Is LXI A Buy?

The LXI REIT Plc stock has a sell signal from the short-term moving average but a buy signal from the long-term moving average. Since the short-term average is higher than the long-term average, there is a general buy signal in the stock, which indicates that the stock will perform well.

Is LXI REIT A Good Investment?

The LXI REIT Plc stock has buy signals from both the short-term and long-term moving averages, which indicate a positive outlook for the stock. Additionally, there is a general buy signal from the relationship between the two signals, which indicates that the short-term average is higher than the long-term average.

What Is The Yield On LXI REIT?

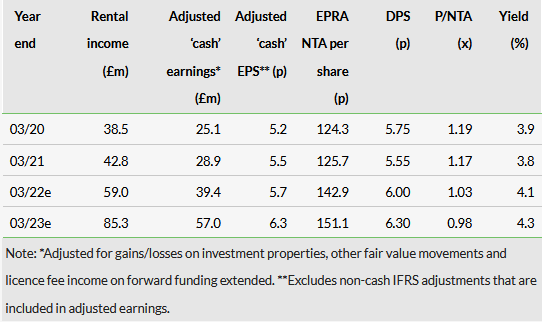

LXI REIT plc (LXI) Ord GBP0. 01Year ending: 31 March 2023 31 March 2020 Total dividend: -5.75p Dividend metrics Dividend growth: n/a6.51% Dividend yield: n/a5.30%

What Is REIT Price Prediction?

Based on 8 Wall Street analysts’ 12-month price targets for Apartment Income REIT, the average target is $40.38, with a high forecast of $43.00 and a low forecast of $39.00. This is a 17.49% change from the current price of $34.37.

Who Owns LXI REIT?

owned by Alvarium Investments Limited, a significant international multi-family office and asset manager that oversees more than US$22 billion in assets for families, private individuals, and institutions. Alvarium was founded in 2009 and is now owned by Alvarium.

- Breaking Down the Recent Vesuvius Share Price Rally on the NSE - March 23, 2023

- Understanding the Factors Driving Vikas Multicorp’s Share Price on BSE - March 23, 2023

- Analyzing the Major Factors Affecting National Express Share Price in 2021 - March 23, 2023