Is Croma Owned By Tata?

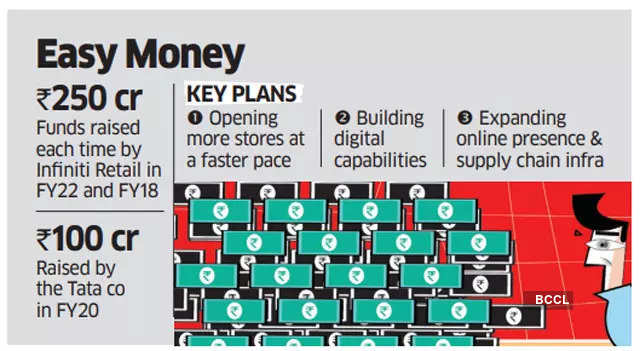

About Infiniti Retail Limited: Tata Sons owns 100% of Infiniti Retail Limited, which opened “Croma,” a national chain of megastores selling consumer electronics and durables.

What Is The History Of Croma?

Under the brand name “Croma,” Infiniti Retail is one of the leading Consumer Durables and Electronics (CDE) retailers in India. Croma was the first large format specialist retail store in India that catered to all multi-brand digital gadgets and home electronics needs.

Who Are Competitors Of Croma In India?

In November 2022, the top five competitors of croma.com include tatacliq.com, flipkart.com, amazon.in, 91mobiles.com, and others.

Who Is The Owner Of Croma?

Organizations of parents and crops

stocks below one rupeeS.No.NameP/E1.7NR Retail Ltd.30.632.Sawaca Business23.623.Paras Petrofils34.144.NCl Res. & Finl.150.50

What Is The Price Of Tata Consumer Today?

Share Price Value Today/Current/Last736.95Previous Day740.05 Tata Consumer share price insights

COMPARISONFinancials (in Cr)CG Power & Industries Agni GreenPrice300.4028.40% Change0.354.99Mcap Cr45,873.9655.48Revenue TTM Cr5,561.4015.40

January 26, 202357.5056.70January 25, 202357.5056.50January 23, 202359.5056.60January 20, 202359.5059.50

What Is The Stock Name Of Croma?

CSSG, or Croma Security Solutions Group Plc

View 18 reports from seven analysts outlining Tata Consumer Products Ltd.’s long-term price targets. The average target for Tata Consumer Products Ltd. is 936.83, which represents an upside of 28.42 percent from the current price of 729.50.

Is Tata Consumer A Good Stock?

The fact that Tata Consumer Products has a median payout ratio of 40% over the past three years indicates that the company keeps the remaining 60% of its profits. This indicates that the dividend is well covered, and the company’s decent growth suggests that management is effectively reinvesting its earnings.

Is Tata Consumer Debt Free?

Peer comparison: NameTata ConsumerP/E65.42Mar Cap Rs.Cr.67706.36Div Yld %0.83NP Qtr Rs.Cr.389.43 Company has reduced debt.

- How Will Ethereum 2.0 Improve Upon Existing Blockchain Platforms? - February 9, 2023

- Dogecoin Explained: What is Dogecoin and How Can You Use It? - February 9, 2023

- Smart Investing Strategies for Wise in 2018: A Share Price Forecast - February 5, 2023