What Happened To Smithson Investment Trust?

Smithson Investment Trust (SSON), a mid-cap investor, reported a respectable return for 2021, with a net asset value total return per share of 18.9%, slightly ahead of the 17.8% return for the MSCI World Small and Mid-cap index. This was despite the fact that SSON’s performance in 2022 was poor.

Why Has Smithson Dropped?

As investors can get a better return from safe cash and government bonds, higher interest rates make it less appealing to invest in future profits. This was bad news for Barnard’s highly valued stocks, sending shares plunging. Finally, investors downgraded profit expectations for businesses due to concerns about recessions.

Does Smithson Pay A Dividend?

Your account is set up to receive notifications from Smithson Investment Trust plc whenever they declare dividends. There are currently no dividends from Smithson Investment Trust plc….Dividend Summary.SummaryPrevious dividendNext dividendPay date––

Is Smithson An Investment Trust?

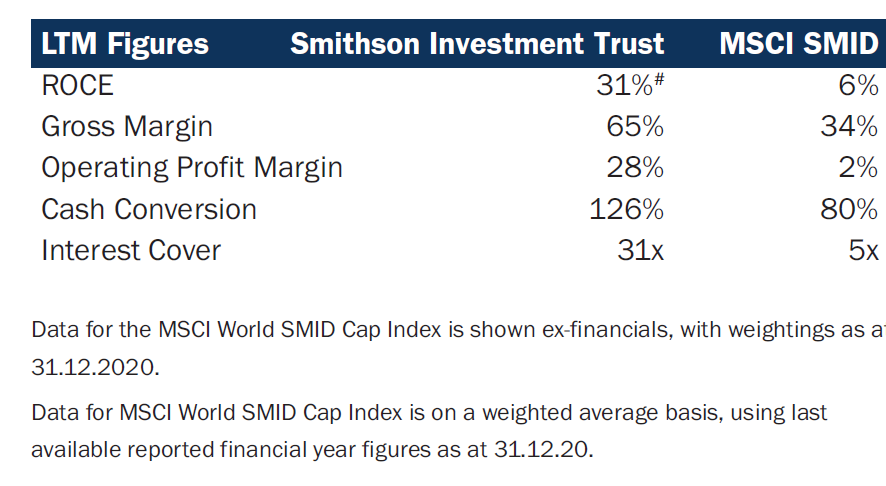

Smithson Investment Trust is a large British investment trust that invests in small and mid-sized international listed or traded companies with a market cap of between £500 million and £15 billion at the time of investment. Established in 2010, the company is a part of the FTSE 250 Index.

Who Runs Smithson Trust?

Lead manager Simon Barnard and assistant portfolio manager Will Morgan run Smithson Investment Trust (SSON), which aims to provide investors with a highly concentrated portfolio that currently consists of 32 holdings of global small and mid-cap companies.

- Breaking Down the Recent Vesuvius Share Price Rally on the NSE - March 23, 2023

- Understanding the Factors Driving Vikas Multicorp’s Share Price on BSE - March 23, 2023

- Analyzing the Major Factors Affecting National Express Share Price in 2021 - March 23, 2023