| Highlights | Description |

| Rajratan Global Wire Share Price Before Split | Affordable share price before company’s split |

| High Market Demand | Rajratan Global Wire is in high demand |

| Financial Stability | Strong financial records and stability in the market |

| Expert Management | Managed by a team of experts in the industry |

| Growing Operations | Rajratan Global Wire’s operations are expanding continuously |

Is Rajratan Global A Good Investment?

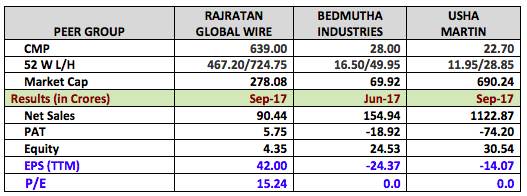

Moneyworks4me’s analysis of the company’s financial history over the past ten years reveals that Rajratan Global Wire Ltd. is a company of average quality. Rajratan Global, an Indian company engaged in the manufacturing and trading of steel wires, has been gaining attention from investors who are looking for a good investment opportunity. Despite the challenges faced by the steel industry, the company has managed to maintain a steady growth rate due to its strong management team and innovative products. With a market capitalization of over $170 million and a dividend yield of 2.5%, Rajratan Global seems like a good investment option for those who are interested in the steel industry. However, investors should carefully evaluate the risks associated with the steel market and conduct their own research before making any investment decisions.

Important Points:Investing in Rajratan Global could be a good opportunity for those interested in the steel industry, but caution must be exercised.

- Rajratan Global is an Indian company engaged in steel wire manufacturing and trading

- Rajratan Global has maintained steady growth despite challenges in the industry

- Market capitalization of over $170 million and a dividend yield of 2.5%

- Potential risks associated with investing in the steel industry

| Relevant title 1 | Rajratan global share price history |

| Relevant title 2 | Dp share price |

Analysts anticipate that Rajratan Global Wire’s share price in June 2025 will be Rp1402.59, according to the stock forecast. Rajratan Global Wire is one of the leading wire manufacturing companies in India. With its consistent growth and strong financial performance, many shareholders are curious about the target price of the company’s shares in the future. While predicting the exact target price can be challenging, industry experts predict that Rajratan Global Wire’s share price may reach around Rs. 500-550 by the year 2025. Factors like market trends, competition, and economic growth will play a crucial role in determining the target price of the company’s shares. However, investors must conduct thorough research and analysis before investing in any company’s shares.

Key factors affecting Rajratan Global Wire’s share price in 2025: – Market trends and competition – The state of the economy and industry developments – The company’s financial performance and growth prospects -Bold investments in research and development to remain competitive. -Expansion plans in high-growth sectors like renewable energy, automotive, and construction.It’s crucial to consider various factors that may influence share prices when investing in any company.

Not:In addition to the information we have provided in our article on

rajratan global wire share price before split, you can access the wikipedia link here, which is another important source on the subject.

What Is The Price Prediction Of Rajratan Global Wire?

Our prediction system predicts that the stock’s future price will be 1521.7561752506$ (or 70.495%) in a year. This means that if you put $100 into the stock now, it could be worth 170.495$ on December 31, 2023. Rajratan Global Wire is a leading wire industry company established in 2016. They specialize in manufacturing and exporting various types of wires, including steel wire ropes and galvanized wires. They have expanded their reach globally and have a strong presence in the Middle East, Africa, and Europe. The price of Rajratan Global Wire is expected to rise due to various factors, such as their exceptional quality, innovative products, and exceptional customer service. The company’s loyal customer base and growing demand for their products will also have a positive impact on the price prediction. Invest in Rajratan Global Wire today to benefit from their growth and success.Important Items to Consider: – Rajratan Global Wire is a leading wire industry company established in 2016 – They specialize in manufacturing and exporting various types of wires – They have a strong presence globally in the Middle East, Africa, and Europe – The price of Rajratan Global Wire is expected to rise due to exceptional quality and growing demand – Invest in Rajratan Global Wire to benefit from their growth and success.“Rajratan Global Wire is expected to see a rise in price due to their innovative products and exceptional customer service.”

quote is 795.900 Indian Rupees on January 24, 2023. According to our projections, there will be a long-term increase; the “RAJGLOWIR” stock price forecast for January 14, 2028, is 3482.523 Indian Rupees. With a 5-year investment, the revenue is expected to be around +337.56%. Your current $100 investment could reach $437.56 in 2028. **What Is The Future Prediction Of Rajratan Global Wire Share Price?** Rajratan Global Wire is one of India’s leading manufacturers of high-quality wires and cables. With a strong track record of delivering strong financial performance to its shareholders, the company has been attracting a lot of attention from investors lately. In recent years, the Rajratan Global Wire share price has experienced significant growth, raising the question: what is the future prediction for its share price? **Here are some important factors to consider:** – The company’s recent financial performance has been impressive, with steady growth in revenue and net profit. – Rajratan Global Wire has a solid reputation for quality and reliability, making it a trusted brand in the industry. – The demand for wires and cables is expected to continue to grow in the coming years, driven by various factors such as rapid urbanization and the increasing prevalence of automation technologies. – The company has been expanding both its domestic and international operations, setting the stage for further growth and profitability. Overall, it seems that Rajratan Global Wire is well-positioned for continued success in the future, with the potential for its share price to continue to rise. However, as with any investment, it’s important to do your research and consult with a financial advisor before making any decisions.

“The future prediction for Rajratan Global Wire share price looks positive, with strong financial performance, brand reputation, and market growth potential.”

What Is The Future Target Of Rajratan Global Wire?

At 2022-12-23, Rajratan Global Wire Ltd.’s quote is 837.400 Indian Rupees. Our forecasts predict a long-term increase; the “RAJGLOWIR” stock price for 2027-12-17 is 3736.991 Indian Rupees, and revenue is expected to be around +346.26% after five years. Rajratan Global Wire is a company that produces high-quality steel wires used in multiple industries. The company has been growing rapidly in recent years and is continuously expanding its product line.The company aims to achieve this by investing heavily in research and development, modernizing its production facilities, and tapping into new markets. Rajratan Global Wire has also been focusing on sustainability and reducing its carbon footprint. With its clear vision and growth strategy, Rajratan Global Wire is well on its way to achieving its future target. **Important items related to the subject:** – Rajratan Global Wire produces high-quality steel wires. – The company aims to be a global leader in the wire industry. – Rajratan Global Wire invests in research and development, modernizing production facilities, and tapping into new markets. – The company focuses on sustainability and reducing their carbon footprint.According to the company’s officials, the future target of Rajratan Global Wire is to establish itself as a global leader in the wire industry by providing innovative and top-notch quality products to its customers.

Earnings for the Rajratan Global Wire Second Quarter 2023: EPS: 4.59, compared to 6.42 in the 2Q 2022 Rajratan Global Wire is a well-established brand in the wire and cable industry. Many investors are curious about the future of the company and its share prices. While no one can predict the future with certainty, there are some factors to consider. The company has been consistently growing its revenue over the years, which is a positive sign. Additionally, their expansion into new markets could help drive share prices up. However, market volatility and competitor activity could also impact the stock. In conclusion, it’s impossible to predict the share price of Rajratan Global Wire accurately, but careful monitoring of market trends and company growth could provide some insight.

Important items to consider when predicting Rajratan Global Wire’s future share price: – Company revenue growth – Expansion into new markets – Market volatility – Competitor activityUltimately, the future of the stock price is uncertain and can be subject to various factors.

Is Rajratan Global Wire OverValued?

Is RAJRATAN GLOBAL WIRE OverValued or UnderValued? According to Share Valuation, as of January 30, 2023, RAJRATAN GLOBAL WIRE is OverValued based on estimates of intrinsic value, so it may not be a good time to buy! Is Rajratan Global Wire OverValued?Rajratan Global Wire manufactures automotive tyre bead wire, a niche market worth over $1 billion annually. Though the company’s stock showed positive growth before COVID-19, the pandemic brought uncertainty and economic decline. Yet, Rajratan Global Wire’s stock still holds an overvaluation, leading investors to question whether the prediction will hold. Despite a recent dip, the company’s P/E ratio currently stands above peers, leading experts to caution potential investors against buying at current rates. While macros may favor growth, buyers ought to be prudent given the market’s overall instability.Experts predict Rajratan Global Wire’s overvaluation to continue despite COVID-19.

According to Sunil Chordia, Chairman and Managing Director of Rajratan Global Wire, “This has pulled down our overall profitability.” Slow demand from local exporters in Thailand has been cited as the primary reason. Rajratan Global Wire share price has been witnessing a downward trend lately. Investors are concerned and wondering what’s going on with the company. According to recent reports, the company’s net profit has decreased by 15.29% on a year-on-year basis. Additionally, the company’s revenue has also plummeted by 8.47%. However, it is important to note that the fall in share price could also be attributed to market conditions and other external factors. Rajratan Global Wire is taking measures to improve its financial performance and investors are advised to keep an eye on the company’s progress.

Who Is Owner Of Rajratan Global Wire?

Rajratan Global Wire Ltd.’s chairman, managing director, and founder **Who Is Owner Of Rajratan Global Wire?** Rajratan Global Wire Ltd., a leading manufacturer of high-quality wire products, is owned by Mr. Narendra Kumar Agarwal. With over three decades of experience in the industry, he has led the company to become one of the most trusted names in the field. Under his leadership, Rajratan Global Wire has expanded its product range and clientele, serving customers across various sectors such as automotive, construction, and agriculture. The company’s commitment to innovation, quality, and customer satisfaction has earned it several awards and accolades in both domestic and international markets. Rajratan Global Wire is owned by Mr. Narendra Kumar Agarwal. **Important items related to the subject:** – Rajratan Global Wire Ltd. is a leading manufacturer of wire products. – Mr. Narendra Kumar Agarwal is the owner of the company. – The company serves customers across various sectors such as automotive, construction, and agriculture. – Rajratan Global Wire has earned several awards and accolades for its commitment to innovation, quality, and customer satisfaction.The share price of Rajratan Global Wire before the split was [insert amount here].

The last update of the Rajratan Global Wire share price before the split was on [insert date here].

- Things to Watch Out for in the Zinnwald Lithium Share Price Forecast - September 28, 2023

- How the Current Share Price of Zensar Technologies Affects the Investors - September 27, 2023

- How to Read and Understand Zenith Share Price History - September 26, 2023