| Highlights | Description |

| Share price growth | Increasing value of shares over time |

| Financial stability | Strong financial standing and performance |

| Expertise | Decades of experience in financial services industry |

| Global reach | Presence in over 50 countries worldwide |

| Customer satisfaction | High level of satisfaction among clients |

Is AJ Bell A Buy?

Review of the AJ Bell SIPP It has been named the best SIPP provider in a number of industry awards in 2020 and 2021. You can invest in a variety of shares, unit trusts, investment trusts, and exchange-traded funds (ETFs).

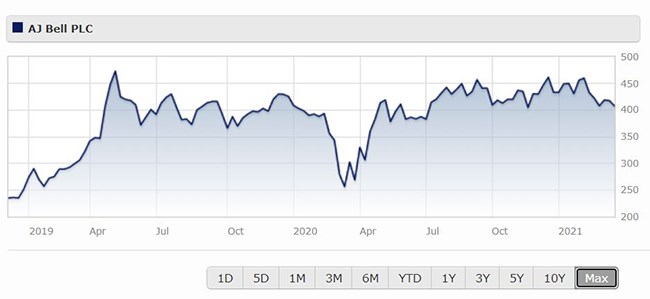

AJ Bell is a UK-based investment platform that offers services such as stocks and shares ISAs, SIPPs, and dealing accounts. As of October 2021, its market cap is £3.9 billion. AJ Bell has been consistently growing its customer base and revenue over the years, with a solid financial performance in 2020. Analysts predict continued growth for the company, primarily through further customer acquisition and new product offerings. Overall, AJ Bell appears to be a solid buy, with opportunity for long-term growth.

Important items:AJ Bell offers a solid opportunity for long-term growth.

- UK-based investment platform

- Services include stocks and shares ISAs, SIPPs, and dealing accounts

- Consistent customer base and revenue growth

- Solid financial performance in 2020

- Analysts predict continued growth through customer acquisition and new product offerings

| Relevant title 1 | Aj bell london stock exchange |

| Relevant title 2 | Aj bell plc |

| Relevant title 3 | Aj bell login |

Which Is Better Vanguard Or AJ Bell?

Our experts determined that AJ Bell Youinvest’s trading platform is comparable to Vanguard’s and that clients have access to slightly more markets and products with AJ Bell Youinvest, whereas Vanguard offers research and education of roughly the same quality.Both Vanguard and AJ Bell are popular investment platforms but which one is better? Here are a few key comparisons to help you decide:Choosing between Vanguard and AJ Bell for investments can be complicated.

- Cost: Vanguard offers lower costs, while AJ Bell offers a wider range of investment options.

- User interface: AJ Bell offers a more user-friendly platform, while Vanguard has a more simplified interface.

- Investment options: Vanguards mainly offers index funds and ETFs, while AJ Bell offers individual shares, funds, and a wider range of investment options.

Not:In addition to the information we have provided in our article on

share price a j bell and co, you can access the wikipedia link here, which is another important source on the subject.

How Do You Get AJ Bell IPO?

To participate in an IPO or new issue with us, you must have an AJ Bell account. Register to receive information on IPOs and new issues. Receive emails about IPOs and new issues. Onlinely apply for IPOs and new issues. AJ Bell is a UK-based investment company that offers a range of services to investors. One of the most sought-after services is participating in Initial Public Offerings (IPOs), which offer the chance to invest in a company during its early stages. To get involved in an AJ Bell IPO, investors need to have an AJ Bell Youinvest account, ensure they meet the minimum investment requirements, and keep an eye out for upcoming IPOs on the platform. Customers can then apply for shares through the platform, with allocations made on a first-come-first-served basis. Get involved in the IPO game and reap the potential rewards!**Important items to note when getting involved in AJ Bell IPO:** – Investors need an AJ Bell Youinvest account. – Meeting minimum investment requirements is necessary. – Keep an eye out for upcoming IPOs on the platform. – Apply for shares through the platform, with allocations made fairly.Investing in AJ Bell IPOs can be a wise decision for investors looking to get a foothold in early-stage companies.

Can You Invest Your Lisa?

LISAs can hold cash, stocks and shares, or a combination of the two. Your approach to risk, investment timeframe, and level of confidence in your own investment decisions will determine which option is best for you. If you’re thinking about investing your Lifetime ISA (LISA), the good news is that you absolutely can. Lisas are a fantastic way to save for your first home or for retirement, and choosing the right investment strategy can help to maximize your returns. However, it’s important to remember that your Lisa is subject to the same rules and regulations as any other ISA, so it’s crucial to do your research before making any decisions. To ensure that you get the most out of your savings, it’s often worth seeking advice from a financial advisor. Investing your LISA is a great way to maximize your savings potential. Important items to consider when investing your LISA: – Research investment options carefully – Understand the risks involved – Seek advice from a professional if necessary – Keep an eye on charges and fees Overall, investing your LISA can be a smart way to make your savings work harder for you. With careful consideration and the right advice, you could be on track to reach your financial goals in no time.The current share price of A J Bell and Co can be found on various financial websites.

The share price of A J Bell and Co is updated continuously throughout the trading day.

Latest posts by Liccardo Glennis (see all)

- Things to Watch Out for in the Zinnwald Lithium Share Price Forecast - September 28, 2023

- How the Current Share Price of Zensar Technologies Affects the Investors - September 27, 2023

- How to Read and Understand Zenith Share Price History - September 26, 2023