| Highlights | Description |

| Mineral Resources ASX today | Stock prices of Mineral Resources on Australian Stock Exchange |

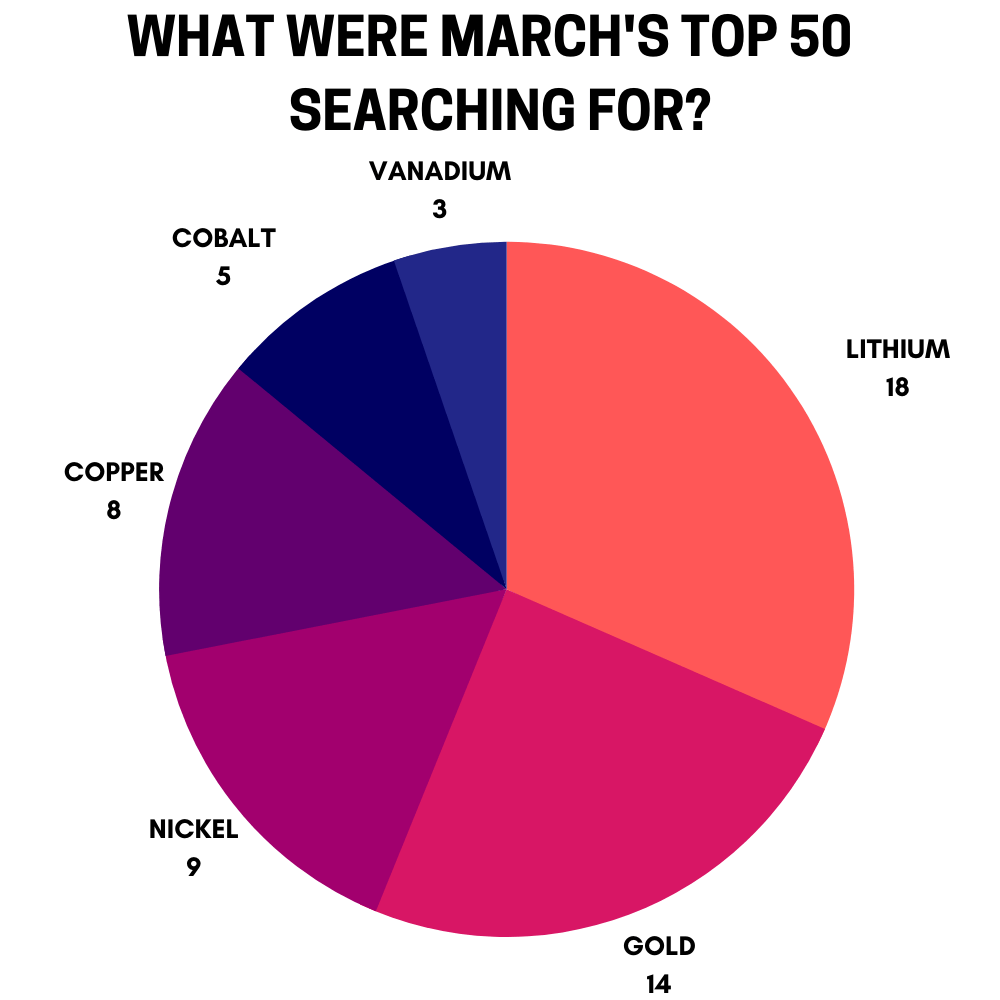

| Market trends | Current overview of the mineral resource market trends |

| Production levels | Current mineral resources production levels and projections |

| Company news | Latest news and updates from Mineral Resources company |

| Analyst opinion | Expert opinion on Mineral Resources stock and market performance |

Will TMC Stock Go Up?

Cobtent

Hide

**Key considerations regarding TMC stock:** – Strong financial performance – Positive industry trends in the electric vehicle market – Concerns about the company’s ability to deliver While there are risks associated with investing in TMC stock, many investors believe that the potential rewards outweigh those risks. As with any investment decision, it’s important to do your own research and stay up-to-date on company news and industry trends. Only time will tell if TMC stock will go up, but investors remain hopeful.Only time will tell if TMC stock will go up, but investors remain hopeful.

| Relevant title 1 | Mineral resources share price forecast |

| Relevant title 2 | Is mineral resources a good buy |

| Relevant title 3 | Minres share price asx |

Is Mineral Resources Limited A Good Buy?

Mineral Resources (ASX: MIN) shares have become one of the primary beneficiaries of the lithium and iron commodity surge of 2022. MIN’s share price has increased by 20% in the past month, increased by fourfold since the pandemic began, and increased by more than double over the past year. Mineral Resources Limited is a leading Australian mining company with operations in iron ore mining, lithium production, and mining services. With a strong track record of growth and profitability, the company offers an attractive opportunity for investors looking to invest in the mining sector. However, as with any investment, it is important to consider the risks and potential rewards before making a decision. Key factors to consider include the company’s financials, growth prospects, and exposure to commodity price risk. Ultimately, investors must weigh these factors carefully to determine if Mineral Resources Limited is a good buy for their portfolio.**Important items to consider when evaluating Mineral Resources Limited include:** – The company’s financial performance and balance sheet strength – Exposure to commodity price risk, particularly in iron ore and lithium markets – Growth prospects and expansion plans in the mining and mining services sectors.Investors must weigh key factors before investing in Mineral Resources Limited.

Not:In addition to the information we have provided in our article on

mineral resources share price asx today, you can access the wikipedia link here, which is another important source on the subject.

What Are 5 Of Australia’s Most Valuable Mineral Resources?

Bauxite (aluminium ore), iron ore, lithium, gold, lead, diamond, rare earth elements, uranium, and zinc are all mined in Australia, making it one of the world’s largest producers. Australia is home to an abundance of mineral resources. Among these, five minerals stand out as particularly valuable: Iron ore, coal, gold, copper, and lithium.These minerals have contributed significantly to the country’s economy, making Australia one of the world’s leading mining nations. Iron ore is the most valuable mineral, accounting for a large percentage of the country’s total mineral exports. Coal is also important, serving as the primary fuel source for many industries. Gold is a valuable precious metal and a symbol of wealth, while copper is widely used in electrical applications. Finally, lithium is a vital component of batteries used in electric vehicles, making it an increasingly important resource for the future.Citation

Use a limit order to delay your purchase until Mineral Resources reaches your desired price. Find the share by name or ticker symbol: MIN. Research its history to confirm that it is a solid investment for your financial goals. When it comes to buying mineral resource shares, there are specific things to keep in mind. One of the essential steps is to research the company you are considering investing in. Determine the stock’s history, news, financial metrics, and who the management team is. Consult with a financial advisor to help you navigate through the complexities of the market. Practice good risk management by diversifying your portfolio and not investing more than you can afford to lose. Keep up on industry news and monitor the stock regularly. By following these steps, you can make a wise investment decision in mineral resource shares. Research the company you’re considering investing in **Essential Steps to Buying Mineral Resource Shares:** – Research the company – Consult with a financial advisor – Practice good risk management – Stay up to date on industry news – Monitor the stock regularly.

The current share price of Mineral Resources on ASX today is [insert price here].

We cannot predict the future movements of share price.

Latest posts by Liccardo Glennis (see all)

- Things to Watch Out for in the Zinnwald Lithium Share Price Forecast - September 28, 2023

- How the Current Share Price of Zensar Technologies Affects the Investors - September 27, 2023

- How to Read and Understand Zenith Share Price History - September 26, 2023