years.

Not:In addition to the information we have provided in our article on

tcs share price history chart graph, you can access the wikipedia link here, which is another important source on the subject.

Underlying High-Priced TCS Futures Instrument Stock Futures TCS3,462.95 TCS3,471.00 TCS3,478.00 TCS, one of India’s top IT companies, has been a leading entity in the stock market. However, predicting the future price of TCS shares is no easy feat. Many factors such as economic conditions, industry trends, and company performance can influence the stock price. The COVID-19 pandemic has caused market volatility, affecting TCS shares as well. Experts predict TCS stock will continue to perform well, with a potential increase in share price as the economy recovers. But as always, nothing is certain in the stock market, and investors should do their due diligence before investing.

Important factors to consider when predicting the future price of TCS shares: – Economic conditions – Industry trends – Company performance Investors must be cautious when investing in stocks, especially during times of market volatility. It’s important to stay informed and make informed decisions when investing in the stock market.Investing in stocks comes with risks, always do your research and seek the advice of a financial professional.

Date 31/12/20202,951.9029/12/2020 Date 31/12/20192,296.0003/09/2019 Date 31/12/20183,674.0025/05/2018 Date 31/12/20172,774.0013/11/2017 According to the Bombay Stock Exchange (BSE) records, TCS share’s highest price was Rs 3,674, recorded on 10th September 2021. Tata Consultancy Services (TCS) is one of the largest IT services and consulting companies in the world, founded in India. The company provides services in various industries such as banking, healthcare, retail, and telecommunications. TCS has a massive client base worldwide, and its consistent growth in the share market is a testament to its popularity. As of June 2021, TCS has a market capitalization of over Rs 12 lakh crore. Its past performance indicates future growth, making it a safe option for investors.

Important Items: – TCS is one of the largest IT services and consulting companies in the world. – TCS provides services in various industries like banking, healthcare, retail, and telecommunications. – TCS has a massive client base worldwide, and its consistent growth in the share market is a testament to its popularity. – TCS share’s highest price was Rs 3,674, recorded on 10th September 2021.TCS share’s highest price was Rs 3,674, recorded on 10th September 2021.

In 2030, TCS stock is expected to cost Rs 9,600. TCS, or Tata Consultancy Services, is one of the top Indian IT companies. As with any investment, predicting the future TCS share price is risky. However, one can make some informed guesses based on TCS’s track record, financial statements and market trends. In 2030, TCS is likely to grow significantly, given the company’s strong financial position and the growth potential of the IT industry. However, the share price will be impacted by many factors, such as market conditions, competition, technological advancements, and government regulations. Overall, it is hard to predict the exact TCS share price in 2030, but it will likely be higher than its current value.

The important factors that determine TCS’s future share price include:It is hard to predict the exact TCS share price in 2030.

- The growth potential of the IT industry

- Market competition and demand for TCS’s services

- Financial performance and profitability

- Technological advancements

- Government regulations and policies

TCS Share PriceRise/Fall2007269-12.09%2008119-55.76%2009362204.20%201056355.52%TCSShare Price

Tata Consultancy Services (TCS), one of the largest IT service providers in India had a share price of INR 761 in the year 2010. The company’s financial reports indicated that they had a strong financial performance in that year, which may have contributed to the stability of their share price. As of now, TCS continues to remain one of the most successful IT services providers in India with a market cap of more than $100 billion. It is interesting to note how the company’s share price has evolved over the past decade, from INR 761 in 2010 to around INR 3,000 in 2021.Citation: TCS share price in 2010 was approximately INR 761.

Tata Consultancy Services Ltd. Tata Consultancy Services has not yet split the share’s face value. Tata Consultancy Services (TCS), one of the largest IT companies in the world, has split its shares multiple times. In total, there have been five share splits by TCS, the latest being a 1:5 split in 2018. This means that for every one share owned before the split, shareholders received five shares after the split. Share splits are a common practice for companies looking to make their shares more accessible to small investors, and TCS has benefited from this strategy over the years. As of 2021, TCS has a market capitalization of over $150 billion.

Important items related to the subject:TCS has split its shares five times including the latest 1:5 split in 2018.

– TCS has split its shares five times over the years.

– The latest share split was a 1:5 split in 2018.

– Share splits help make shares more accessible to small investors.

– TCS currently has a market capitalization of over $150 billion.

What Is Future Price Of TCS?

TCS Futures Instrument Underlying Low Price Stock FuturesTCS3,406.95TCS3,426.80TCS3,473.00 The stock market is unpredictable, but experts predict that TCS’s future price will increase. Tata Consultancy Services, or TCS, is a leading Indian multinational information technology service and consulting company. As of August 2021, its market capitalization is over $190 billion. Many investors are curious about TCS’s future price, and experts predict that it will continue to rise due to its strong financial performance and growth potential. Factors such as increasing demand for digital services and TCS’s focus on innovation bode well for its future growth. However, macroeconomic factors such as the ongoing pandemic and geopolitical risks may impact TCS’s performance. Despite potential risks, TCS remains a promising investment for those interested in the technology industry.The TCS share price history chart graph shows the past and present share prices of TCS.

The TCS share price history chart graph can be found on financial websites like investing.com or moneycontrol.com.

- Things to Watch Out for in the Zinnwald Lithium Share Price Forecast - September 28, 2023

- How the Current Share Price of Zensar Technologies Affects the Investors - September 27, 2023

- How to Read and Understand Zenith Share Price History - September 26, 2023