Why Did Riverstone Prices Drop?

Riverstone has the most appealing margins among glove manufacturers. The likelihood of loosening Covid-19 restrictions has lowered the share prices of most glove manufacturers thus far this year.

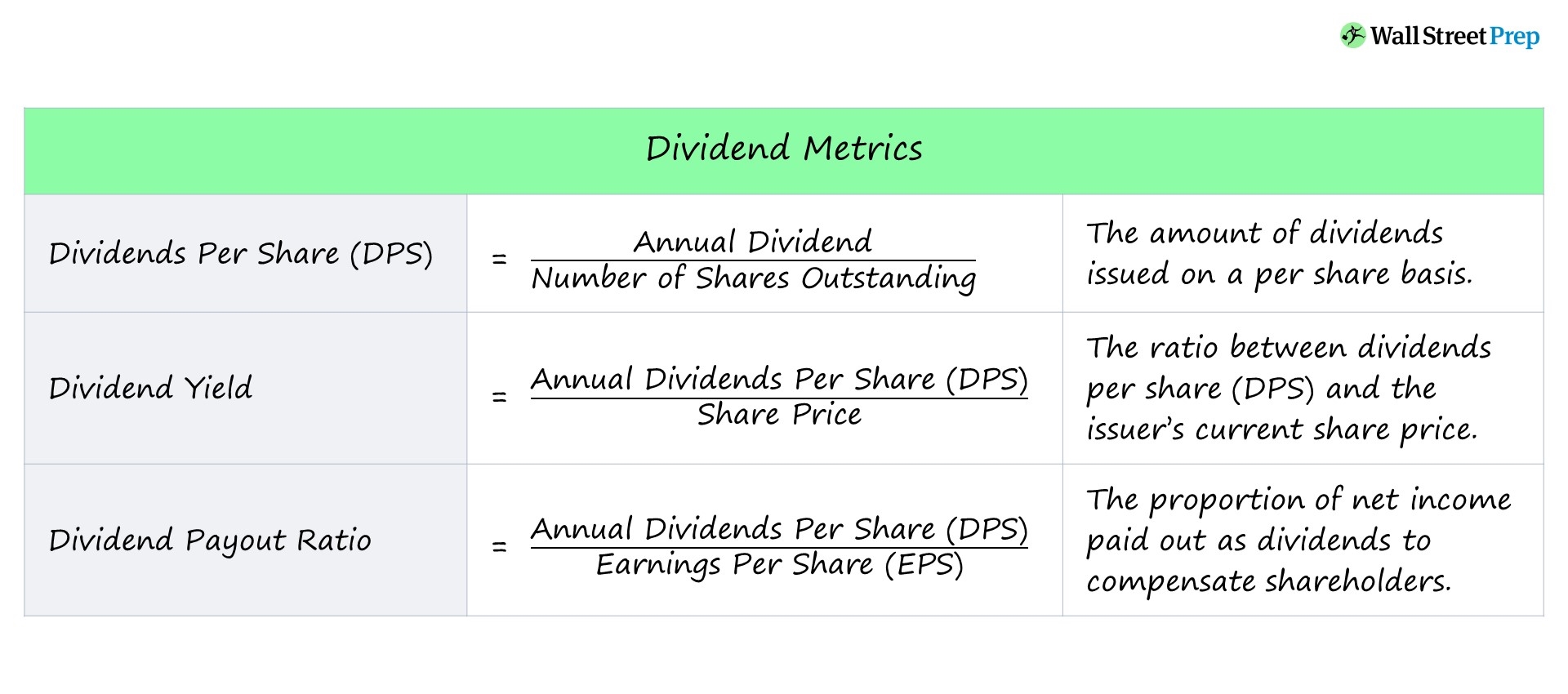

Riverstone Holdings shares currently have a target price of SG$0.71, which is 4.23 percent higher than the stock’s previous closing price of SG$0.69. Analysts covering Riverstone Holdings currently have a consensus forecast for the company’s Earnings Per Share (EPS) for the upcoming fiscal year of MYR0.021.

After the recent payment of the 38 sen (12.2 cents) in special and final dividends, there are no immediate catalysts for this.

Who Is Riverstone Competitor?

Bluetrack, ASKEW, Vallen, and Core Tech are Riverstone Holdings’s competitors and similar businesses. Riverstone Holdings is a holding company that makes, sells, and distributes specialized cleanroom products for use in highly controlled and critical environments.

The majority of glove manufacturers’ stock prices have fallen so far this year as a result of the possibility of loosening Covid-19 restrictions.

What Is Happening To Riverstone?

UOB Kay Hian (UOBKH) is ending its coverage of glovemaker Riverstone Holdings (SGX:AP4) due to a lack of immediate and future catalysts and ongoing industry headwinds. The pace and scale of changes over the past two and a half years have been extreme.

- Breaking Down the Recent Vesuvius Share Price Rally on the NSE - March 23, 2023

- Understanding the Factors Driving Vikas Multicorp’s Share Price on BSE - March 23, 2023

- Analyzing the Major Factors Affecting National Express Share Price in 2021 - March 23, 2023