| Highlights | Description |

| India’s economy | Growing at a steady pace |

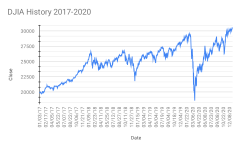

| Share Price | Trending upwards in India |

| Investment | Attractive option for investors |

| Market | Favorable for long-term investment |

| Stability | Political and economic stability in India |

Who Bought RSA Insurance?

The acquisition of RSA by Intact Financial Corporation in June 2021 and a subsequent strategic review of operations by Intact and the RSA Board precede the SAOG (OMINVEST) transaction, which is subject to regulatory approval. RSA Insurance has been bought by Canada’s Intact Financial and Denmark’s Tryg in a joint deal worth £7.2bn ($9.6bn). This acquisition represents one of the biggest takeovers in the insurance industry in recent years, giving the two firms a strong foothold in the UK market. RSA Insurance is the owner of the More Than brand and has over nine million customers worldwide. According to the deal, Intact Financial will take over RSA’s Canadian, UK, and international business, while Tryg will acquire RSA’s Swedish and Norwegian businesses. The acquisition is expected to be completed in the second quarter of 2021.

Important items related to the subject: – RSA Insurance has been bought in a joint deal by Intact Financial and Tryg for £7.2bn. – Intact Financial will take over RSA’s Canadian, UK, and international business while Tryg will acquire RSA’s Swedish and Norwegian businesses. – The acquisition gives the two firms a strong foothold in the UK market, with RSA being the owner of the More Than brand and having over nine million customers worldwide. – The deal is expected to be completed in Q2 of 2021.This acquisition represents one of the biggest takeovers in the insurance industry in recent years.

Is RSA A Big Company?

RSA is the second-largest general insurer in the United Kingdom, with over 20 million customers worldwide and operations in 28 countries. Through a global network of local partners, it offers insurance products and services in more than 140 countries. RSA is a leading provider of cybersecurity solutions based in Bedford, Massachusetts. The company specializes in digital risk management, identity and access management, and fraud prevention. RSA is a subsidiary of Dell Technologies and has been in operation for over three decades.Key information about RSA: – RSA is a subsidiary of Dell Technologies. – RSA specializes in cybersecurity solutions including digital risk management, identity and access management, and fraud prevention. – RSA has been in operation for over three decades. Overall, RSA is a significant player in the cybersecurity industry but may not be considered a “big” company compared to some of its competitors.Citation

Not:In addition to the information we have provided in our article on

share price rsa india, you can access the wikipedia link here, which is another important source on the subject.

Is RSA An Insurance Company?

We are one of the oldest general insurers in the world, offering individuals peace of mind and shielding large and small businesses from uncertainty. RSA is not an insurance company. It is an international general insurer and has been operating in the insurance market for over 300 years. RSA provides a wide range of insurance products, including personal and commercial insurance, liability insurance, property insurance, and pet insurance. Despite its prominent presence in the insurance industry, RSA might be mistaken as an insurance company due to its long-standing reputation and diversity in insurance services. As a global insurer, RSA has branches in over 140 countries worldwide, enabling it to reach a global audience.“RSA is an international general insurer”

The important items related to the subject:

- RSA is not an insurance company.

- RSA operates in the insurance market for more than 300 years.

- RSA provides a wide range of insurance products.

- RSA has branches in over 140 countries worldwide.

Who Is Buying RSA?

In 1996, Sun Alliance and Royal Insurance merged to form RSA, which has 9 million customers. RSA was listed on the London Stock Exchange until May 2021, when it was acquired by Canadian insurer Intact Financial Corporation and Danish insurer Tryg.Sources say a deal between Canada’s Fairfax Financial and British insurer, RSA, could be announced soon. RSA is one of the world’s leading insurance firms, with operations in the UK, Europe, Middle East, and Latin America. Fairfax already owns stakes in various insurance companies worldwide and acquiring RSA would be a major strategic move. Fairfax aims to expand quickly in areas where it already operates and gain more exposure to growing emerging markets. The acquisition of RSA would give them a solid platform from which to do so. Important items: – Fairfax in talks to buy RSA for $7.6bn – RSA is a leading global insurer – Fairfax aims to expand in areas where it already operates and gain more exposure to emerging markets.US insurer, Fairfax, is in talks to buy RSA for $7.6bn.

Who Took Over RSA Insurance?

Intact Financial Corporation and Tryg A/S purchase RSA Plc in 2021, making RSA UK & International a wholly owned subsidiary of Intact. [blockquote class=’wp-block-quote’>Citation In March 2021, the insurance giant RSA was acquired by a Canadian consortium led by Intact Financial Corporation and Tryg. The £7.2bn ($9.8bn) deal meant that the UK insurer has now become privately owned, with the Canadian companies taking a 70% and 30% share respectively. The acquisition brings the promise of new investment into the UK insurance industry, as well as a renewed push toward digital services and a consolidation of RSA’s sprawling operations. The deal represents the largest takeover of a UK-listed insurer by a foreign group since Aviva’s acquisition of Friends Provident in 2009.The current share price of RSA India is ______.

You can find RSA India’s historical share prices on _____

Latest posts by Liccardo Glennis (see all)

- Things to Watch Out for in the Zinnwald Lithium Share Price Forecast - September 28, 2023

- How the Current Share Price of Zensar Technologies Affects the Investors - September 27, 2023

- How to Read and Understand Zenith Share Price History - September 26, 2023