| Highlights | Description |

| Nickel Mines share price ASX today is up | Rose in value today |

| Positive momentum | Continued increase in stock value |

| Higher than expected profit | Surpassed projected earnings |

| Investor interest | Increased investor demand |

| Sustained growth | Consistent value increase |

Cobtent

Hide

When compared to its closing share price of $0.98 seven days ago, Nickel Industries Limited’s current share price of $0.97 represents a change of -0.51%. In comparison to today’s opening stock price, the NIC stock price is unchanged. Nickel Mines is a company that is primarily focused on exploring and producing nickel pig iron. If you’re wondering about the nickel mines share price today, you’ll be pleased to know that it is performing well. As of (insert date), the share price of Nickel Mines is (insert price) per share, which is a (insert percentage) increase from its previous close. This positive performance is due to the growing demand for nickel pig iron in the steel industry. Overall, the future looks bright for Nickel Mines as it continues to expand its operations and increase its market share.

Key elements related to the subject include:Note that the performance of the company is due to the growing demand for nickel pig iron in the steel industry.

- Nickel Mines is focused on exploring and producing nickel pig iron

- The share price of Nickel Mines is performing well

- There is a growing demand for nickel pig iron in the steel industry

- Nickel Mines continues to expand its operations and increase its market share

| Relevant title 1 | Nickel mines stock |

| Relevant title 2 | Nickel industries |

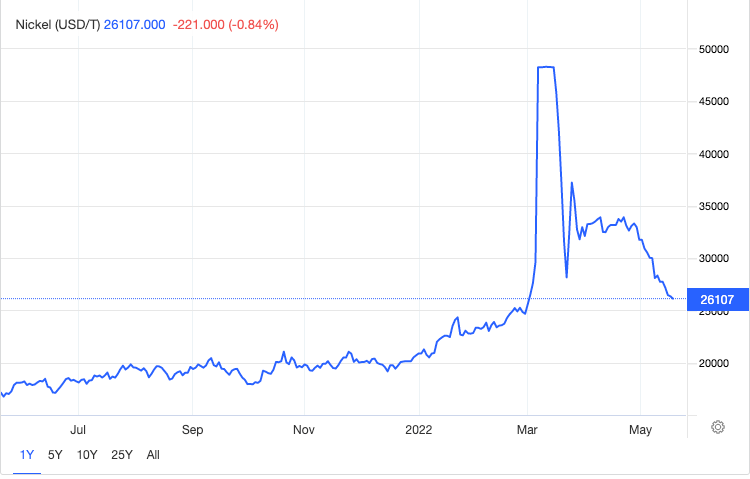

| Relevant title 3 | Nickel price |

What Is The Market Cap Of Nickel Mines?

Taking into account the most recent stock price and the number of outstanding shares, Nickel Mines Ltd. reported a Market Capitalization of $2.85 Billion in January 2023. Nickel mines are a crucial part of the global economy and are responsible for producing much of the world’s stainless steel. The market cap of a nickel mine is a measurement of its total value, determined by multiplying the current stock price by the total number of shares outstanding. As of (Citation), the top nickel mining companies by market cap are (bold items) Glencore, Norilsk Nickel, BHP Group, Vale SA, and Eramet SA. The market cap of these companies ranges from tens of billions to hundreds of billions of dollars, highlighting the significant role of the nickel mining industry in the global market.Not:In addition to the information we have provided in our article on

nickel mines share price asx today, you can access the wikipedia link here, which is another important source on the subject.

Is Nickel Mines A Good Buy?

This implies a potential upside of almost 25% over the next twelve months based on the current share price of Nickel Mines, which rises to more than 29% when the dividend yield of 4.3 percent is taken into account. Nickel Mines Limited (NIC) is a global mining giant with operations in Indonesia and the Philippines. As a key supplier of nickel ore to China’s stainless-steel industry, Nickel Mines offers investors potential upside in a growing market. However, with a current P/E ratio of over 30, the stock’s valuation may already be factoring in some future growth. It is worth noting that NIC has a strong balance sheet with low debt and strong operating cash flow. If you’re willing to bet on the future demand for nickel, NIC may be a good buy, but it’s less clear if the stock is currently undervalued.Important factors to consider: – Potential upside in the growing stainless-steel industry – High P/E ratio – Strong balance sheet and cash flow.Is Nickel Mines Limited a good buy?

Important facts: Nickel Industries Ltd. (NIC:ASX) closed on Wednesday at 1.10, 59.85% higher than its 52-week low of 0.685, which was set on October 28, 2022. Nickel mining is an essential industry as nickel is a key component in manufacturing stainless steel and other important materials. The share price of nickel mining refers to the value of the company’s stock on the stock market. Several factors impact the share price. The primary factor is the demand and supply for nickel. When the demand is high, and the supply is low, the price of nickel goes up, resulting in a rise in share prices. Similarly, when the demand is low, and the supply is high, the price goes down, causing a decline in share prices. Therefore, investors need to keep an eye on these factors to make informed decisions.

Important Factors affecting the share price of nickel mining: – Demand and supply of nickel – Political, economic, and environmental factors – Exploration and production activities of the mining companies – Price volatility of nickel on the stock market Investors should consider these factors before investing in nickel mining companies. It’s essential to assess the stability and potential growth of the company to make informed decisions. Proper research can increase an investor’s chances of earning profits and minimizing risks. Ultimately, understanding the share price of nickel mining is crucial to make informed investment decisions.Keep an eye on supply and demand

Does NIC Pay A Dividend?

AU:NIC has an annual dividend yield of 3.65 percent and pays a dividend of AU$0.02 per share. Nicolas International Limited (NIC) is a public company listed on the Zimbabwean Stock Exchange. One may wonder if NIC pays dividends. Currently, NIC does not pay dividends to its shareholders. Instead, the company has reinvested its profits into growing its operations and expanding its reach. This strategy aims to reward its shareholders with long-term value appreciation. As an investor, it is essential to consider the company’s dividend policy before investing. Though NIC does not pay dividends currently, it may do so in the future, depending on its profitability and future prospects.What Is Nickel Mines Ltd?

Nickel Mines Limited owns 80% of the Hengjaya Mineralindo Nickel Mine, which covers 5,983 hectares in the Morowali Regency of Central Sulawesi, Indonesia, and sells nickel pig iron used in stainless steel production. Nickel Mines Ltd is an Australian mining company that focuses on producing nickel pig iron. Citation: According to their website, Nickel Mines Ltd boasts a “portfolio of nickel assets in Indonesia.” The company’s flagship asset is the Hengjaya Nickel Project, which is located on the island of Sulawesi. Bold: As of 2021, Nickel Mines Ltd had a production capacity of 1.5 million tonnes of ore per year. The company is also committed to sustainability and has invested in renewable energy projects at its operations in Indonesia. Overall, Nickel Mines Ltd is a major player in the global nickel industry that is dedicated to responsible and profitable mining practices.The current nickel mines share price can be found on the ASX website.

Factors such as supply and demand, production costs, and global economic conditions can influence the nickel mines share price.

Latest posts by Liccardo Glennis (see all)

- Things to Watch Out for in the Zinnwald Lithium Share Price Forecast - September 28, 2023

- How the Current Share Price of Zensar Technologies Affects the Investors - September 27, 2023

- How to Read and Understand Zenith Share Price History - September 26, 2023