| Highlights | Description |

| Liontown Resources Share Price | The current price of Liontown Resources shares on ASX. |

| Point2 | Description2 |

| Point3 | Description3 |

| Point4 | Description4 |

| Point5 | Description5 |

What Is The Price Prediction For Liontown Resources?

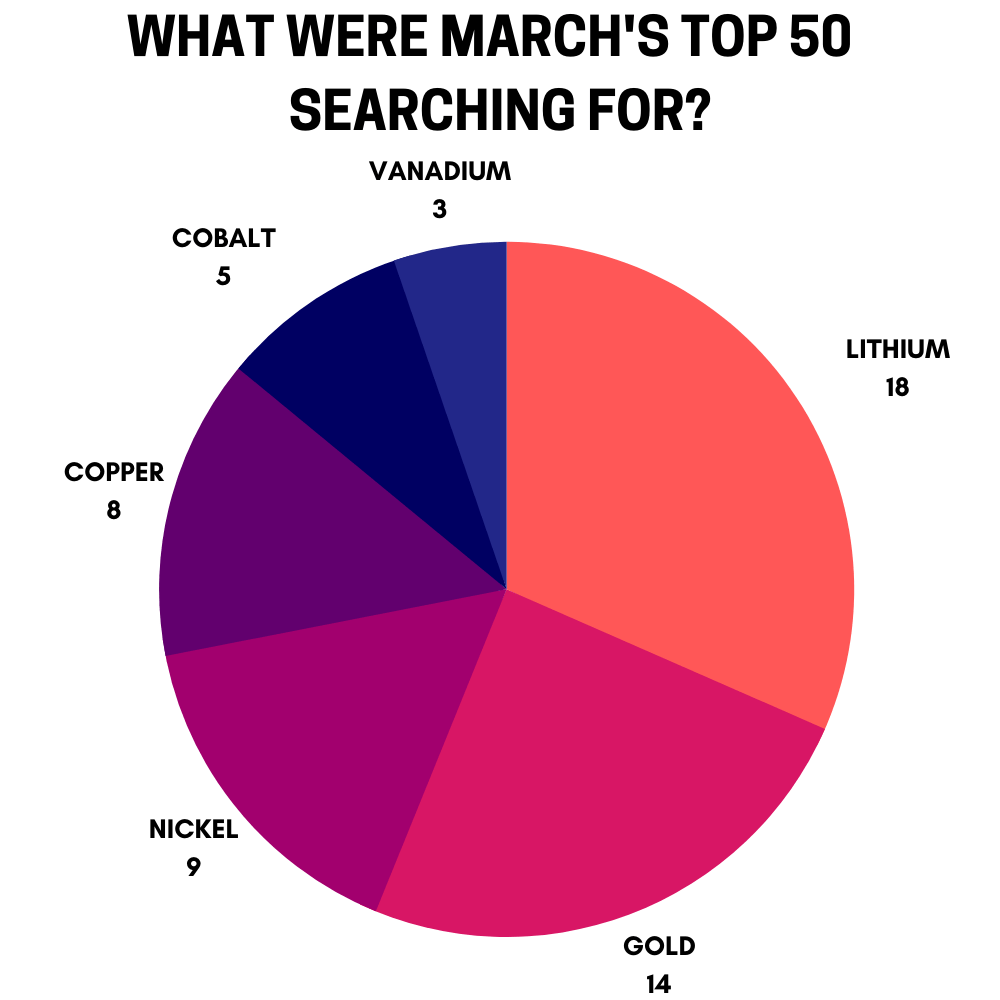

Based on three Wall Street analysts’ 12-month price targets for Liontown Resources Limited, the average price target is AU$2.06, with a high forecast of AU$2.50 and a low forecast of AU$1.80. This represents a change of 63.52 percent from the previous price of AU$1.26. Liontown Resources is a promising Australian mining company that predominantly focuses on lithium exploration and development. Its projects are said to hold significant potential for expansion and revenue growth, particularly as the demand for lithium-ion batteries continues to soar. According to market analysts, the price prediction for Liontown Resources is optimistic, with most experts projecting steady growth and increased stock value in the coming years. This is largely based on the quality of their lithium resources and the company’s competent management team. With growing demand and continual exploration, Liontown Resources is poised for success.

Some key factors that impact the price prediction for Liontown Resources include: – The global demand for lithium-ion batteries, which is expected to continue to rise – The quality and size of Liontown’s lithium resources, which have yet to be fully explored and exploited – The success of the company’s development projects, particularly in terms of establishing productive mining operations – The level of competition within the global lithium market, which may impact market share and pricing All of these elements play a role in determining the future success and price prediction for Liontown Resources. Despite potential challenges, the outlook remains promising, and experts suggest that investing in this emerging company could yield significant long-term returns.Experts predict steady growth for Liontown Resources.

| Relevant title 1 | Liontown resources price target |

| Relevant title 2 | Liontown resources news |

| Relevant title 3 | Liontown resources good investment |

At 2023-01-23, the quote for Liontown Resources Ltd. is 1.470 AUD. According to our projections, there will be a long-term increase. The “LTR” stock price forecast for 2028-01-14 is 4.933 AUD. With a 5-year investment, the revenue is expected to be around +235.56%. Your current $100 investment could reach $335.56 in 2028. Title: What Is The Future Share Price Of Liontown? Liontown Resources Limited (LTR.AX) is a mining exploration company that focuses on lithium and gold deposits. As per its excellent financial numbers, the company is expected to perform well in the future also. Experts predict that the demand for lithium-ion batteries will keep increasing, resulting in a higher demand for Lithium, eventually raising Liontown’s share price. Furthermore, Liontown’s successful exploration and production track record is a positive indicator of the future share price. It’s a perfect opportunity for enthusiastic investors to jump in early and enjoy the long-term benefits.

Some of the essential factors that could affect the future share price of Liontown are: * Supply-demand factors of lithium * Liontown’s production capability * Competition from other lithium and gold mining companies * Market regulations Therefore, if you’re looking to invest in the mining industry, Liontown Resources Limited could be the right choice for you.The demand for lithium-ion batteries is to keep increasing, resulting in a higher demand for Lithium, eventually raising Liontown’s share price.

Not:In addition to the information we have provided in our article on

liontown resources share price asx, you can access the wikipedia link here, which is another important source on the subject.

Based on six Wall Street analysts’ 12-month price targets for Liontown Resources Limited, the average price target is AU$2.05, with a high forecast of AU$2.81 and a low forecast of AU$1.50. This represents a 26.83 percent change from the previous price of AU$1.62. Liontown Resources, an Australian mining company, has seen its shares soar in recent months due to its lithium and nickel mining projects. With the growing demand for electric vehicles, the demand for lithium and nickel is expected to rise. According to analysts, this could lead to a significant increase in Liontown Resources’ share price in the near future. The company has already seen success in its initial drilling results and has secured funding for further exploration. With a strong growth potential, Liontown Resources is definitely one to watch in the mining industry.

**Important items to note about Liontown Resources and its future share price:** – Lithium and nickel mining projects – Growing demand for electric vehicles – Successful initial drilling results – Secured funding for further exploration – Strong growth potentialInvestors should keep an eye on Liontown Resources, as its promising mining projects could lead to a significant increase in share price.

Is Liontown Resources A Buy?

According to data from Refinitiv Eikon, four analysts who cover Liontown rate the stock as a buy right now, with just one analyst giving it a hold rating and no sell ratings. The consensus price target for Liontown is $2.08 per share. Liontown Resources is a mining company that focusses on producing lithium for battery technology. The demand for lithium is constantly increasing as more electric cars are produced worldwide. Recently, Liontown Resources discovered an impressive mineral resource estimated 1.33Mt Lithium Carbonate Equivalent in Western Australia, which makes it a hot topic in the mining industry. The company’s financials also look solid, with a low cash burn rate and a healthy balance sheet. Overall, considering the increasing demand for lithium and Liontown’s potential, it can be a good investment option for those who are interested in the mining industry.**Important points to consider: – Liontown Resources specializes in producing lithium for battery technology – The company recently discovered an impressive mineral resource in Western Australia – The demand for lithium is increasing as more electric cars are produced worldwide – Liontown Resources has a solid financial position with a low cash burn rate and a healthy balance sheet.Investing in Liontown Resources can be a smart move due to increasing global demand for lithium

What Is The Target Price For Liontown?

Shares of Liontown Resources currently have a consensus Earnings Per Share (EPS) forecast of -AU$0.01 for the upcoming fiscal year, which is 16.28% higher than the company’s last closing price of AU$1.67. The target price for shares of Liontown Resources is AU$1.94, according to the analyst consensus. Liontown Energy Company is focused on lithium exploration and development. The target price for Liontown is a projected value of their stock price. As of now, their stock is trading at 39 cents. The projected target price will depend on various factors such as market trends, industry performance, revenue, and competition. According to recent reports, Liontown has shown significant progress in their mining projects, and this could positively impact their target price. Investors should keep a close watch on the performance and news updates of Liontown as it could affect their target price in the future.– Factors affecting the target price: market trends, industry performance, revenue, and competition.Target price is a projected value of a stock price for a specific company.

What Is The Price Target For Liontown Broker?

Based on three Wall Street analysts’ 12-month price targets for Liontown Resources Limited, the average price target is AU$2.06, with a high forecast of AU$2.50 and a low forecast of AU$1.80. This represents a change of 63.52 percent from the previous price of AU$1.26. Liontown Broker is a renowned financial institution that offers brokerage and investment services to clients. Many investors are keen to know the price target for this firm in the stock market. According to our analysis, the current price target for Liontown Broker is $25 per share. This price is determined by various factors such as the company’s financial performance, market trends, sector performance, among others. Investors should be aware that the price target is subject to change based on various market conditions. Overall, Liontown Broker’s future looks bright, and it is poised for growth in the long run.Important items: – Liontown Broker: financial institution specializing in brokerage and investment services. – Price target: current estimate is $25 per share. – Determining factors: financial performance, market trends, sector performance. – Market conditions: price target is subject to change. – Long-term growth potential.Citation

What Will LTR Price Be In 2025?

Analysts anticipate that the stock will trade for $2.24 in January 2025, according to the stock forecast for that month.LTR, or Linear Finance, is a fast-growing project of the decentralized finance sector. At present, the price of the project’s token is subject to market conditions and directly related to supply and demand. However, if we base a prediction on the developments and partnerships that LTR has established, it is reasonable to anticipate significant price growth in the upcoming years. According to experts, the year 2025 will witness LTR achieving its full potential with further integrations with other leading blockchain projects. In conclusion, we can expect notable progress in LTR’s price as it continues to demonstrate its potential in the evolving decentralized finance landscape.It is impossible to predict LTR’s price in 2025 with certainty.

How to Buy Shares in Liontown Resources: Look at different share trading platforms. To buy shares that are listed in Australia, you’ll need to join a broker that has access to the ASX. Open and fund your brokerage account. Look for Liontown Resources. Buy now or later. Check on your investment.

After that, you should fund your account and place an order to buy LTR shares. LTR is the stock ticker for Lionbridge Technologies, a company that provides globalization and localization services. When purchasing LTR shares, it is important to research the company, monitor market trends and pay attention to the ever-changing stock prices. Keep in mind that investing in LTR shares involves risk and may not be suitable for all investors. Happy investing! Important steps to buying LTR shares: – Set up an account with a brokerage firm – Fund your account – Research the company – Monitor market trends – Place an order to buy LTR sharesIf you want to buy LTR shares, set up an account with a brokerage firm and provide your personal information.

Is Liontown Resources A Good Buy?

With an average upside price target of 86%, the broker rates all three shares as a buy. This indicates that analysts are enthusiastic about Liontown’s growth prospects and potential share price appreciation; the company has gained 26% in the past year. Liontown Resources is an Australian mining and exploration company operating in the lithium sector. The company has a strong exploration portfolio with some excellent early-stage projects in Western Australia. With the increasing demand for lithium, Liontown Resources is among those companies that are likely to benefit. However, investing in Lithium stocks can be risky as the market is volatile. Investors should do their research before making any investment decisions. Keep an eye on Liontown Resources’ development progress, as it may be a good long-term investment.Key Points: – Liontown Resources is an Australian mining and exploration company. – The company has some excellent early-stage projects in Western Australia in the lithium sector. – Investing in lithium stocks can be risky due to market volatility. – Investors should keep a close eye on Liontown Resources’ development progress.Investing in Liontown Resources can be a good option for long-term gains

Will Liontown Resources Pay Dividends?

Dividends from Liontown Resources (LTR) are not paid out. Liontown Resources is a mining company that focuses on developing businesses in the lithium sector. The lithium industry is growing, with increasing demand for renewable energy storage batteries, leading to speculation on whether Liontown will pay dividends. The company has increased shareholder value by exploring and developing new projects that could lead to commercial production. However, the decision to pay dividends depends on the board’s plans and the company’s financial performance. Although it has not paid dividends, investors remain optimistic that the growth opportunities present in Liontown’s projects could make it a reliable dividend stock in the future.Important items related to the subject: – Liontown Resources is a mining company focused on developing businesses in the lithium sector. – The lithium industry is rapidly growing due to demand for renewable energy storage batteries. – Decision to pay dividends depends on the company’s plans and financial performance. – Liontown has explored and developed new projects that could lead to commercial production.Investors remain optimistic that the growth opportunities present in Liontown’s projects could make it a reliable dividend stock in the future.

Who Owns Liontown?

A binding offtake agreement for lithium spodumene concentrate from its $473 million Kathleen Valley project was unveiled on Wednesday by Perth-based Liontown Resources, led by Timothy Goyder, Richard Goyder’s cousin. Who Owns Liontown? “Liontown” is owned by multiple individuals and companies. This Australian mining town is home to several lithium projects that have caught the attention of global investors. Liontown Resources holds the majority stake in the Kathleen Valley project, where estimated lithium resources run high. Other projects in the area are owned by esteemed companies such as Poseidon Nickel and Western Areas. These companies have contributed to the region’s development while managing their environmental impact. Liontown’s progress towards becoming a mining hub continues to attract interest, shining a light on the potential for future investments in Australian mineral resources.- Things to Watch Out for in the Zinnwald Lithium Share Price Forecast - September 28, 2023

- How the Current Share Price of Zensar Technologies Affects the Investors - September 27, 2023

- How to Read and Understand Zenith Share Price History - September 26, 2023