| Highlights | Description |

| Gold price is up | Positive change in the share’s worth |

| Record high prices | All-time high performance |

| Positive market outlook | Favorable market conditions |

| New discoveries | Exploration successes |

| Acquisition activities | Expansion and merger deals |

The analyst consensus target price for Greatland Gold shares is 21.27p, which is 176.23% higher than the most recent closing price of 7.70p. Is there a forecast for the price of Greatland Gold shares in 2022?

The target price for GGP shares is a projection of the stock’s future value based on various financial and market factors. This target price is important for investors looking to buy or sell GGP shares. Some important factors that may influence the target price for GGP shares include the company’s financial performance, economic trends, competition, and other industry-specific factors. Keeping an eye on the target price can help investors make informed decisions about when to buy or sell GGP shares. Ultimately, the target price is just one piece of information investors should consider when making investment decisions. **Important Factors that Affect GGP Shares’ Target Price** – Company’s financial performance – Economic trends – Competitors’ performance – Industry-specific factorsWhat Is The Target Price For GGP Shares?

| Relevant title 1 | How high can greatland gold go |

What Is The Broker Forecast For Greatland Gold?

Forecast for GGP Stock in 12 Months Based on 1 Wall Street analysts’ 12-month price targets for Greatland Gold, the average target is 18.00p, with a high forecast of 18.00p and a low forecast of 18.00p. This is a 107.61 percent change from the current price of 8.67p. Greatland Gold, the UK-based gold exploration and development company, is generating a lot of interest among investors due to its promising Havieron gold-copper project in Western Australia. Brokers are increasingly optimistic about Greatland Gold’s future, with the consensus outlook remaining bullish. According to Broker Forecast, the company is expected to achieve an average price target of 40p per share over the next 12 months. The company’s high-quality assets and strong management team have boosted its prospects in the gold mining industry. Greatland Gold is certainly worth considering for those looking to invest in gold exploration ventures.Key points: – Greatland Gold is a UK-based gold exploration and development company – The company’s Havieron gold-copper project in Western Australia is generating a lot of interest among investors – Brokers are bullish about Greatland Gold’s future and expect an average price target of 40p per share over the next 12 months – Greatland Gold’s high-quality assets and strong management team make it an attractive investment option in the gold mining industry.Greatland Gold has a promising Havieron gold-copper project in Western Australia and is expected to achieve an average price target of 40p per share over the next 12 months.

Not:In addition to the information we have provided in our article on

what is happening to greatland gold share price history, you can access the wikipedia link here, which is another important source on the subject.

What Happened To Greatland Gold?

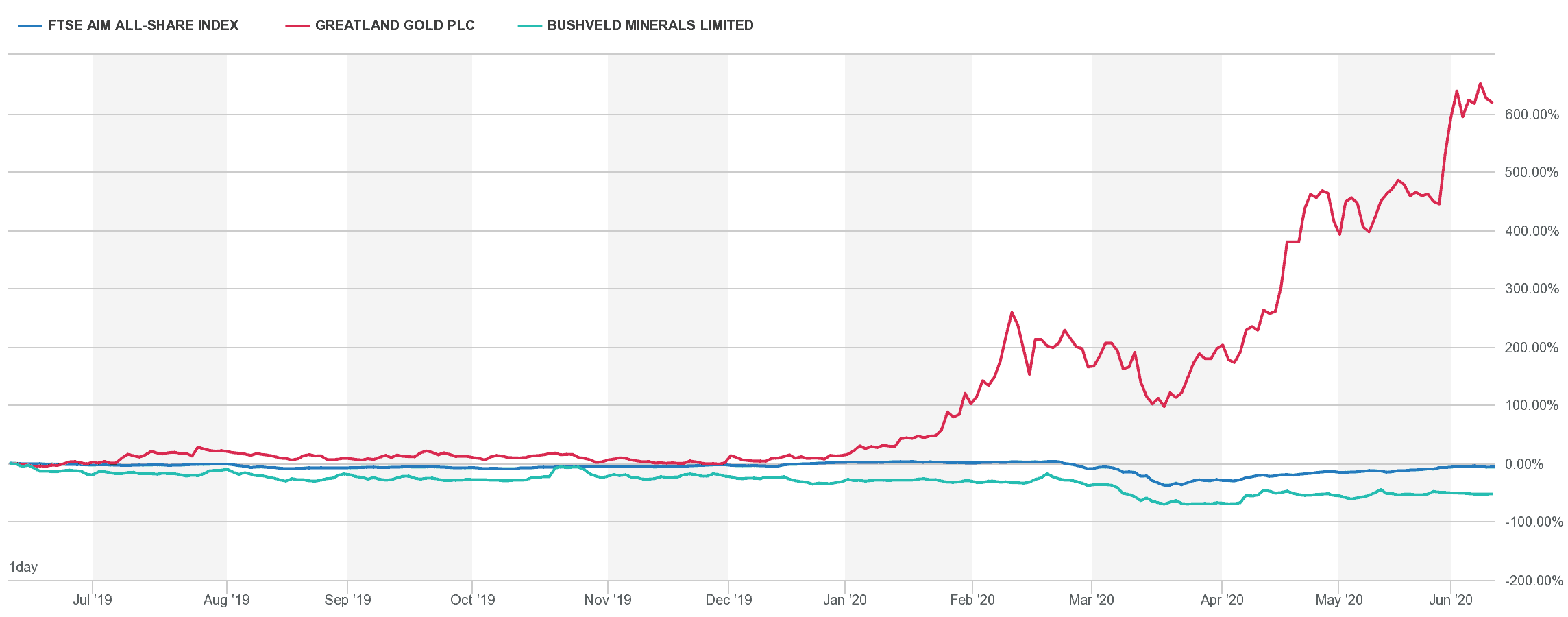

Whether Greatland Gold shares recover in 2023 will depend on the timing of feasibility studies and investors’ patience. Despite the fact that Greatland Gold owns a 30% stake in Havieron, the company is currently conducting feasibility studies that will take time to complete.Despite a lot of hype, Greatland Gold recently announced disappointing drilling results. The shares fell nearly 10% in response to the news. The exploration company has been focusing on gold, copper and nickel deposits in Western Australia for the last 15 months. Over this period, the stock market has reacted positively with its shares increasing by more than 1000%. However, with the latest announcement of sub-optimal drilling results, investors are now concerned about the future prospects of the company. Some are questioning whether the exploration firm peaked too soon.Greatland Gold Slumps As Drilling Fails To Impress Investors

**What went wrong with Greatland Gold?** – Disappointing drilling results – Shares fell by nearly 10% – Investor concern over future prospects Greatland Gold is a company that has made a name for itself in the mining exploration industry. Focusing on Western Australia, the company has been exploring for gold, copper and nickel deposits. For the past 15 months, the company has been seeing a lot of success with its share price soaring by over 1000%. However, things recently took a turn for the worse when the company announced that drilling results were disappointing. Investors responded negatively, causing the shares to slump by nearly 10%. With concerns raised over the company’s future prospects, Greatland Gold may need to take stock and consider a new approach to regain investor confidence.

Is Greatland Gold A Buy Or Sell?

The consensus rating for Greatland Gold is Buy, with an average rating score of 3.00 based on 2 buy ratings, no hold ratings, and no sell ratings. In the world of investing, it can be difficult to discern which companies are worth your time and money. Greatland Gold is a mining company that has garnered attention recently due to its promising exploration results. While some analysts believe that this makes Greatland Gold a buy, others are more cautious. The company’s stock price has fluctuated significantly in recent months, making it difficult to predict its future trajectory. Ultimately, whether Greatland Gold is a buy or sell is up to the individual investor’s risk tolerance and investment strategy. As always, it’s important to do your own research and consult with a financial advisor before making any investment decisions. Greatland Gold’s exploration results are promising, but investors should proceed with caution. **Important factors for consideration:** – Exploration results – Fluctuating stock prices – Individual risk tolerance and investment strategyMarket factors, including COVID-19, affecting gold prices.

Depends on market performance and company news.

- Things to Watch Out for in the Zinnwald Lithium Share Price Forecast - September 28, 2023

- How the Current Share Price of Zensar Technologies Affects the Investors - September 27, 2023

- How to Read and Understand Zenith Share Price History - September 26, 2023