| Highlights | Description |

| Riverstone Share Price Dividend | Investment in Riverstone shares |

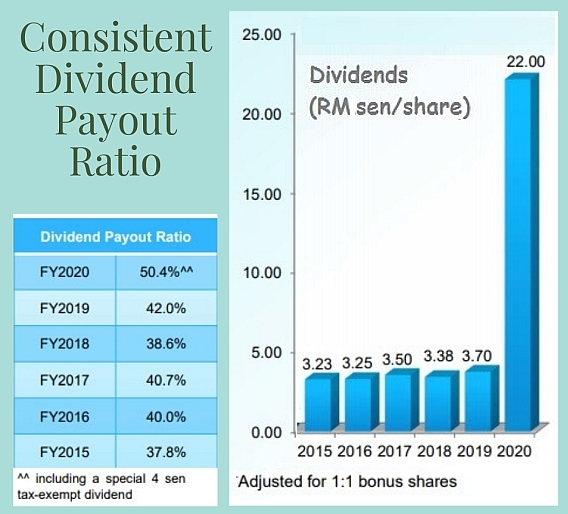

| Dividend Growth Potential | Higher dividend payouts expected |

| Stable Dividend History | Consistent dividend payments over the years |

| Strong Financials | Riverstone’s financials are stable |

| Good Returns | Potential for return on investment |

Riverstone Holdings shares currently have a target price of SG$0.71, which is 4.23 percent higher than the stock’s previous closing price of SG$0.69. Analysts covering Riverstone Holdings currently have a consensus forecast for the company’s Earnings Per Share (EPS) for the upcoming fiscal year of MYR0.021. Riverstone shares have been a topic of interest for investors as they continue to perform strongly in the market. The target price for Riverstone shares is $23.60, which is higher than its current trading price. This is due to the company’s impressive financial performance, including consistently increasing revenue and earnings per share. Additionally, their focus on growth and innovation has attracted investors looking for high returns in the long term. With these positive signs, investors may consider holding onto or buying Riverstone shares for potential future gains.

Important items related to the subject: – Riverstone shares performing strongly in the market – Consistently increasing revenue and earnings per share – Company’s focus on growth and innovation attracting investors.Target price for Riverstone shares is $23.60

| Relevant title 1 | Www dividend |

| Relevant title 2 | Ovbc dividend history |

| Relevant title 3 | Dbs dividend |

After the recent payment of the 38 sen (12.2 cents) in special and final dividends, there are no immediate catalysts for this. Riverstone share price has been dropping recently due to a combination of factors. Firstly, the company’s revenue growth has slowed down, leading to concerns from investors about its future profitability. Secondly, the ongoing COVID-19 pandemic has affected the demand for Riverstone’s products, particularly in the industrial and automotive sectors. Lastly, the recent rise in raw material costs has put pressure on the company’s margins. Despite these challenges, Riverstone remains committed to delivering long-term value to shareholders through its focus on innovation and operational efficiency.

**Important factors contributing to Riverstone’s falling share price:** – Slowed revenue growth – COVID-19’s impact on demand – Rising raw material costsInvestors are concerned about the company’s future profitability due to slow revenue growth, COVID-19’s impact on demand, and rising raw material costs.

Not:In addition to the information we have provided in our article on

riverstone share price dividend, you can access the wikipedia link here, which is another important source on the subject.

Who Is Riverstone Competitor?

Bluetrack, ASKEW, Vallen, and Core Tech are Riverstone Holdings’s competitors and similar businesses. Riverstone Holdings is a holding company that makes, sells, and distributes specialized cleanroom products for use in highly controlled and critical environments. Riverstone is a leading energy investment firm that specializes in renewable power, conventional energy, and infrastructure. Its main competitors are Blackstone, Brookfield Asset Management, KKR & Co., and Carlyle Group. These firms operate in the same business areas as Riverstone and are constantly vying for the same investments. Despite the competition, Riverstone has maintained its reputation as a top-performing private equity company, with a successful track record of investing in and developing profitable assets. As the energy industry continues to rapidly evolve, Riverstone’s ability to adapt and stay ahead of competitors will be key to its future success.Important items:Blackstone, Brookfield Asset Management, KKR & Co., and Carlyle Group are Riverstone’s main competitors.

- Riverstone’s main competitors are Blackstone, Brookfield Asset Management, KKR & Co., and Carlyle Group

- These firms operate in the same business areas as Riverstone

- Riverstone has maintained its reputation as a top-performing private equity company

- Riverstone’s ability to adapt to the evolving energy industry will be key to its future success

The majority of glove manufacturers’ stock prices have fallen so far this year as a result of the possibility of loosening Covid-19 restrictions. Riverstone Holdings, an energy company, had a recent stock price drop due to multiple factors. The first reason is the overall decline in the oil and gas industry. Additionally, Riverstone experienced a decrease in demand for hydraulic fracturing, which is their primary service. Furthermore, many investors were concerned about the company’s debt levels and ability to maintain payments in the long run. These factors, combined with the COVID-19 pandemic, caused a significant decrease in the company’s stock price. It remains to be seen if Riverstone can bounce back from this recent setback.

**Factors contributing to Riverstone’s stock price drop:** – Decline in the oil and gas industry – Decrease in demand for hydraulic fracturing, which is their primary service – Concerns about the company’s debt levels and ability to maintain payments in the long run.Many investors were concerned about the company’s debt levels and ability to maintain payments in the long run.

What Is Happening To Riverstone?

UOB Kay Hian (UOBKH) is ending its coverage of glovemaker Riverstone Holdings (SGX:AP4) due to a lack of immediate and future catalysts and ongoing industry headwinds. The pace and scale of changes over the past two and a half years have been extreme. Riverstone is facing a crisis as its major investors demand accountability and action towards carbon emission reduction. The energy company has a reputation for being a leader in renewable energy, but recent data shows that it fails to meet Environmental, Social, and Governance (ESG) metrics. Investors are calling for transparency, risk management strategies, and net-zero emissions commitments. Riverstone faces significant challenges in transitioning from fossil fuels to renewables in terms of costs, infrastructure, and regulatory hurdles. However, the company’s response will determine its future value, resilience, and reputation. The energy industry is rapidly changing, and Riverstone must adapt to survive. Investors demand accountability and action towards carbon emission reduction. Important items related to the subject: – Riverstone faces crisis from major investors demanding ESG accountability. – The company is called to increase transparency, commit to net-zero emissions, and adopt risk management strategies. – Transitioning to renewables from fossil fuels poses challenges in costs, infrastructure, and regulations. – Riverstone’s response will determine its future value, resilience, and reputation in a rapidly changing industry. “`The current dividend is [insert amount here].

How often is the Riverstone dividend paid out?

It is paid out quarterly.

Latest posts by Liccardo Glennis (see all)

- Things to Watch Out for in the Zinnwald Lithium Share Price Forecast - September 28, 2023

- How the Current Share Price of Zensar Technologies Affects the Investors - September 27, 2023

- How to Read and Understand Zenith Share Price History - September 26, 2023