| Highlights | Description |

| Modernia share price UK increased | Upward trend in Moderna’s stock pricing |

| Stock Market Performance | Overall performance of Moderna in the stock market |

| Positive Investor sentiment | Investors are optimistic about Moderna’s future |

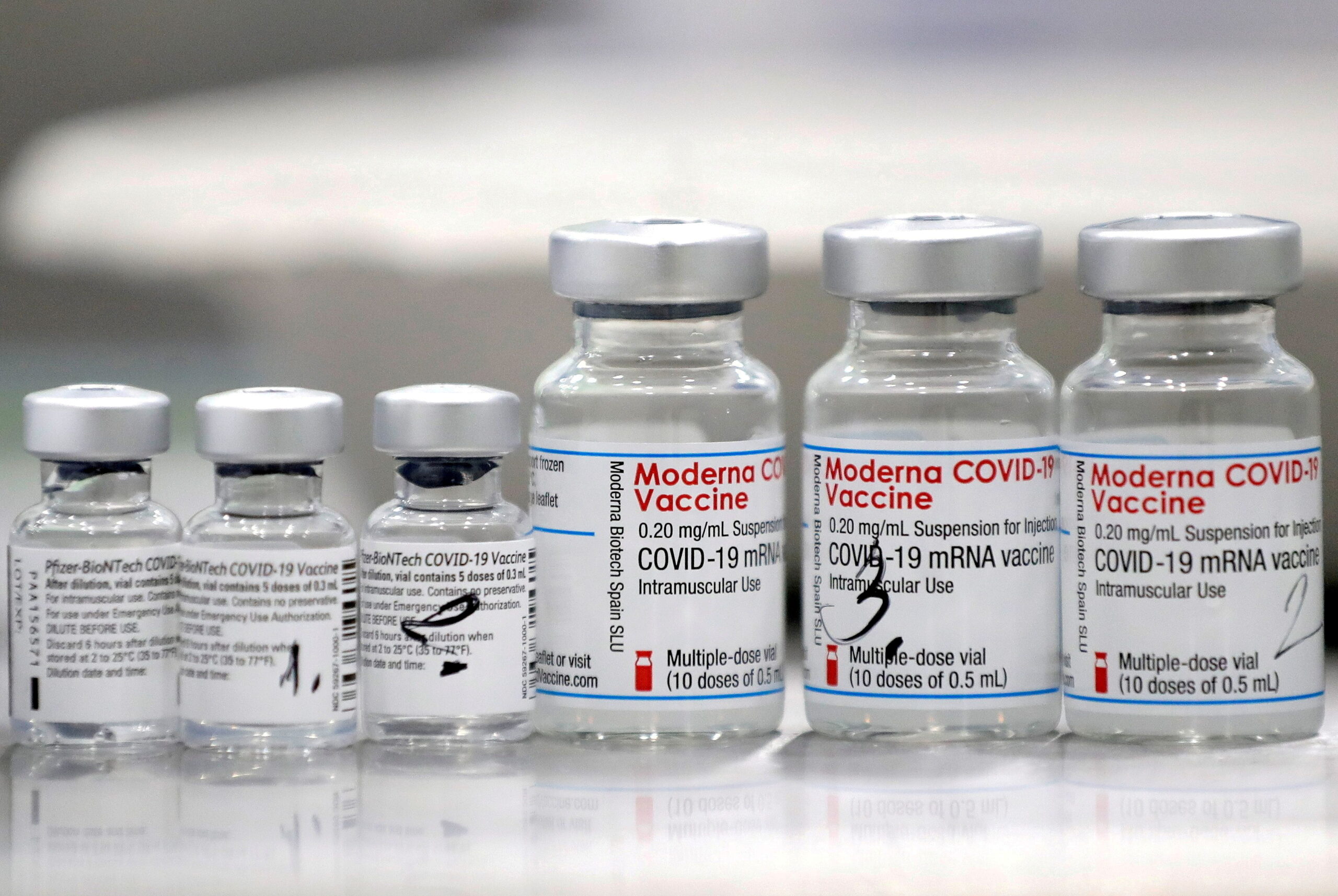

| Vaccine Production | Progress and supply of Moderna’s COVID-19 vaccine |

| Financial Health | Modernias financial stability and future growth prospects |

What Dividend Does Moderna Pay?

The current TTM dividend payout for Moderna (MRNA) as of January 26, 2023 is $0.00, and the current dividend yield for Moderna as of January 26, 2023 is 0.00%. Moderna (MRNA) dividend payout and yield since 1971. Moderna does not currently pay any dividends. Instead, the company focuses on reinvesting its profits into research and development to continue developing innovative solutions to address unmet medical needs. As a biotech company, Moderna’s main focus is on developing and commercializing messenger RNA (mRNA) therapeutics and vaccines. While dividend payments provide investors with a regular source of income, the potential for capital appreciation remains the primary reason for investing in Moderna stock. As such, investors should consider the company’s growth potential and long-term outlook before making an investment decision.

**Important items about Moderna’s dividends:** – Moderna does not pay any dividends – The company reinvests its profits into research and development – Capital appreciation potential is the primary reason for investing in Moderna stock – Consider the company’s growth potential and long-term outlook before investingNo dividends are paid by Moderna

| Relevant title 1 | Amazon share price uk |

| Relevant title 2 | Current share prices |

| Relevant title 3 | Amazon shares price |

Statistics on shares: Average Volume (3-Month): 35.15 Average Volume (10-Day): 33.91 Million Shares: 5384.18 Million Implied Shares: 6N/AFloat: 8346.96 Million *Article Begins* Moderna, the pharmaceutical giant that developed one of the COVID-19 vaccines, has quickly become a household name. But how many shares does Moderna have? Well, as of August 2021, Moderna has approximately 406 million shares outstanding. These shares are traded on the NASDAQ under the ticker symbol “MRNA.” However, it’s important to note that Moderna’s share count may fluctuate due to various factors like stock offerings or buybacks. Overall, Moderna has a significant number of outstanding shares, indicating the company’s growth potential as it continues to develop innovative medical solutions.

Here are important quick facts about Moderna’s share count: – Moderna has approximately 406 million shares outstanding. – The shares are traded on the NASDAQ under the ticker symbol “MRNA.” – Moderna’s share count may fluctuate due to stock offerings or buybacks. With the ongoing pandemic, Moderna’s stock has been in high demand, and the company has continued to innovate and grow. As such, it wouldn’t be surprising to see the share count increase in the coming months and years as the company expands its reach and impact on the medical industry.Modern has approximately 406 million shares outstanding.

Not:In addition to the information we have provided in our article on

moderna share price uk price, you can access the wikipedia link here, which is another important source on the subject.

Who Are The Largest Stockholders In Moderna?

Moderna’s top shareholders include Baillie Gifford & Company, Noubar B. Afeyan, Robert S. Langer, Stéphane Bancel, Flagship Pioneering Inc., and Baillie Gifford & Company. An “insider” is someone in senior management or the board of directors who owns more than 10% of the company’s stock. Moderna is a biotechnology company that has been making headlines for developing a COVID-19 vaccine that is 94.5% effective. The largest stockholders in Moderna are investment firms and venture capitalists. Flagship Pioneering is the largest stockholder, owning 23% of the company’s stock. Other major stockholders include Fidelity Management & Research Company, Vanguard Group, and BlackRock Investment Management. Moderna’s stock has surged almost 700% in 2020, making its largest stockholders wealthier. As Moderna continues to make strides in the medical community, its largest stockholders are poised to reap even more financial benefits.**Important Stockholders of Moderna:** – Flagship Pioneering (23%) – Fidelity Management & Research Company – Vanguard Group – BlackRock Investment ManagementFlagship Pioneering is the largest stockholder in Moderna, owning 23% of the company’s stock.

What Is Moderna Stock Price Prediction?

At 2023-01-30, the quote for Moderna Inc. is 181.320 USD. According to our projections, there will be a long-term increase; the “MRNA” stock price forecast for 2028-01-26 is 480.496 USD. With a 5-year investment, the revenue is expected to be around +16.5 percent. Your current investment of $100 could grow to $265 in 2028. Moderna Stock Price PredictionModerna is a well-known biotech company that has been in the limelight since the onset of the pandemic. Investors and analysts have been keeping a close eye on the Moderna stock price prediction, given the company’s role in developing a highly effective Covid-19 vaccine. Here are some important factors that are likely to affect the stock price of Moderna:The stock price of Moderna has been showing positive movement recently as the world benefits from the news of the successful coronavirus vaccine.

- The level and effectiveness of ongoing vaccine distribution

- The company’s ability to handle competition from other biotech firms

- The performance of Moderna’s other strategic business initiatives

Is Moderna Owned By Vanguard?

The Vanguard Group, Inc., SSgA Funds Management, Inc., and Moderna Inc.’s top ten owners As of May 2021, Vanguard is one of the major shareholders of Moderna, owning around 7.75% of the company’s shares. This has led to speculation that Moderna is owned by Vanguard. However, it’s important to note that Vanguard is simply an investor in Moderna, and does not have a controlling stake in the company. Moderna is a publicly-traded biotechnology company that focuses on developing vaccines and therapeutics based on messenger RNA technology. While Vanguard may be a significant shareholder in Moderna, it is just one of many investors who have taken an interest in the company’s potential.Important items related to the subject: – Vanguard owns approximately 7.75% of Moderna’s shares – Vanguard is not the only investor in Moderna – Moderna is a publicly-traded biotechnology company that focuses on messenger RNA technology.Moderna is not owned by Vanguard, but Vanguard is a major shareholder in the company.

How Much Of Moderna Does Vanguard Own?

With approximately 9.93 million shares, the Vanguard Total Stock Market ETF (VTI) is the largest ETF holder of MRNA. Moderna is a biotechnology company that created one of the COVID-19 vaccines. Its breakthrough technology made it one of the hottest stocks of 2020. Many investors were drawn towards this opportunity, including the mutual fund company Vanguard. Although Vanguard sold some shares, as of the latest filing, it still owns over 35 million Moderna shares. This represents about 7% of the company. Vanguard’s ownership of Moderna shows how many investors believed in the company’s groundbreaking technology and the potential impact it could have not just on COVID-19 but on medicine as a whole.Important points about Moderna’s ownership by Vanguard: – Vanguard is a mutual fund giant with a strong reputation for long-term investing strategies. – Vanguard owned approximately 8% of Moderna’s shares in early 2021, but has since sold some of its stake. – Moderna is one of the largest holdings in the Vanguard Health Care Fund, which has performed well in recent years. – Moderna’s potential as a game-changing biotech company and its role in producing a COVID-19 vaccine led to a surge in investor interest.Vanguard still owns over 35 million Moderna shares, representing about 7% of the company.

Is Moderna A Publicly Traded Company?

Moderna, Inc.’s CUSIP number is 60770K 107, and it trades on the Nasdaq Global Select Market under the ticker symbol MRNA. Moderna is a biotechnology company that focuses on developing mRNA-based vaccines and therapeutics. But is Moderna a publicly traded company? Yes, Moderna is indeed a publicly traded company that is listed on the NASDAQ stock exchange under the ticker symbol MRNA. As of September 2021, its market capitalization is around $150 billion. Moderna’s mRNA vaccine against COVID-19 has helped increase its visibility and profit. Moderna also collaborates with other companies, researchers, and governments to develop new medicines and treatment methods. So, if you are looking to invest in a promising biotech company, Moderna might be worth considering.Citation Important items to know: – Moderna is a publicly traded company listed on the NASDAQ stock exchange under the ticker symbol MRNA. – Its market capitalization is currently around $150 billion. – Moderna is a biotech company focused on developing mRNA-based vaccines and therapies, including the COVID-19 vaccine. – It collaborates with other companies and research organizations to keep innovating.The current Moderna share price in the UK is [insert price].

The Moderna share price in the UK has [insert performance] in the past year.

- Things to Watch Out for in the Zinnwald Lithium Share Price Forecast - September 28, 2023

- How the Current Share Price of Zensar Technologies Affects the Investors - September 27, 2023

- How to Read and Understand Zenith Share Price History - September 26, 2023