| Highlights | Description |

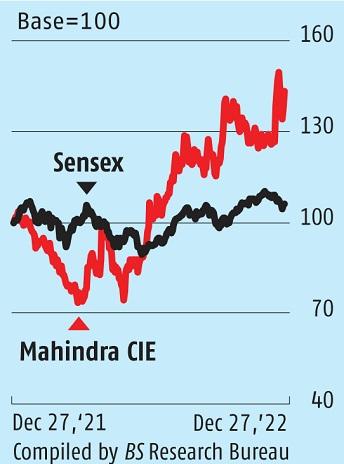

| Mahindra CIE share forecast rising | Positive outlook for stock prices |

| Upward trend in profits | Company projected to earn higher profits |

| Large scale expansion plans | Company set to grow rapidly in the near future |

| Risk associated with economic downturns | External economic factors may impact stock prices negatively |

| Investment potential in Mahindra CIE shares | Company stock is a potential investment opportunity |

What Is The Business Of Mahindra CIE?

Cobtent

Hide

Mahindra CIE Automotive Limited (MCAL), formerly Mahindra Forgings Limited, is a multi-location, multi-technology manufacturer of automotive components with facilities in India, Germany, Spain, Lithuania, and Italy on the European continent, as well as a plant in Mexico’s North Mahindra CIE is a leading Indian company that specializes in manufacturing and supplying high-quality castings and forgings. With a focus on the automotive sector, the company provides various services, including design, prototyping, testing, machining, and assembly. The company initially began as a joint venture between Mahindra & Mahindra and CIE Automotive, but now operates as a single entity. Mahindra CIE has a global presence with manufacturing plants located in countries such as India, Spain, Germany, Brazil, and the United Kingdom. Overall, the company’s goal is to provide innovative solutions and quality products to meet customer demands.

Important items related to the subject: – Mahindra CIE specializes in manufacturing castings and forgings. – The company primarily serves the automotive industry. – They offer various services such as design, prototyping, testing, machining, and assembly. – Mahindra CIE has a global presence with manufacturing plants in several countries.Mahindra CIE aims to provide innovative solutions and quality products to customers worldwide.

| Relevant title 1 | Mahindra cie share price target 2023 |

| Relevant title 2 | Mahindra cie share price target 2025 |

| Relevant title 3 | Mahindra cie news |

What Does Mahindra CIE Do?

Mahindra CIE Automotive Limited is a manufacturer of engine and steering components as well as a variety of other forged metal products. The company also designs, manufactures, installs, and repairs automotive components. Mahindra CIE Automotive is a leading engineering company that provides high-quality automotive solutions to various industries. They are engaged in manufacturing and marketing of a wide range of products such as gears, powertrain, forgings, castings, its hybrids and electrical components. Their products cater to a diverse range of markets, including passenger cars, commercial vehicles, railways, and aerospace. At Mahindra CIE, they prioritize innovation, sustainability, and customer satisfaction to deliver the best products and services possible. With their dedication to excellence, they continue to be a dominant player in the auto engineering industry.Some of the key products and solutions they offer include: – Powertrain solutions: transmission gears, differential gears, driveline components, engine gears, and bearings. – Forgings and castings: crankshafts, connecting rods, suspension components, and steering components. – Hybrid and electrical components: electromagnetic actuators, clutch systems, ABS and ESP control, among others. Mahindra CIE has a global presence, with operations spanning across Asia, Europe, and North America. They have a reputation for providing quality, reliability, and timely delivery, making them a preferred supplier for many key automotive OEMs worldwide. With their strong focus on sustainability, they have also implemented various initiatives to reduce their carbon footprint and promote a cleaner environment. Overall, Mahindra CIE Automotive is a company committed to providing innovative engineering solutions that are built to last.“Mahindra CIE is a leading engineering company that provides high-quality automotive solutions to various industries.”

Not:In addition to the information we have provided in our article on

mahindra cie share price forecast, you can access the wikipedia link here, which is another important source on the subject.

Is Mahindra CIE A Good Stock To Buy?

As of January 31, 2023, the MAHINDCIE SHARE’s closing price was 394.75. We recommend a strong buy for the long term with a stop loss of 256.73 and a strong buy for the short term with a stop loss of 324.79, and we anticipate that the stock will respond on the following important levels. Mahindra CIE Automotive is a leading manufacturer of automotive parts in India. The company is actively expanding its operations in new markets and has recently acquired companies in Europe and North America. So, is Mahindra CIE a good stock to buy?Here are some key points to keep in mind when considering investing in Mahindra CIE: – The company has a track record of consistent revenue growth, which is expected to continue in the coming years. – Mahindra CIE has a diverse product portfolio, which helps it maintain a competitive edge in the market. – Expansion into new markets, such as Europe and North America, provides significant growth opportunities for the company. – The demand for auto parts is expected to increase due to the global shift towards electric vehicles, which could benefit Mahindra CIE. Overall, Mahindra CIE Automotive appears to be a good stock to buy for investors looking to benefit from the growth of the automotive industry. However, as with any investment, it’s important to conduct thorough research and analysis before making any decisions.According to analysts, Mahindra CIE Automotive is considered a good stock to buy due to its strong financials and growth potential in the automotive industry.

Is Mahindra CIE Debt Free?

Because Mahindra CIE Automotive’s net debt is only 0.96 times its EBITDA, and its EBIT, which is 26.6 times the size of its debt, easily covers its interest costs, we are pretty comfortable with its extremely conservative debt use. **Is Mahindra CIE Debt Free?** Mahindra CIE is an Indian multinational company that primarily focuses on manufacturing and selling automotive components. The company has experienced immense growth over the years due to its exceptional services and quality products. Investors are curious to know whether Mahindra CIE is debt-free or not. According to the latest financial reports, the company’s debt-to-equity ratio stands at 0.9, which indicates that the company has a moderate debt level. However, the company’s ability to service its debt is strong, making it a good investment opportunity for investors. Overall, Mahindra CIE is in a stable financial position and a promising investment option for investors. Investors should be aware of Mahindra CIE’s moderate debt level. **Important items related to the subject:** – Mahindra CIE is an Indian multinational company that primarily focuses on manufacturing and selling automotive components. – The company’s debt-to-equity ratio stands at 0.9, indicating a moderate debt level. – However, the company’s ability to service its debt is strong, making it a promising investment option for investors.The forecast depends on market trends.

It depends on individual investment goals.

Latest posts by Liccardo Glennis (see all)

- Things to Watch Out for in the Zinnwald Lithium Share Price Forecast - September 28, 2023

- How the Current Share Price of Zensar Technologies Affects the Investors - September 27, 2023

- How to Read and Understand Zenith Share Price History - September 26, 2023