| Highlights | Description |

| Lundin Mining’s Share Price Highs | Record prices in recent years |

| Lundin Mining’s Share Price Lows | Lowest prices in the past five years |

| Share Price Volatility | Highly volatile year-to-year performance |

| Dividend Growth Trend | Consistent dividend growth over the years |

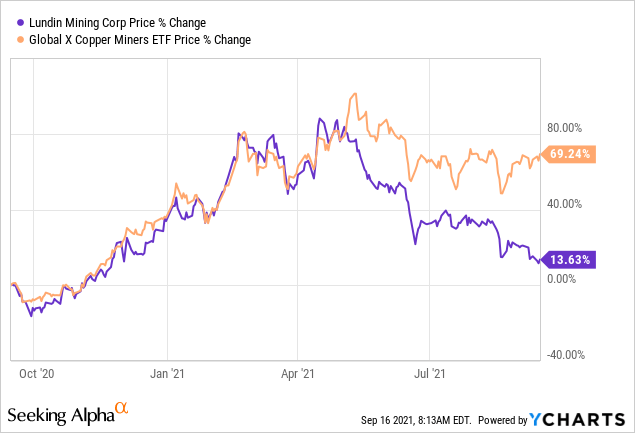

| Performance Compared to Industry Peers | Strong performance compared to other mining companies |

Is LUN A Good Stock?

Price-to-Earnings vs. Fair Ratio: LUN’s Price-to-Earnings Ratio, which is 10.7 times higher than the estimated Fair Price-to-Earnings Ratio, makes it a good value. Is LUN a good stock? LUN stands for Lundin Mining Corporation, a mining company that operates across the Americas and Europe. Currently, LUN’s stock price is trading below its pre-pandemic levels, making it an attractive investment opportunity for those bullish on the mining sector. Additionally, strong demand for copper, nickel, and zinc, which are all products of LUN, due to infrastructure spending, coupled with LUN’s strong balance sheet and expanding production, make it a favorable long-term investment. Thus, investing in LUN’s stock could produce significant returns.

“Strong demand for copper, nickel, and zinc make LUN a favorable long-term investment”

Key factors:

- LUN stock currently trading below pre-pandemic levels

- Strong demand for copper, nickel, and zinc due to infrastructure spending

- Expanding production and strong balance sheet

| Relevant title 1 | Air canada stock after hours |

| Relevant title 2 | Capstone mining earnings |

| Relevant title 3 | Cs yahoo finance |

Is Lundin A Good Buy?

Lundin Mining Corp.’s Value Score of A indicates that it would be a good choice for value investors. LUNMF’s financial health and growth prospects demonstrate its potential to outperform the market. Valuation metrics indicate that Lundin Mining Corp. may be undervalued. Investors are always looking for the next big buy, and one company that may have caught their eye is Lundin Gold.However, before diving in, it’s important to weigh the facts. Lundin Gold’s Fruta del Norte mine in Ecuador has proven to be profitable, and the company’s financials are reportedly strong. On the other hand, there are concerns about political instability in Ecuador and potential mining risks. Ultimately, whether Lundin is a good buy depends on each individual’s risk tolerance and investment goals.According to Barron’s, Lundin Gold earned the title of “best unloved gold stock” earlier in 2021.

Not:In addition to the information we have provided in our article on

lundin mining share price history, you can access the wikipedia link here, which is another important source on the subject.

What Is The Price Target For Lundin Mining?

Based on 11 Wall Street analysts’ 12-month price targets issued within the past three months, the average price target for Lundin Mining is C$9.26, with C$15.50 being the highest target and C$8.00 being the lowest. Lundin Mining is a well-known mining company that has been around since 1994. Many investors are wondering what the price target for Lundin Mining is. According to analysts, the average price target for Lundin Mining is $11.43 per share. This implies a potential upside of 30.64% from the current stock price of $8.76. Lundin Mining’s long-term prospects remain positive due to its strong financial position, diversified portfolio of assets, and low-cost operations. With the global economy rebounding from the pandemic and the demand for commodities on the rise, Lundin Mining is well-positioned for growth in the years ahead.Key points: – The average price target for Lundin Mining is $11.43 per share. – Lundin Mining has a strong financial position and diversified portfolio of assets. – The company’s low-cost operations make it well-positioned for growth. – The global economy is rebounding from the pandemic, which bodes well for Lundin Mining’s prospects.Analysts set Lundin’s price target at $11.43 per share.

What Does Lundin Mining Do?

Copper, zinc, gold, and nickel are the primary products produced by Lundin Mining, a diversified Canadian base metals mining company with projects and operations in Argentina, Brazil, Chile, Portugal, Sweden, and the United States of America. Lundin Mining is a Canadian mining company that specializes in the extraction and production of copper, nickel, zinc, and other base metals.The company operates through its multiple underground and open-pit mines in Chile, Brazil, Portugal, and Sweden. Lundin Mining’s core values are built on responsible mining practices that prioritize safety, environmental stewardship, and community engagement. Through sustainable mining, Lundin aims to create value for its stakeholders while minimizing its environmental impact. With a committed workforce, advanced technology, and decades of experience, Lundin Mining is a leading player in the global mining industry. **Lundin Mining’s Key Highlights:** – Specializes in copper, nickel, and zinc mining – Operates multiple mines in Chile, Brazil, Portugal, and Sweden – Prioritizes responsible and sustainable mining practices – Committed to safety, environmental stewardship, and community engagementCitation

Is Lundin Mining A Good Stock To Buy?

In conclusion, while the equity market as a whole may continue to be volatile in the short term, long-term investors should take advantage of the steep correction to acquire Lundin Mining because of its growth initiatives, strategic acquisitions, higher prices, and attractive valuation. Lundin Mining is a Canadian company engaged in the exploration, development, and production of mineral properties worldwide. Its stocks have been a topic of interest for many investors. Lundin Mining is a good stock to consider buying for several reasons. Firstly, the company has a diverse range of mineral assets globally, including copper, gold, nickel, and zinc. Secondly, their strong balance sheet and low debt levels make them an attractive investment option. Finally, Lundin Mining’s management team has a successful track record of delivering strong returns for shareholders. Some important points to consider when investing in Lundin Mining:- Global presence with diversified mineral assets

- Strong financial position

- Experienced management team

Where Is Lundin Mining Based?

Adolf Lundin founded Lundin Mining Corporation, a Canadian company that owns and operates mines that produce base metals like copper, zinc, and nickel in Sweden, the United States, Chile, Portugal, and Brazil. The company has its headquarters in Toronto and is run by Lukas Lundin. Lundin Mining is a global mining company that operates in locations around the world. However, its headquarters are based in Toronto, Canada. The company was founded in 1994 and since then has expanded its operations to Europe, the Americas, and Africa. With a focus on sustainable mining practices, Lundin Mining aims to operate in a responsible and environmentally conscious way. The company specializes in mining copper, nickel, zinc, and other metals. As of 2021, Lundin Mining has operations in Chile, Brazil, Portugal, Sweden, and the United States. Citation Important items related to the subject: – Lundin Mining is based in Toronto, Canada. – The company operates in Europe, the Americas, and Africa. – Lundin Mining specializes in mining copper, nickel, zinc, and other metals. – The company prioritizes sustainable and responsible mining practices.The current share price of Lundin Mining is [insert current share price here]

The highest share price ever reached by Lundin Mining was [insert highest share price here]

If you have any questions that are not covered here or require more detailed information, please contact our Investor Relations team.

Latest posts by Liccardo Glennis (see all)

- Things to Watch Out for in the Zinnwald Lithium Share Price Forecast - September 28, 2023

- How the Current Share Price of Zensar Technologies Affects the Investors - September 27, 2023

- How to Read and Understand Zenith Share Price History - September 26, 2023