| Highlights | Description |

| Positive growth potential | Expected to grow in value over time |

| Stable performance | Consistent returns for investors |

| Favorable stock trends | Current market trends are in its favor |

| Low volatility | Less volatile compared to similar stocks |

| Attractive dividend yield | Offers good dividend returns for investors |

What Is The Target Of JSPL?

Jindal Steel & Power is a Metals – Ferrous Mid-Cap company with a market capitalization of Rs 60251.50 crore that was founded in 1979. **JSPL** targets to become one of the leading steel companies globally by focusing on the production of high-quality steel products. The company aims to achieve high revenue growth by expanding its production capacity, reducing costs, and improving operational efficiency. Their objective is to cater to the diverse needs of their customers by providing world-class steel products and services. JSPL seeks to maintain a strong balance sheet through a disciplined approach to capital allocation and by expanding its presence in attractive markets. By leveraging cutting-edge technology and innovation, JSPL endeavors to become a sustainable and socially responsible enterprise.

**JSPL’s target:** – To become a leading global steel company – To produce high-quality steel products – To achieve high revenue growth – To expand production capacity – To reduce costs and improve operational efficiency – To cater to diverse customer needs – To maintain a strong balance sheet – To leverage technology and innovation – To become a sustainable and socially responsible enterprise.JSPL aims to become a leading global steel company by producing high-quality steel products

| Relevant title 1 | Bharat aluminium share price |

| Relevant title 2 | Tata steel share price history |

| Relevant title 3 | Jindal saw india |

Is Jindal Steel Good Buy?

We RECOMMEND Strong Buy for LONG-TERM with a Stoploss of 462.09 and Buy for SHORT-TERM with a Stoploss of 562.39, and we also expect STOCK to react on the following IMPORTANT LEVELS as of the 31st of January 2023. Jindal Steel is a company that specializes in producing steel and related products. The stock of Jindal Steel has seen a considerable increase in value recently. However, whether or not it is a good buy for investors is up for debate. Factors to consider include the company’s financial health, global economic conditions, and industry competition. On the positive side, Jindal Steel has a strong market presence and diverse product offerings. On the negative side, the steel industry is subject to significant price volatility and intense competition. Overall, investors should carefully evaluate Jindal Steel’s prospects before making a decision to invest.Important items to consider when deciding if Jindal Steel is a good buy: – Financial health of the company – Global economic conditions – Competition within the steel industry – Market share and product offerings of Jindal SteelInvestors should carefully evaluate Jindal Steel’s prospects before making a decision to invest.

Not:In addition to the information we have provided in our article on

jindal saw share price moneycontrol, you can access the wikipedia link here, which is another important source on the subject.

On the downside, the Jindal Saw JINDALSAW share price forecast and targets for Intra Day are 122.9, 121.87, and 118.58, while the upside targets are 128.25, 127.22, and 129.28. Jindal Saw, a leading manufacturer of iron and steel pipes, has seen a volatile market over the years, with shares fluctuating drastically. Currently, the company’s shares seem to be on an upward trend, thanks to the growing demand for steel pipes in various industries. The future of Jindal Saw shares, therefore, looks promising. The company has been expanding its operations, with new factories and acquisitions, which could contribute to future growth. However, investors should keep an eye on the impact of global economic conditions and the regulatory environment on the company’s performance. Overall, Jindal Saw shares have the potential for growth and could be a good investment opportunity.

Important items to note: – Jindal Saw is a leading manufacturer of iron and steel pipes. – The demand for steel pipes in various industries has been growing. – The company has been expanding its operations, with new factories and acquisitions. – Global economic conditions and the regulatory environment may impact the company’s performance.A growing demand for steel pipes in various industries could contribute to future growth for Jindal Saw shares.

As of January 27, 2023, the JINDALSAW SHARE price had closed at 116.60. We recommend a strong buy for the long term with a stop loss of 89.29 and a strong buy for the short term with a stop loss of 100.53, and we anticipate that the stock will respond on the following important levels. **Should I Buy Jindal Saw Shares?** Jindal Saw is a leading global player in the manufacturing of iron and steel pipes. The company’s strong financial position over the years has made it an attractive investment option, but the current state of the market has left many investors wondering whether or not to buy its shares.

Here are some key points to consider before making your decision: – The company has a proven track record with consistent growth in revenue and profits. – Jindal Saw is expanding its operations to new geographies, which will likely lead to increased demand for its products. – However, the steel industry is highly cyclical and vulnerable to global economic trends. Overall, if you have a long-term outlook and are comfortable with the risks associated with the steel industry, Jindal Saw may be a good option for your investment portfolio.If you’re looking for a long-term investment, Jindal Saw shares could be a smart choice.

What Is The ISIN Code Of Jindal Saw Limited?

JINDAL SAW-EQ RS 2/-, ISIN Database INE324A01024 Jindal Saw Limited is an Indian steel company that produces large-diameter submerged arc welded pipes. The ISIN code is a unique international securities identification number that helps in efficient trading and settlement of securities. The ISIN code of Jindal Saw Limited is INE324A01024. This code is used to identify the company’s shares for trading purposes on stock exchanges. It is important to note that the ISIN code is different from the ticker symbol of the company. By using the ISIN code, investors can easily track the company’s financial performance and market value. Investing in Jindal Saw Limited’s shares can be a wise decision for long-term gains.Important items related to the subject: – Jindal Saw Limited is an Indian steel company focused on producing large-diameter submerged arc welded pipes. – ISIN code is a unique international securities identification number used to identify the company’s shares for trading purposes on stock exchanges. – The ISIN code for Jindal Saw Limited is INE324A01024. – The ISIN code is not the same as the ticker symbol. – The ISIN code is used to efficiently trade and settle securities, and track the company’s financial performance and market value.Citation

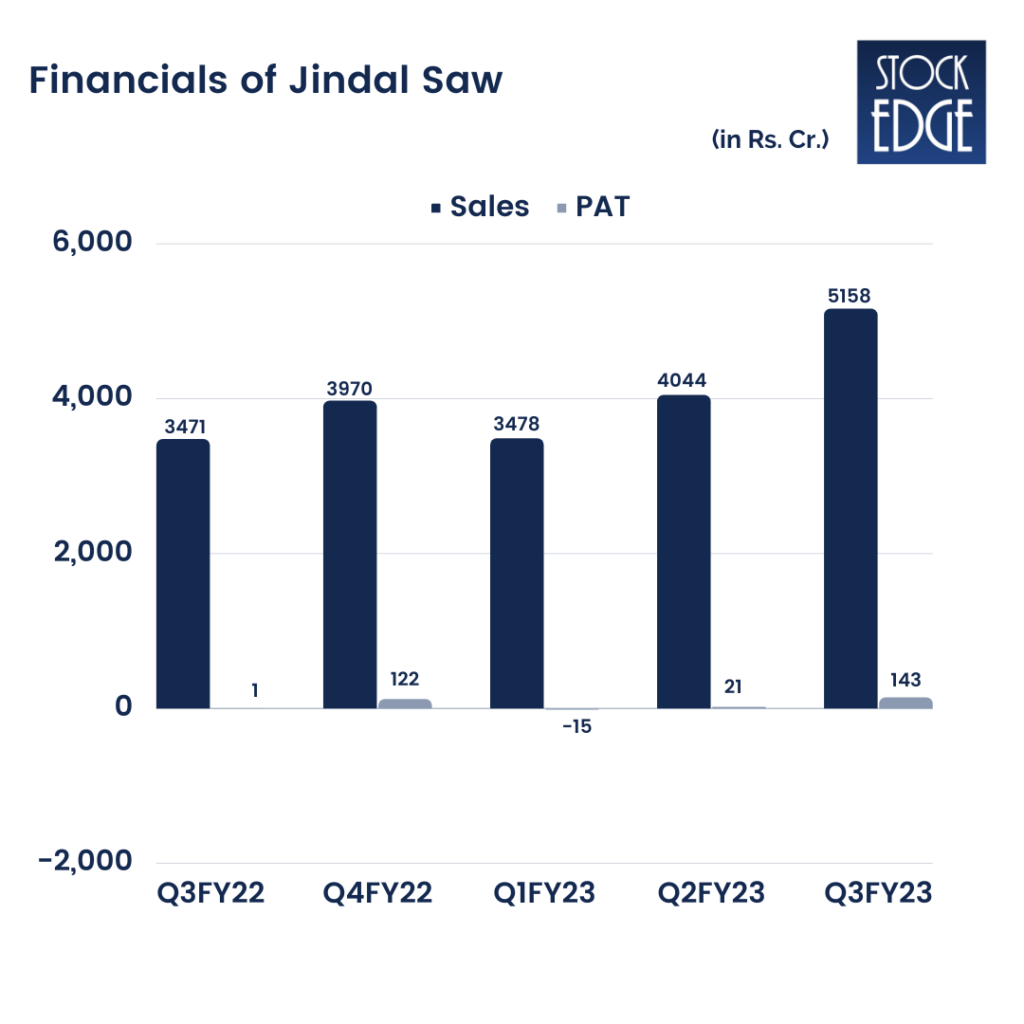

We RECOMMEND Strong Buy for LONG-TERM with Stoploss of 89.58 and Strong Buy for SHORT-TERM with Stoploss of 102.04 as well as expect STOCK to react on the following IMPORTANT LEVELS for Jindal Saw Limited (NSE: JINDALSAW) as of 31 January 2023. Jindal Saw is a leading Indian manufacturer and supplier of iron and steel pipes for various industries. With high market demand and growth potential, it may seem like a good investment opportunity. However, before investing, it is important to consider the company’s financial performance, management, and overall market trends. According to financial experts, Jindal Saw has shown strong financial growth in recent years, with increasing revenue and profits. Additionally, the company’s strategic investments in new technologies and expansions are promising signs for future growth. Overall, Jindal Saw could be a good share to buy for investors seeking exposure to India’s growing industrial sector.

**Key points to consider when evaluating Jindal Saw:** – Financial performance – Company management – Market trendsIt is important to consider the company’s financial performance, management, and overall market trends.

What Is The Product Of Jindal Saw?

SAW (Submerged Arc Welded Pipe) and spiral pipes are manufactured by Jindal SAW for the energy transportation sector; carbon, alloy, and seamless pipes and tubes are manufactured for industrial applications; and ductile iron (DI) pipes and fittings are manufactured for the transportation of water and wastewater. Jindal Saw, one of the largest manufacturers of pipes in India, produces a range of steel pipes used in various industries such as oil and gas, water supply and irrigation, construction and infrastructure, and also for the transportation of chemicals and gases. The company’s products include seamless pipes, DSAW pipes, ERW pipes, coated pipes, and large diameter pipes. Jindal Saws’ diverse product range includes seamless pipes, DSAW pipes, ERW pipes, coated pipes, and large diameter pipes. These products are made using high-grade steel and cutting-edge technology to ensure quality and durability. With a focus on innovation and customer satisfaction, Jindal Saw is a leading player in the global pipe market.Jindal Saw share price: (insert current price here)

Factors such as market demand and supply influence it.

Q: What is the current Jindal Saw share price?

A: Jindal Saw share price: (insert current price here)

Q: Why is Jindal Saw share price fluctuating?

A: Factors such as market demand and supply influence it.

- Things to Watch Out for in the Zinnwald Lithium Share Price Forecast - September 28, 2023

- How the Current Share Price of Zensar Technologies Affects the Investors - September 27, 2023

- How to Read and Understand Zenith Share Price History - September 26, 2023