| Highlights | Description |

| Sustainable growth | Attained through socially responsible investments |

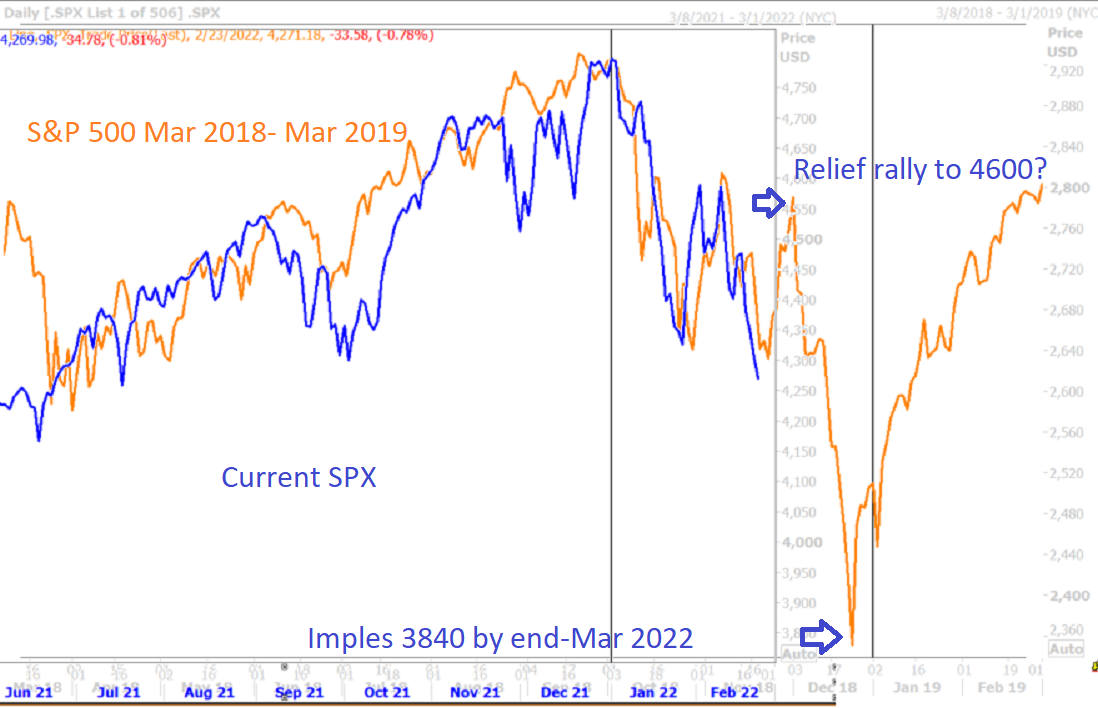

| Latest trends analysis | Real-time stock market data forecasting |

| Vibrant trading platform | User-friendly for beginners and experienced traders |

| Intuitive charts | Interactive chart controls for expert insights |

| Dynamic visualization | Customizable graphs showing key stock indicators |

What Is The S&P 500 Growth At A Reasonable Price Index Index?

The performance of 75 growth stocks with high quality and value composite scores in the S&P 500 (the “Index Universe”) is tracked by the S&P 500 GARP (Growth at a Reasonable Price) Index. The S&P 500 Growth At A Reasonable Price Index measures the performance of large-cap stocks with strong growth potential and a reasonable valuation. This index is based on three factors: earnings growth, price-to-earnings ratio, and historical earnings per share growth. Companies with strong earnings and reasonable valuations are included in the index. The index is an alternative to the standard S&P 500 index, which includes all large-cap stocks regardless of valuation. The S&P 500 Growth At A Reasonable Price Index aims to provide investors with a selection of stocks with strong growth potential while also providing a margin of safety.

| Relevant title 1 | Best garp etf |

| Relevant title 2 | Spgp etf |

| Relevant title 3 | Etf that beat the s&p 500 |

How Much Is SGP Philippines IPO?

If we compare SGP’s projected Enterprise Value, which is estimated to be P196 billion, to the company’s invested capital, which is P272 billion, we will discover a EV-to-IC ratio of only 0.72 times. SGP’s IPO price offer is P12 per share. Singaporean company SGP Philippines (SGP) is planning an initial public offering (IPO) in the Philippines. The IPO is expected to raise at least PHP 1.2 billion ($24.4 million) for the company. SGP Philippines invests in high-growth potential sectors in the Philippines such as real estate, healthcare, and logistics. The company aims to become a leading investment holding firm in the country. The exact price of the IPO has not been announced yet, but interested investors can stay updated on the Philippine Stock Exchange website. Get ready to invest in SGP Philippines!**Important IPO details to note:** – Company: SGP Philippines – Expected IPO amount: PHP 1.2 billion ($24.4 million) – Sectors of investment: Real estate, healthcare, logistics – Company goal: Become a leading investment holding firm in the Philippines Investing in the Philippines has never been more exciting. Don’t miss out on the chance to be part of SGP Philippines’ success story!SGP Philippines’ IPO is expected to raise at least PHP 1.2 billion ($24.4 million).

Not:In addition to the information we have provided in our article on

spgp share price chart, you can access the wikipedia link here, which is another important source on the subject.

Who Owns Synergy Grid?

The investment holding company that Henry Sy, Jr. and Robert Coyiuto, Jr. jointly own, Synergy Grid and Development Philippines (PSE: SGP), controls 60% of the National Grid Corporation of the Philippines (NGCP). The ownership of Synergy Grid is a topic of interest for many individuals.Synergy Grid is primarily owned by Brookfield Asset Management, a Canadian-based firm specializing in asset management. Other investors that hold minority stakes in Synergy Grid include the Abu Dhabi Investment Authority and Qatar Investment Authority. Synergy Grid is responsible for managing the transmission and distribution of electricity in Western Australia. This involves maintaining and improving the power infrastructure, as well as ensuring reliable electricity supply to households and businesses. Overall, Synergy Grid remains an important asset to the energy sector in Western Australia, and its ownership plays a significant role in its success.Citation

Is SPGP A Good Investment?

The Vanguard Growth ETF (VUG) and the Invesco QQQ (QQQ) both track a similar index, so investors seeking exposure to the Style Box – Large Cap Growth segment of the market should also consider these other ETFs. SPGP is a great option for this purpose.SPGP, or the SPDR Portfolio S&P 500 Growth ETF, is designed to track the performance of the S&P 500 Growth Index, making it a popular choice for investors seeking growth and diversification. As of August 2021, the ETF’s top holdings include leading technology companies, such as Apple, Microsoft, and Amazon. While past performance is not a guarantee of future success, there are indications that SPGP has shown solid performance over the years. If you’re looking for a low-cost way to invest in growth stocks, SPGP can be a good option to consider. Just make sure to do your own research and evaluate your investment goals before putting any money in. Important Factors:Is SPGP A Good Investment?

- SPGP is designed to track the performance of the S&P 500 Growth Index

- Top holdings include leading technology companies like Apple, Microsoft, and Amazon

- Has shown solid performance over the years

- A low-cost way to invest in growth stocks

Is SPGP A Good ETF?

The Invesco S&P 500 GARP ETF has a Zacks ETF Rank of 3 (Hold), which is determined, among other things, by the expected asset class return, expense ratio, and momentum. As a result, SPGP is a reasonable choice for people who want to get exposure to the Style Box – Large Cap Growth sector of the market.SPGP is a good exchange-traded fund (ETF) for investors seeking exposure to small-cap growth stocks. This ETF tracks the S&P Small Cap 600 Growth Index and has performed well over the past few years. Its low expense ratio and diversification across various small-cap growth sectors make it an attractive option for investors. However, as with any investment, there are risks to consider, such as the potential for market fluctuations and the inherent volatility of small-cap stocks. It’s important to do your research and diversify your portfolio to minimize risk.Is SPGP A Good ETF?

Does SPGP Pay Dividends?

In the previous year, SPGP paid $1.01 per share and has a dividend yield of 1.13 percent. SPGP does not pay dividends. SPGP, or the SPDR Portfolio S&P 500 Growth ETF, is a passively managed fund that tracks the S&P 500 Growth Index. Despite the popularity of dividend-paying stocks, SPGP does not pay dividends to its investors. This may seem like a downfall to some investors, but the lack of dividends allows for potential tax benefits and reinvestment opportunities. The fund’s holdings include well-known growth companies such as Amazon, Apple, and Facebook, making it a diverse investment option for those looking for long-term growth. “`question1

answer1

question2

answer2

Latest posts by Liccardo Glennis (see all)

- Things to Watch Out for in the Zinnwald Lithium Share Price Forecast - September 28, 2023

- How the Current Share Price of Zensar Technologies Affects the Investors - September 27, 2023

- How to Read and Understand Zenith Share Price History - September 26, 2023