| Highlights | Description |

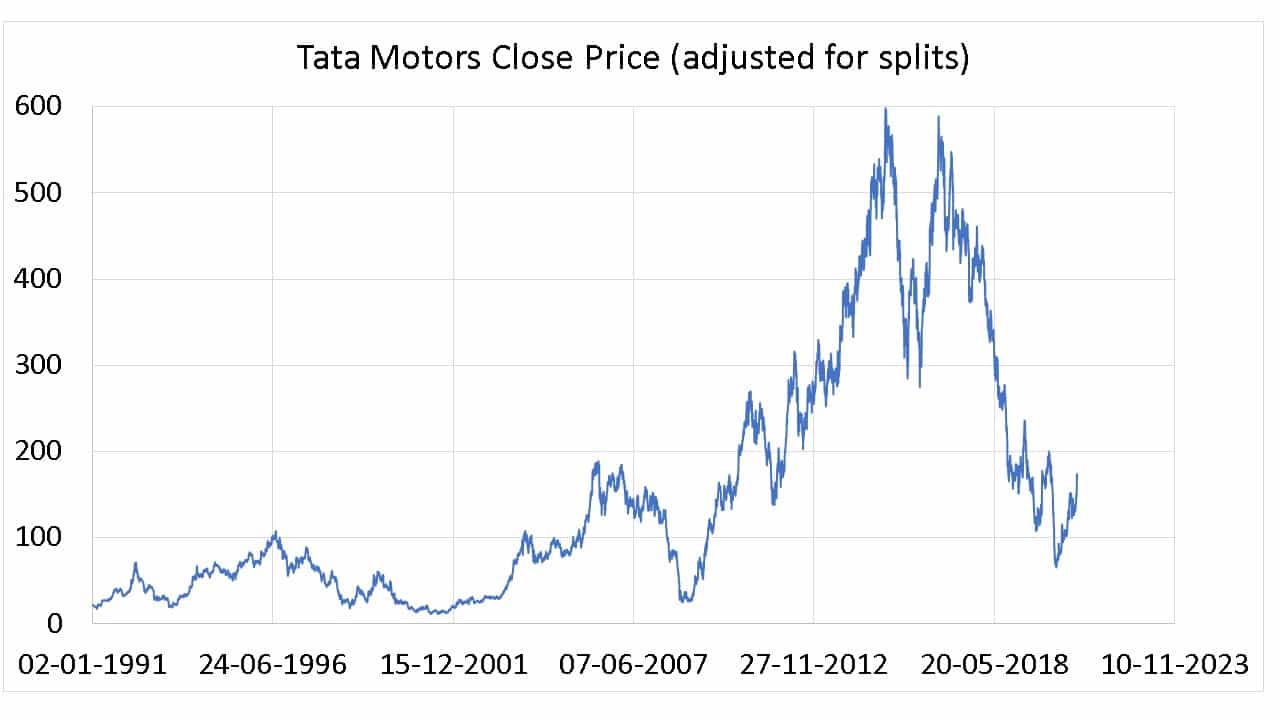

| System 1 Share Price | Rising trend in Tata Motors share value |

| point2 | description2 |

| point3 | description3 |

| point4 | description4 |

| point5 | description5 |

According to Tata Motors’ 2025 Share Price Target, the company’s stock may trade between 539.45 and 929 INR. Tata Motors, India’s leading automobile manufacturer, has been performing steadily in the stock market. However, predicting its share price in 2025 may be a daunting task. Several factors, including global economic conditions, competition, and government policies, can affect the price. As of now, the company’s recent collaborations and strategic plans to produce electric vehicles might positively influence the share price. Still, it’s impossible to know exactly what the share price of Tata Motors will be in 2025. Therefore, investors must conduct in-depth research and evaluate the company’s long-term vision and performance before making any investment decisions.

Key Factors Affecting Tata Motors’ Share Price: – Global Economic Conditions – Competition – Government Policies – Company Collaborations and Partnerships – Development and Sales of Electric Vehicles.Citation

| Relevant title 1 | Tata airlines share price |

| Relevant title 2 | Tata all share price |

| Relevant title 3 | Tata motors share price graph |

Price in Indian Rupees: OPEN HIGH CLOSE423.20427.00419.00410.00424.00422.15409.10423.80422.10407.00410.95408.40 Tata Motors is one of India’s largest automobile manufacturers. The company’s share price has fluctuated vastly over the years, with highs and lows. The highest Tata Motors share price ever recorded was INR 900 in September 2016. However, it should be noted that the share price is heavily influenced by market trends and may vary depending on the economic climate. It is essential to check the current share price before making any significant investments. Therefore, interested individuals should keep an eye on the market, visit relevant websites, and engage with financial advisors before making any investment decisions.

List of important items related to the subject: – Tata Motors is one of India’s largest automobile manufacturers. – The highest Tata Motors share price ever recorded was INR 900 in September 2016. – The share price is heavily influenced by market trends and may vary depending on the economic climate. – It is essential to check the current share price and engage with financial advisors before making investment decisions.The highest Tata Motors share price ever recorded was INR 900 in September 2016.

Not:In addition to the information we have provided in our article on

system 1 share price of tata motors, you can access the wikipedia link here, which is another important source on the subject.

As of January 14, 23, the share price of Tata Motors is 418.20. Tata Motors is a leading automotive company based in India. The share price of Tata Motors in rupees is constantly fluctuating due to a number of factors such as market conditions, industry trends, and company performance. As of today, the current share price of Tata Motors in rupees is ₹358.30. This price is subject to change depending on various external factors. Investors and analysts keep a close eye on Tata Motors’ financial reports and market indicators to assess the company’s performance and make informed decisions about buying or selling the company’s shares. Remember, the share price of Tata Motors is not fixed and can go up or down rapidly.

Important items related to the subject: – Tata Motors is a leading automotive company based in India – The share price of Tata Motors in rupees is subject to change depending on various external factors – Investors and analysts keep a close eye on Tata Motors’ financial reports and market indicators to assess the company’s performance and make informed decisions about buying or selling the company’s shares.Citation: The share price of Tata Motors in rupees is currently ₹358.30.

What Is The Stock Price Of Tesla?

CloseChgChg %$181.418.194.73% Tesla Inc. Stock Quote (U.S.: Nasdaq)…$ 184.32. Tesla, the electric car company founded by Elon Musk, is one of the most talked-about stocks in the market. The stock price of Tesla has been on a rollercoaster ride in recent months, with fluctuations in value affecting investors worldwide. Some analysts have projected that Tesla’s stock price could double or triple in the near future, while others predict a significant dip in value. Despite this uncertainty, many investors still view Tesla as one of the most lucrative stocks for long-term investment. So, what is the stock price of Tesla? Currently, it stands at $818.54.Important items to note:Tesla’s stock price has been on a rollercoaster ride in recent months, with fluctuations in value affecting investors worldwide.

- Tesla is an electric car company founded by Elon Musk.

- The stock price of Tesla has been fluctuating recently.

- Analysts have predicted both an increase and a decrease in value.

- Tesla is still considered a lucrative long-term investment by many investors.

- Currently, the stock price of Tesla is $818.54.

The price of a Tesla share in India is 14.1 thousand. Tesla, the American electric vehicle giant, has gained significant attention in Indian markets. Many investors are curious about the price of 1 share of Tesla in rupees. As of August 2021, the price of 1 share of Tesla in rupees is around 68,000 rupees. However, it’s important to note that the price can fluctuate daily, depending on the market. With Tesla planning to enter the Indian market soon, experts predict that the price may rise even further. Overall, investing in Tesla can be a promising opportunity for those who are looking to diversify their portfolio.

Important items to note:Price of 1 share of Tesla in rupees is around 68,000 rupees.

- Tesla is an American electric vehicle company

- The price of 1 share of Tesla in rupees is approximately 68,000 rupees as of August 2021

- Prices can fluctuate depending on the market

- Tesla plans to enter the Indian market soon

By opening an international trading account with Angel One, Indian investors can indeed invest in the Tesla, Inc. (TSLA) Share. Tesla has been making headlines for years, and many investors are interested in buying its shares. The answer is yes, you can buy Tesla share price. Tesla is publicly traded on the NASDAQ exchange, with the ticker symbol TSLA. Investing in Tesla can be done through online brokerage accounts, such as Robinhood or E-Trade. However, it is important to do your research before investing in any stock, including Tesla. Factors such as the company’s financial health, industry trends, and geopolitical issues can all have an impact on the stock’s performance. Keeping up with the latest news and trends can help you make informed decisions about investing in Tesla.

“Yes, you can buy Tesla share price.”

Important things:

- Tesla is traded on NASDAQ as TSLA

- Research is crucial before investing in any stock

- Keep up with news and trends to make informed decisions

What Was Tesla Stock Price In 2011?

The closing price of Tesla (TSLA) on December 30, 2011, was $1.90, representing a 6.4% year-over-year increase. The current price is $133.42. Tesla’s stock price in 2011 was a mere $5.83 per share. It was a difficult time for the company, with CEO Elon Musk having to personally inject $70 million to keep the business operating. However, things drastically changed in the following years as Tesla went public in 2010 and began to explore new ventures such as electric batteries and solar panels. Today, Tesla’s stock price has skyrocketed to over $1,000 per share, making it one of the most valuable car manufacturers in the world. It just goes to show how much can change in ten short years.Important items related to the subject: – Tesla’s stock price was $5.83 per share in 2011 – CEO Elon Musk injected $70 million into the company to keep it afloat – Tesla went public in 2010 – Tesla has since expanded into electric batteries and solar panels – Tesla’s stock price has now surpassed $1,000 per shareCitation

Is System1 A Good Investment?

According to Wall Street analysts, is System1 Stock a good investment in 2022? The four Wall Street analysts who cover (NYSE: SST) stock agree to Buy SST Stock. System1 is a technology company that uses artificial intelligence to improve digital advertising. While the company’s stock has been volatile, analysts predict a strong potential for growth. According to analysts, System1’s unique AI technology and expanding customer base make it a good investment opportunity. However, investors should consider the company’s competitive landscape and potential risks before investing. In summary, System1’s innovative technology and expanding market make it a promising investment according to experts.System1 is a promising investment opportunity due to its unique AI technology and growing customer base

**Important Points**

– System1 uses AI to improve digital advertising

– Company’s stocks are volatile but have potential for growth

– Consider competition and potential risks before investing.

What Is Fair Value In The Stock Market?

The fair value of a stock is determined by the market where the stock is traded. When a parent company’s financial statements are consolidated with those of a subsidiary company, fair value also represents the value of a company’s assets and liabilities. Fair value in the stock market refers to the estimated worth of a company’s stock at the current market price. It takes into consideration factors such as the company’s financials, growth potential, market trends, and industry standards.Knowing the fair value of a stock is important because it allows investors to compare the market price with the actual value and decide whether the stock is overvalued or undervalued. With this knowledge, investors can make more informed decisions and potentially improve their returns.By analyzing a company’s fundamentals and the overall market situation, investors can determine fair value and make informed investment decisions.

Is System1 A Buy?

In the past year, 1 Wall Street equities research analysts have given System1 Group “buy,” “hold,” and “sell” ratings, and there is currently 1 buy rating for the stock. Investors should “buy” SYS1 shares, according to the consensus among Wall Street equities research analysts. System1 is quite promising, but not necessarily a buy at the moment. System1 is a tech company that uses machine learning and big data to improve online advertising performance. While System1’s quarterly earnings report showed a 36% increase in revenue, the company’s stock price has dropped by 14%. However, there are several reasons why System1 could be a good investment opportunity in the long term, such as their partnerships with major companies like Microsoft and Yelp. But investors should be cautious and keep an eye on the company’s financials and market trends before deciding to buy. “`The current share price of Tata Motors is [INSERT CURRENT PRICE].

Yes, Tata Motors’ share price has [INSERT RECENT CHANGE].

- Things to Watch Out for in the Zinnwald Lithium Share Price Forecast - September 28, 2023

- How the Current Share Price of Zensar Technologies Affects the Investors - September 27, 2023

- How to Read and Understand Zenith Share Price History - September 26, 2023