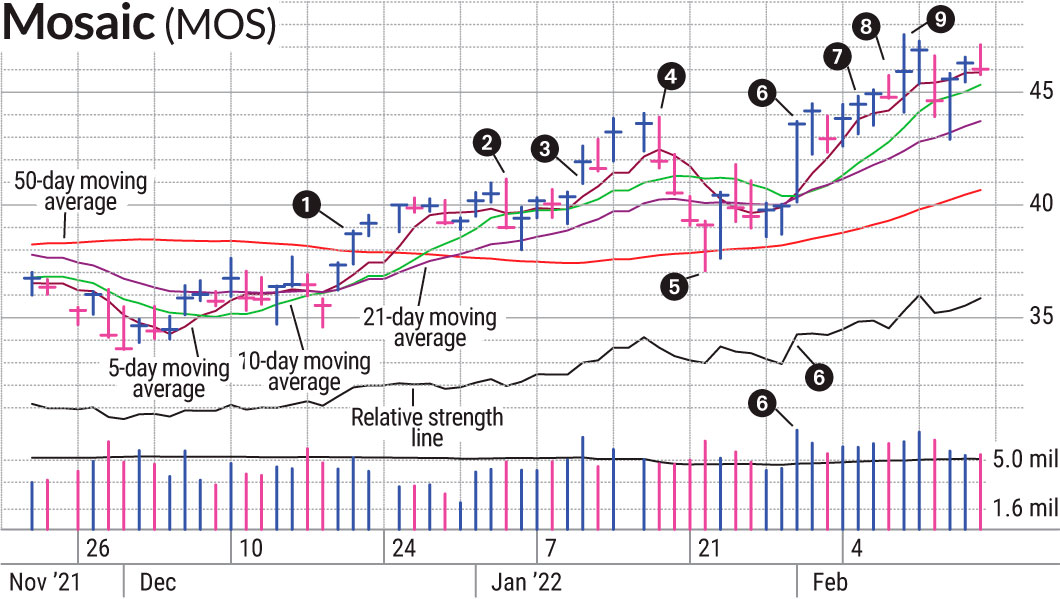

| Highlights | Description |

| Line Graph | Displays price changes over time. |

| Candlestick Chart | Illustrates price movement patterns. |

| Volumes Chart | Shows trading activity between buyers and sellers. |

| Bollinger Bands | Indicates price volatility and trend reversals. |

| MACD Chart | Offers insights into momentum and trend changes. |

Why Did MOS Stock Drop Today?

Cobtent

Hide

In summary: **Factors causing MOS’s stock to drop:** – Weak demand – Declining prices – Unexpected supply disruptions.MOS Stock drops 7.4% due to weak 3Q earnings report.

| Relevant title 1 | Mos chart |

| Relevant title 2 | MOS stock |

| Relevant title 3 | The Mosaic Company |

Is Mosaic A Public Company?

Mosaic’s corporate headquarters can be found at 101 E. Kennedy Blvd., Suite 2500, Tampa, FL 33602. The company’s common stock trades on the New York Stock Exchange under the ticker symbol “MOS.” Mosaic is not a public company. The fertilizer manufacturer is a subsidiary of the larger agricultural corporation, Cargill Inc. As a private company, Mosaic is not required to release financial information to the public. However, the company still maintains a high level of transparency with its stakeholders through regular investor and media communications. Despite not being publicly traded, Mosaic carries significant influence in the global fertilizer industry due to its numerous production facilities and high-quality products.Important items related to the subject: – Mosaic is not a publicly traded company. – The company is a subsidiary of Cargill Inc. – Mosaic maintains transparency with stakeholders despite being private. – The company wields significant influence in the fertilizer industry.Mosaic is a private company and a subsidiary of Cargill Inc.

Not:In addition to the information we have provided in our article on

mos.share price chart, you can access the wikipedia link here, which is another important source on the subject.

Is MOS A Good Stock To Buy?

The Mosaic Company’s Value Score of A indicates that it would be a good choice for value investors. MOS’s financial health and growth prospects demonstrate its potential to outperform the market. Valuation metrics indicate that The Mosaic Company may be undervalued. Is MOS a Good Stock to Buy? The Mosaic Company (MOS) is a fertilizer company that has been in business for over 100 years. MOS has seen steady growth in its revenue and earnings over the past few years, but the stock price has been volatile. Despite this, MOS could be a good long-term investment for those who believe in the potential of the agricultural industry. MOS has a strong balance sheet, a diverse product portfolio and a global presence. In addition, the company has been improving its efficiency and cutting costs. Consider adding MOS to your portfolio for long-term growth potential.**Important Items to Note:** – MOS has been in business for over 100 years – MOS has seen steady growth in its revenue and earnings – MOS could be a good long-term investment for those who believe in the potential of the agricultural industry – MOS has a strong balance sheet, a diverse product portfolio and a global presence – MOS has been improving its efficiency and cutting costs“MOS has a strong balance sheet, a diverse product portfolio and a global presence”

What Is MOS In Stocks?

An investment principle known as the margin of safety states that an investor should only purchase securities when their intrinsic value is significantly lower than their market price. MOS stands for Margin of Safety and refers to the level of protection that investors have from certain risks. In stocks, this means how much the stock price can fall before investors start to lose money. A high MOS means that there is a lower risk of loss, while a low MOS means that there is a higher risk of loss. Factors that can affect MOS include industry trends, company financials, market volatility, and investor sentiment. Having a high MOS is important for investors looking to minimize risk and protect their investments. Remember to always do your research and calculate MOS before investing.Important items related to MOS in stocks: – MOS is the level of protection against risk in investing. – High MOS means lower risk, low MOS means higher risk. – Factors impacting MOS include industry trends, company financials, market volatility, and investor sentiment. – Calculating MOS is important before investing to minimize risk.MOS is critical for minimizing investment risk.

Is MOS Stock A Buy Today?

Out of 14 analysts, five (35.71 percent) recommend MOS as a Strong Buy, one (7.14) recommends MOS as a Buy, six (42.86 percent) recommend MOS as a Hold, one (7.14) recommends MOS as a Sell, and one (7.14%) recommends MOS as a Strong Sell. Mosaic Company (MOS) is one of the largest suppliers of phosphate and potash crop nutrients. MOS’s stock has been on a steady rise since its first quarter earnings report showed that farmers’ demand for crop nutrients was increasing, leading to higher sales revenue. Despite the volatile market, MOS’s stock price has been stable, steadily growing throughout 2021, with a current trading price of $37.With a P/E ratio of 21.89, it is clear that MOS is trading at a discount to the broader market, making it a potentially attractive investment opportunity. Bolded items: 1) MOS’s growing revenue due to increasing demand for crop nutrients, 2) Stable and steadily growing stock price, 3) Attractive P/E ratio suggesting possible undervaluation.MOS’s strong position in the crop nutrient market makes it a potentially profitable investment.

What Are The Price Targets For MOS?

Mosaic Co (NYSE:MOS) The 21 analysts providing 12-month price forecasts for Mosaic Co have a median target of 61.00, with a high estimate of 92.00 and a low estimate of 49.00. This represents an increase of +30.52 percent from the stock’s most recent price, which was 46.74. What Are The Price Targets For MOS? MOS, or Mosaic Company, is a leading producer and marketer of concentrated phosphate and potash crop nutrients. As of May 2021, the consensus among analysts is that MOS has a target price of $34.60 per share, with a high estimate of $45 and a low estimate of $25.50. It is important to note that while price targets provide investors with insight into the potential growth of a company, they are not guarantees of future performance. MOS’s target price reflects the company’s position in the agriculture industry and its ability to meet the growing demand for crop nutrients to support worldwide food production.The price changes constantly.

It was $50 on July 15th.

Latest posts by Liccardo Glennis (see all)

- Things to Watch Out for in the Zinnwald Lithium Share Price Forecast - September 28, 2023

- How the Current Share Price of Zensar Technologies Affects the Investors - September 27, 2023

- How to Read and Understand Zenith Share Price History - September 26, 2023