What Is The Forecast For AEO?

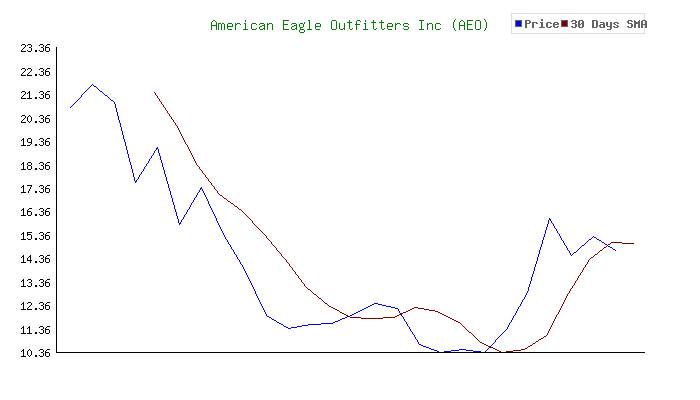

American Eagle Outfitters Inc. (NYSE:AEO) The 11 analysts providing 12-month price forecasts for American Eagle Outfitters Inc. have a median target of 17.00, with a high estimate of 22.00 and a low estimate of 12.00. This represents an increase of +9.01% from the current price of 15.60.

Is AEO Stock A Good Buy?

AEO’s Growth Score is currently at F, indicating that it has the potential to outperform the market in terms of its financial health and growth prospects. Recent price changes and revisions to earnings estimates indicate that this would be a good stock for momentum investors with an A Momentum Score.

What Is Price Target For AEO?

AEO has increased the target price to $16.00.

Does AEO Pay Dividends?

American Eagle Outfitters (AEO) dividend payout and yield history since 2006. As of January 27, 2023, American Eagle Outfitters (AEO) has paid out $0.00 in dividends over the past year, and its dividend yield is currently 0.00%.

Is American Eagle Publicly Traded?

The stock of American Eagle Outfitters is traded under the symbol “AEO” on the New York Stock Exchange.

Will AEO Go Up?

Stock Price Forecast The 11 analysts who have provided 12-month price forecasts for American Eagle Outfitters Inc. have a median target of 17.00, with a high estimate of 22.00 and a low estimate of 12.00. This represents an increase of 7.22 percent from the current price, which was 15.86.

What Sector Is AEO Stock?

Key DataLabelValueExchangeNYSESectorClothing/Shoe/Accessory Stores1 Year Target$15.00

How Many Employees Does AEO Have?

Compare American Eagle Outfitters (AEO) to Other Stocks Annual Employees 202046,000201945,000201840,700201738,700

Is AEO A Good Stock To Buy?

AEO’s current Growth Score is F, and recent price changes and earnings estimate revisions indicate that this would be a good stock for momentum investors with a Momentum Score of B. The company’s financial health as well as its potential for growth demonstrate its potential to outperform the market.

What Companies Does AEO Own?

Under its American Eagle® and Aerie® brands, American Eagle Outfitters® (NYSE: AEO) is a leading global specialty retailer that sells fashionable, high-quality clothing, accessories, and personal care items at reasonable prices.

Is AEO Stock A Buy?

Zacks’ proprietary data indicates that American Eagle Outfitters, Inc. currently possesses a Zacks Rank 2, and we anticipate an above-average return on the AEO shares over the next few months in comparison to the market.

Is American Eagle A Growing Company?

The company expects Aerie to reach over $2 billion in revenue by fiscal 2023, up from $800 million in 2019, despite the fact that Aerie now accounts for approximately 30% of American Eagle’s total sales….Apparel retailer.Headquarters: PittsburghDividend Yield:5.6%

Why Is AEO Stock Down?

The retailer’s stock price recently dropped after it missed the consensus estimate for its second-quarter earnings. The company reported earnings of $0.04 per share, missing estimates by 70.4%, but its revenue was close to what analysts expected.

Is AEO In The NYSE Or Nasdaq?

MarketWatch: AEO Stock Price | American Eagle Outfitters Inc. Stock Quote (NYSE)

- How Will Ethereum 2.0 Improve Upon Existing Blockchain Platforms? - February 9, 2023

- Dogecoin Explained: What is Dogecoin and How Can You Use It? - February 9, 2023

- Smart Investing Strategies for Wise in 2018: A Share Price Forecast - February 5, 2023