What Is The Outlook For SEGRO?

For the upcoming fiscal year, the company’s 22 analysts anticipate dividends of 0.27 GBP, an increase of 27.63 percent.

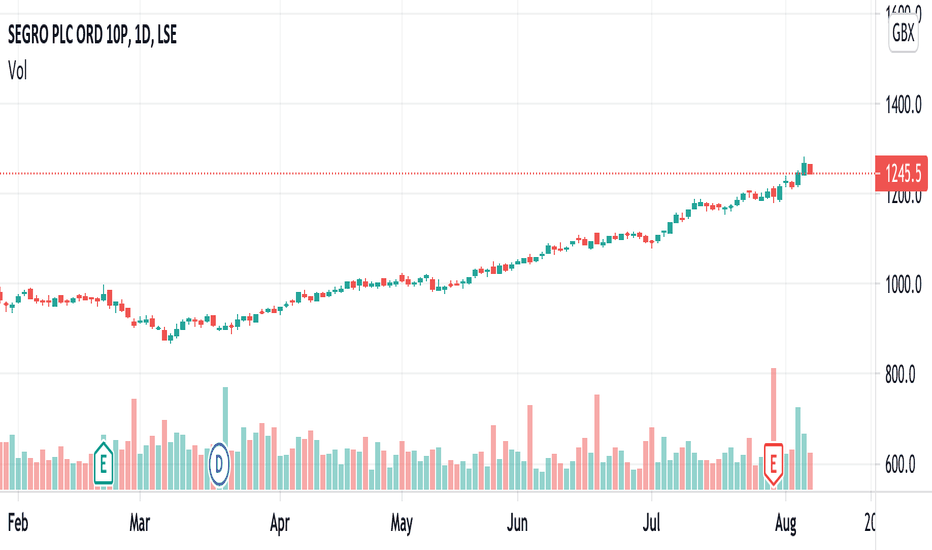

Why Is SEGRO Down?

Market Report: Shares of Segro fell to their lowest level in six months following a downgrade from analysts, sending the Footsie warehouse giant plunging 10% as the online shopping boom fades.

What Is SEGRO Annual Revenue?

SEGRO generated $0.751B in annual revenue in 2021, a 35.45% increase from 2020.

What Sector Is Segro In?

It serves transportation and logistics, retail, food and general manufacturing, technology, media and telecommunications, wholesale and retail distribution, services, and utilities. As of December 2021, the company owned 9.6 million square feet.

In the past year, 8 Wall Street research analysts have given SEGRO “buy,” “hold,” and “sell” ratings; there are currently 2 hold ratings and 6 buy ratings for the stock. Investors should “buy” SGRO shares, according to the consensus among Wall Street research analysts.

What Does Segro Do?

We are a leading owner, asset manager, and developer of contemporary warehouses and industrial properties and a UK Real Estate Investment Trust (REIT) that is listed on the London Stock Exchange and Euronext Paris.

- Breaking Down the Recent Vesuvius Share Price Rally on the NSE - March 23, 2023

- Understanding the Factors Driving Vikas Multicorp’s Share Price on BSE - March 23, 2023

- Analyzing the Major Factors Affecting National Express Share Price in 2021 - March 23, 2023