Does Liontown Produce Lithium?

When it comes online in 2024, our project at Kathleen Valley in Western Australia will be one of the largest lithium mines in the world, producing 500,000 tonnes of 6% lithium oxide (Li2O) concentrate annually.

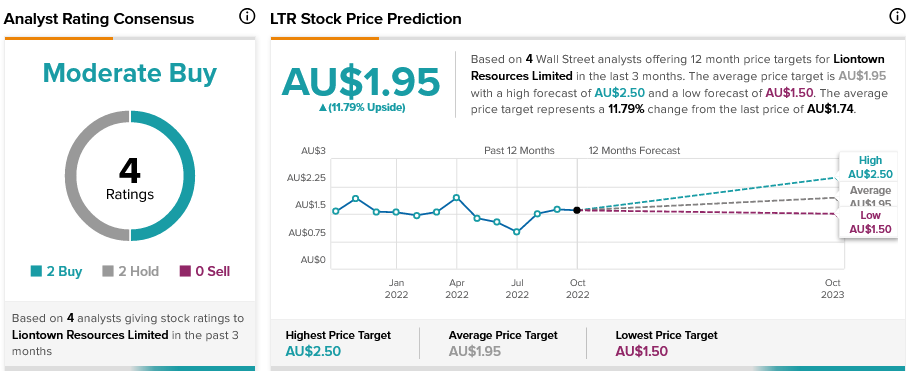

What Is The Price Prediction For Liontown Resources?

Based on three Wall Street analysts’ 12-month price targets for Liontown Resources Limited, the average price target is AU$2.06, with a high forecast of AU$2.50 and a low forecast of AU$1.80. This represents a change of 63.52 percent from the previous price of AU$1.26.

At 2023-01-23, the quote for Liontown Resources Ltd. is 1.470 AUD. According to our projections, there will be a long-term increase. The “LTR” stock price forecast for 2028-01-14 is 4.933 AUD. With a 5-year investment, the revenue is expected to be around +235.56%. Your current $100 investment could reach $335.56 in 2028.

Based on six Wall Street analysts’ 12-month price targets for Liontown Resources Limited, the average price target is AU$2.05, with a high forecast of AU$2.81 and a low forecast of AU$1.50. This represents a 26.83 percent change from the previous price of AU$1.62.

Is Liontown Resources A Buy?

According to data from Refinitiv Eikon, four analysts who cover Liontown rate the stock as a buy right now, with just one analyst giving it a hold rating and no sell ratings. The consensus price target for Liontown is $2.08 per share.

What Is The Target Price For Liontown?

Shares of Liontown Resources currently have a consensus Earnings Per Share (EPS) forecast of -AU$0.01 for the upcoming fiscal year, which is 16.28% higher than the company’s last closing price of AU$1.67. The target price for shares of Liontown Resources is AU$1.94, according to the analyst consensus.

What Is The Price Target For Liontown Broker?

Based on three Wall Street analysts’ 12-month price targets for Liontown Resources Limited, the average price target is AU$2.06, with a high forecast of AU$2.50 and a low forecast of AU$1.80. This represents a change of 63.52 percent from the previous price of AU$1.26.

What Will LTR Price Be In 2025?

Analysts anticipate that the stock will trade for $2.24 in January 2025, according to the stock forecast for that month.

How to Buy Shares in Liontown Resources: Look at different share trading platforms. To buy shares that are listed in Australia, you’ll need to join a broker that has access to the ASX. Open and fund your brokerage account. Look for Liontown Resources. Buy now or later. Check on your investment.

Is Liontown Resources A Good Buy?

With an average upside price target of 86%, the broker rates all three shares as a buy. This indicates that analysts are enthusiastic about Liontown’s growth prospects and potential share price appreciation; the company has gained 26% in the past year.

Will Liontown Resources Pay Dividends?

Dividends from Liontown Resources (LTR) are not paid out.

Who Owns Liontown?

A binding offtake agreement for lithium spodumene concentrate from its $473 million Kathleen Valley project was unveiled on Wednesday by Perth-based Liontown Resources, led by Timothy Goyder, Richard Goyder’s cousin.

- How Will Ethereum 2.0 Improve Upon Existing Blockchain Platforms? - February 9, 2023

- Dogecoin Explained: What is Dogecoin and How Can You Use It? - February 9, 2023

- Smart Investing Strategies for Wise in 2018: A Share Price Forecast - February 5, 2023