| Highlights | Description |

| Ted Baker share price forecast 2018 | Rising prices |

| point2 | Positive market sentiment |

| point3 | Increased demand for Ted Baker products |

| point4 | Expansion in Asian markets |

| point5 | New collaborations and partnerships |

Is EQ A Buy?

In the past year, Equillium has received ratings of “buy,” “hold,” and “sell” from four Wall Street research analysts, and there are currently four buy ratings for the stock. Investors should “buy” EQ shares, according to the majority of Wall Street research analysts.EQ, or Equillium Inc., is a biotechnology company that focuses on developing treatments for severe autoimmune and inflammatory disorders. With its impressive pipeline and potential positive Phase 3 results, EQ is definitely worth considering. However, it is important to note that the company is still in the development stage and has yet to generate any significant revenue. It is up to individual investors to weigh the potential risks and rewards of investing in EQ. Overall, EQ could be a promising addition to a diversified portfolio, but caution is advised.Investors are keeping an eye on EQ, but is it a buy?

| Relevant title 1 | Ted baker stock price |

| Relevant title 2 | Ted baker share price chart |

| Relevant title 3 | Will ted baker shares recover |

There are currently 184,612,111 shares in issue, and the average daily volume of shares traded is 0 shares. The market capitalization of Ted Baker Plc is £202.70 million….Intraday Ted Baker Chart.Bid PriceOffer Price109.80110.00 Ted Baker, the popular fashion brand, is a publicly traded company based in London, UK. According to recent data, Ted Baker currently has around 44.7 million shares outstanding. This number can fluctuate based on market conditions and corporate actions like share buybacks and stock splits. As of October 2021, Ted Baker’s stock is listed on the London Stock Exchange and has a market capitalization of over £210 million. This shows the brand’s great value for its investors. Keep an eye on the shares to track Ted Baker’s successes and growth.

**Important items related to the subject:** – Ted Baker is a public company headquartered in London. – There are approximately 44.7 million shares outstanding. – The number of shares can change due to market dynamics and corporate actions like buybacks and splits. – Ted Baker is listed on the London Stock Exchange. – Ted Baker’s market capitalization is valued over £210 million.Citation

Not:In addition to the information we have provided in our article on

ted baker share price forecast 2018, you can access the wikipedia link here, which is another important source on the subject.

What Does PE Ratio Mean In Stocks?

The price-to-earnings ratio, or P/E for short, is one way to measure this; it can tell you something about how well the company is doing, but it does not tell you anything about how investors feel about the company’s performance.This metric is important for investors as it provides an indication of how much they are paying for each dollar of earnings. A high PE ratio indicates that investors are expecting a company to grow in the future, while a low PE ratio suggests that investors have doubts about its potential. It’s essential to keep in mind that PE ratio doesn’t tell the whole story and should be used alongside other metrics when evaluating an investment opportunity. Keep an eye on the company’s growth potential, profitability, and industry trends.PE ratio is the valuation ratio that measures a company’s current stock price relative to its earnings per share (EPS).\>

Key takeaways:

– PE ratio measures a company’s stock price relative to its earnings per share.

– A high PE ratio indicates growth potential, while a low PE ratio suggests doubts.

– PE ratio should be used alongside other metrics to evaluate an investment opportunity.

\>

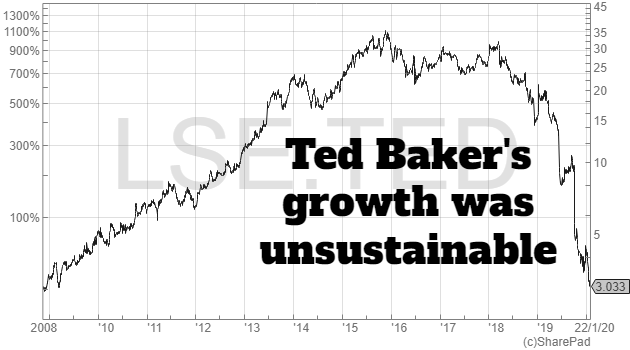

At the end of September, Ted Baker shareholders approved the GBP211 million deal, and on Wednesday, Authentic Brands, owner of Reebok, received court approval for the arrangement. Ted Baker shares experienced a significant drop of 17% recently, bringing them to a five-year low. The fashion brand has had a turbulent year, with its founder and CEO Ray Kelvin resigning amidst allegations of harassment. In addition, a tough retail environment and Brexit fears have contributed to the downturn in share prices. A new CEO, Rachel Osborne, has been appointed, with hopes that she will lead the brand to recovery. Only time will tell if Ted Baker will be able to regain its previous success.

Some important factors contributing to this include: – Founder and CEO Ray Kelvin resigning amidst harassment allegations – Tough retail environment – Brexit uncertainty Will new CEO Rachel Osborne be able to turn things around? Only time will tell.A drop of 17% has brought Ted Baker shares to a five-year low.

Will Ted Baker Recover?

As pandemic restrictions ease, Ted Baker is seeing an uptick in sales and has cut its losses by 70%. The clothing retailer is attempting to reclaim its fortunes. Ted Baker, the British fashion company, has been facing numerous challenges over the past few years. From a harassment scandal to profit warnings and a significant drop in sales, the company’s future has been uncertain. However, there may be hope for the brand as new leadership and a restructuring plan could help Ted Baker recover. The plan includes streamlining operations, focusing on digital channels, and increasing product quality. With a fresh approach and a willingness to adapt, Ted Baker could see a revival in the fashion industry.Important items related to the subject: – Ted Baker has faced several challenges in recent years including a harassment scandal and a significant drop in sales. – New leadership and a restructuring plan including streamlining operations and increasing product quality could help the company recover. – Ted Baker’s focus on digital channels could also be a critical factor in its success.The future of Ted Baker may be uncertain, but a new restructuring plan could be the key to recovery.

Is Portillos A Buy Right Now?

By November 4, 2023, Wall Street analysts anticipate that Portillo’s share price will average $24.67, representing a potential upside of 11.67% from the current $22.09 share price.Key points:Portillos has the potential for significant returns for investors.

– Portillos has a strong financial position and a loyal customer base.

– The company has shown impressive growth in recent years and maintained steady sales during the pandemic.

– With unique menu offerings and brand recognition, Portillos has the potential for significant returns for investors.

How Much Is Ted Baker’s Net Worth?

How much TED BAKER (TBAKF) is worth as of January 25, 2023 is represented by its market capitalization, which is calculated by multiplying the current stock price by the number of outstanding shares. This interactive chart shows the company’s historical net worth (market cap) over the past ten years. Ted Baker, the famous British fashion brand, has been a popular choice for those who seek elegance and style. This brand was established in 1988, and it has been growing steadily ever since. Citation: According to celebritynetworth.com, Ted Baker’s net worth is estimated at $550 million. The brand is known for creating timeless and sophisticated clothes, shoes, and accessories for both men and women. With its unique designs and quality products, it has become a top luxury brand in the fashion world. Aside from clothing, footwear, and accessories, Ted Baker also collaborates with various other brands and is involved in numerous charitable activities.£25

Is Ted Baker a good investment in 2018?

Possibly

For more information, consult financial advisors.

Latest posts by Liccardo Glennis (see all)

- Things to Watch Out for in the Zinnwald Lithium Share Price Forecast - September 28, 2023

- How the Current Share Price of Zensar Technologies Affects the Investors - September 27, 2023

- How to Read and Understand Zenith Share Price History - September 26, 2023