| Highlights | Description |

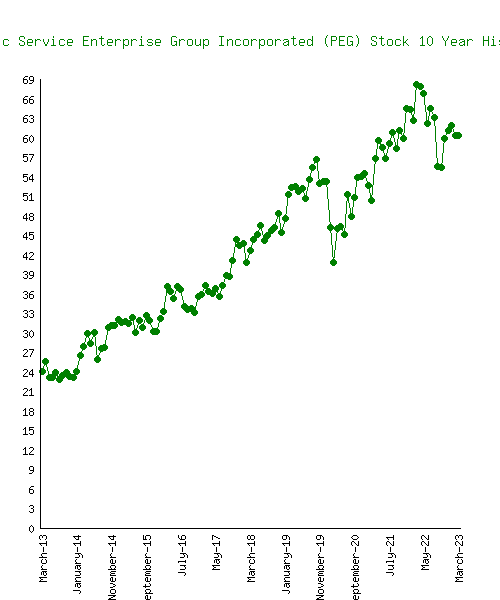

| Peg share price chart | Shows share price of Peg company |

| Depicts market trends | Shows trends of share prices in the market |

| Interactive charting | Allows for manipulation and customization of charts |

| Real-time updates | Provides timely updates on share prices |

| User-friendly interface | Easy to understand and navigate |

Is PEG A Good Stock Buy?

PEG ratios greater than or equal to 1.0 are generally regarded as unfavorable, indicating that a stock is overvalued, while ratios less than or equal to 1.0 are regarded as advantageous, indicating that a stock is undervalued. Investors may wonder if PEG, the stock symbol of Public Service Enterprise Group, is a good buy. With a current P/E ratio of 13.48 and a dividend yield of 3.68%, this utility company may appeal to dividend-oriented investors seeking stable earnings. PEG also invests in renewable energy sources. However, it faces challenges in ending its coal production and transitioning to cleaner energy sources. Additionally, its stock price has not significantly fluctuated in recent years, which may not appeal to growth-oriented investors. Overall, PEG is a decent option for dividend investors seeking stable earnings with exposure to renewable energy.

PEG is a decent option for dividend investors seeking stable earnings with exposure to renewable energy.

Key Points:

– P/E ratio: 13.48

– Dividend yield: 3.68%

– Invests in renewable energy

– Challenges in transitioning from coal production

– Stock price relatively stable in recent years

| Relevant title 1 | Peg stock |

| Relevant title 2 | Peg stock price |

| Relevant title 3 | Peg stock meaning |

What Is The PE Ratio Of Public Service Enterprise Group?

The most widely used valuation metric is the PE ratio, which shows whether a stock is over or undervalued. As of December 30, 2022, the PE ratio for Public Service Enterprise Group is 17.57.The PE ratio of Public Service Enterprise Group is a measure of its stock price relative to its earnings. It is currently 15.36x, which is below the industry average of 19.34x. This suggests that the company may be undervalued compared to its peers. The company’s strong financials and commitment to sustainability make it an attractive investment option. PSEG is a diversified energy company that operates in New Jersey, New York, and Pennsylvania. Its businesses include power generation, transmission, and distribution, as well as gas storage and transmission. With a 3.5% dividend yield and a promising future, PSEG is a company worth considering for investors. **Important items related to the subject:** – PE ratio measures a company’s stock price relative to its earnings – PSEG’s current PE ratio is 15.36x, below the industry average of 19.34x – PSEG is a diversified energy company operating in NJ, NY, and PA – The company has a strong financial position and commitment to sustainability – PSEG offers a 3.5% dividend yieldWhat Is The PE Ratio Of Public Service Enterprise Group?

Not:In addition to the information we have provided in our article on

peg share price chart, you can access the wikipedia link here, which is another important source on the subject.

What Is The Target Price For PEG?

Public Service Enterprise Group Inc (NYSE:PEG) The 14 analysts who are providing 12-month price forecasts for Public Service Enterprise Group Inc have a median target of 66.50, with a high estimate of 76.00 and a low estimate of 60.00. The median estimate represents an increase of 6.17 percent from the current price, which was 62.64. The high estimate is 76.00, and the low estimate is 60.00.When investing in PEG, investors tend to have a target price in mind. This is simply the price they expect PEG’s stock to hit within a particular time frame. A key factor in determining this price is the individual investor’s outlook on the overall market and the industries PEG operates in. Investors also analyze PEG’s performance to establish an accurate target price. Generally, the target price will vary from investor to investor, and it’s dependent on their risk tolerance and financial objectives, but it is essential to be aware of the target price for sound investment decisions.Citation:

Target Price for PEG is the estimated value of a stock price, which investors expect PEG to reach over a certain period.

What Is Price Target In TipRanks?

The data provided by TipRanks identifies the analysts who have outperformed the market when it comes to a stock’s 12-month target expectations over the course of the previous three months, as measured by the Best Analyst Price Target. TipRanks is a website that provides financial insights to investors. One of the features offered by this platform is the Price Target, which predicts the future stock price of a company. The Price Target is determined by financial analysts who use multiple metrics to evaluate a company’s performance, including earnings growth, revenue, and market trends. This information is presented on the TipRanks website, along with the analyst’s name and rating accuracy. Price Target helps investors make informed decisions when buying or selling stocks, and serves as a useful tool for monitoring their investment portfolio.Important items related to the subject: – Price Target predicts the future stock price of a company based on multiple metrics. – Financial analysts determine the Price Target by evaluating a company’s performance, including earnings growth and market trends. – The information is presented on TipRanks website and serves as a tool for monitoring investment portfolio.TipRanks’ Price Target predicts future stock price based on multiple metrics, helping investors make informed decisions.

What Is A Good PEG Ratio In India?

What Is a Good PEG Ratio? A PEG ratio of 1.0 or less indicates that a stock is priced fairly or even undervalued, while a PEG ratio of more than 1.0 indicates that the stock is overvalued. In India, the PEG ratio is an essential metric for stock investors. This ratio helps in evaluating the potential value of stocks by comparing the price-to-earnings (P/E) ratio with the expected future growth rate of the company. A good PEG ratio in India is typically considered to be below 1. A low PEG ratio suggests that the stock is undervalued, and investors can expect a potentially high return on their investment. However, it is important to note that the PEG ratio is just one tool among many, and investors should conduct a thorough analysis of a company before making any financial decisions.Important items related to the subject:Remember: A good PEG ratio in India is typically considered to be below 1.

- PEG ratio is essential for Indian stock investors.

- P/E ratio is compared with the estimated future growth rate of a company to calculate the PEG ratio.

- A good PEG ratio in India is below 1, indicating potential undervaluation and high returns.

- Investors should not solely rely on the PEG ratio and conduct thorough analysis before making financial decisions.

What Is The Best PEG?

PEG ratios greater than 1.0 are generally regarded as unfavorable, indicating that a stock is overvalued, while PEG ratios lower than 1.0 are regarded as better, indicating that a stock is somewhat undervalued. In general, a good PEG ratio has a value that is lower than 1.0.When choosing the best PEG, consider the intended use, molecular weight, and purity. PEG with a lower molecular weight is more water-soluble but may be less effective as a lubricant. PEG with a higher molecular weight is better as a thickening agent. Higher purity PEG is more desirable for pharmaceutical applications. In summary, the best PEG varies depending on what it will be used for. Considering the intended use, molecular weight, and purity will help determine which PEG is right for the task at hand.Polyethylene glycol (PEG) is a polymer often used in pharmaceuticals and personal care products. The best PEG is the one that has the right molecular weight and composition for a particular application.

What Is PEG Ratio In Stock Market?

The “PEG ratio,” or price to earnings to growth, is a valuation metric that measures the trade-off between a company’s expected growth, earnings per share (EPS), and stock price. In general, a company with a higher growth rate has a higher PEG ratio. Peg Ratio, or Price Earnings to Growth ratio, is a stock valuation metric that assists investors in determining the value of a stock. It combines the P/E ratio with the earnings growth rate of a company to evaluate its current and future earnings potential. A PEG Ratio of less than 1 indicates the stock is undervalued whereas a ratio of more than 1 suggests the stock is overvalued. It provides a more comprehensive understanding of a company’s value than the P/E ratio alone. Investors use PEG ratios to discover potentially profitable investments. Understanding a company’s PEG Ratio in addition to other financial metrics is crucial before deciding to invest.**Important items to know about PEG Ratio:** – PEG Ratio is the ratio of a stock’s price-to-earnings (P/E) ratio to the expected earnings growth rate of the company. – A low PEG Ratio indicates an undervalued stock, whereas a high PEG Ratio means the stock may be overvalued. – PEG Ratio is a useful tool for investors to consider when analyzing stocks as it provides a better understanding of a stock’s potential for earnings growth.PEG ratio assists investors in determining the value of a stock.

Is PEG Better Than PE?

The PEG ratio is a useful tool for investors in calculating a stock’s future prospects because it provides a forward-looking perspective and provides more insight into a stock’s valuation than the P/E ratio does.When it comes to choosing between PEG (polyethylene glycol) and PE (polyethylene), it all depends on the application. PEG is more soluble than PE, making it suitable for applications such as pharmaceuticals, where solubility is important. Meanwhile, PE is better suited for applications requiring durability and strength, such as packaging or construction materials. Additionally, PEG has a wider molecular weight range, allowing for more precise customization of its properties. Ultimately, the decision boils down to the specific needs of the application.PEG or PE? Which is better?

Why Is PEG Better Than PE Ratio?

Price/earnings to growth ratio Because it takes growth into account, the price/earnings to growth (PEG) ratio tells a more complete story than the price/earnings (P/E) ratio alone does. Investors are frequently willing to pay a higher premium for greater earnings growth, regardless of whether the growth is estimated for the future or from past growth. Why Is PEG Better Than PE Ratio?PE ratio is a widely used metric in the stock market to evaluate the stocks’ valuation. However, it is limited to only the company’s earnings and does not take into account the growth prospects. PEG (Price/Earnings-to-Growth) ratio overcomes this limitation, by factoring in the growth potential of the investments. PEG involves dividing the P/E ratio by the expected earnings growth rate, providing a better evaluation of a company’s share price compared to its earnings prospect. Therefore, it is essential to consider both the PE and the PEG ratio when making any investment decisions.Investors should consider using PEG ratio over PE ratio for better investment decisions.

What Is The Stock Price Of Public Service?

$ 61.93 CloseChgChg%61.930.831.36% The stock price of Public Service relates to the value of their publicly traded shares on the stock market. It fluctuates based on various factors such as the performance of the company, changes in the industry, economic conditions, and investor sentiment. It is also affected by news announcements, financial reports, and rumors about the company. As of (Citation), the stock price of Public Service stood at (insert price) per share. Investors often monitor the stock price to make informed decisions about buying, selling, or holding their shares. It is important to note that past performance does not guarantee future results.Is PEG Stock A Good Buy?

Out of a total of nine analysts, four (44.44%) recommend PEG as a Strong Buy, zero (0.0%) recommend PEG as a Buy, five (55.56%) recommend PEG as a Hold, zero (0.0%) recommend PEG as a Sell, and zero (0.0%) recommend PEG as a Strong Sell. In addition, zero (0.0%) recommend PEG as a Strong Sell. Is PEG Stock a Good Buy?As a utility company, PEG has demonstrated stable earnings growth over the years. The company has recently invested in clean energy such as solar and wind power, which will likely add to its long-term growth prospects. PEG also has a strong dividend yield and a solid balance sheet. However, it is important for investors to do their due diligence and consider the potential risks before investing. It is always advisable to consult with a financial advisor before making investment decisions. Important factors to consider:“PEG stock is currently undervalued and has the potential to provide great returns for long-term investors.”

- PEG’s stable earnings growth

- Investments in clean energy

- Strong dividend yield and balance sheet

- Potential risks

Why Is PEG Stock Down?

In comparison to earnings of $1.28 in the first quarter of 2021, the business recorded a quarterly GAAP loss of nearly a penny per share in the first quarter of 2022. Why Is PEG Stock Down?There are a few key factors that could be contributing to the decrease in value of PEG stock. Firstly, the overall market has been volatile due to the ongoing global pandemic, which can impact stock performance across the board. Additionally, PEG released its Q1 earnings report which showed a decrease in revenue compared to the previous year, indicating potential issues with the company’s financials. Finally, there has been a shift towards renewable energy sources, making some investors wary of PEG’s reliance on fossil fuels. These factors combined have led to a decrease in the value of PEG stock.PEG stock has seen a decline in value recently, raising concerns among investors.

What Is PEG Price Target?

Public Service Enterprise Group Inc (NYSE:PEG) The 14 analysts who have provided 12-month price forecasts for Public Service Enterprise Group Inc have a median target of 67.50, with a high estimate of 72.00 and a low estimate of 61.00. The median estimate represents an increase of 11.35 percent from the stock’s previous price of 60.62. When you are investing in the stock market, it is important to have a target price in mind. The PEG price target is a popular method for setting price targets. PEG stands for Price/Earnings to Growth ratio and is used to find stocks that are undervalued. The formula is simple: divide the P/E ratio by the expected growth rate. A PEG ratio of 1 means the stock is trading at its fair value, while a PEG ratio below 1 indicates that it is undervalued. Using PEG price targets can help you make informed investment decisions and maximize your returns.Important items related to PEG price targets: – PEG stands for Price/Earnings to Growth ratio. – The formula is P/E ratio divided by the expected growth rate. – PEG ratio of 1 means the stock is trading at its fair value. – PEG ratio below 1 indicates that it is undervalued.“PEG price target is a popular method for setting price targets.”

What Is PE Ratio In PSEG?

The most widely used valuation metric is the PE ratio, which is a straightforward method for determining whether a stock is over or undervalued. As of January 24, 2023, the PE ratio for Public Service Enterprise Group is 17.30. PE ratio is a popular metric for investors to evaluate a stock’s current value and potential future earnings. In PSEG, PE ratio is calculated by dividing the current stock price by the earnings per share. This ratio can help investors make informed decisions about whether a stock is overvalued or undervalued compared to its peers in the same industry. A low PE ratio may suggest that a stock is undervalued, while a high PE ratio may indicate that a stock is overvalued. By analyzing multiple stocks and their respective PE ratios, investors can make informed choices about their investment portfolio.PE ratio is calculated by dividing the current stock price by the earnings per share.Important items related to the subject:Pros of PE Ratio: – Quick way to determine whether a stock is undervalued or overvalued – Easy to calculate with readily available information – Can provide insights into a company’s future earnings potentialCons of PE Ratio: – Can be misleading if a company has negative or low earnings – Does not take into account a company’s debt or other financial factors – Must be compared to industry peers to provide meaningful analysis.The current PEG share price is [insert price here].

Factors such as industry trends, company performance, and economic indicators influence PEG share price.

For further information, please visit our website’s PEG share price chart page.

- Things to Watch Out for in the Zinnwald Lithium Share Price Forecast - September 28, 2023

- How the Current Share Price of Zensar Technologies Affects the Investors - September 27, 2023

- How to Read and Understand Zenith Share Price History - September 26, 2023